Fed Up With Wall Street Fat Cats Racking Up Ridiculous Profits & Leaving You With Little More Than Leftovers?

This “Insiders’ Cheat-Sheet” Could Quietly Double Your Money Three Different Times…

And It’s 100% Legal!

[vertical_spacing height=”20″]

Fellow Investor,

Ever felt shafted by Wall Street?

That the playing field is so heavily tilted against you, it’s hard to even stand up straight?

Or that getting ahead in this market is all but impossible?

Then this letter is for you.

I’ve uncovered a breakthrough investing “cheat sheet” (supplied by, of all things, our own government) that has created a way for you to even the playing field between us and the Wall Street elite.

Making it possible to quietly skim some of their fat profits for yourself… and double your money three times.

Of course, Wall Street is none too happy about this.

They call it “stealing.”

To which I have just one thing to say…

Too. Damn. Bad.

Wall Street has used all sorts of political and financial shenanigans to enrich itself at our expense since, well… forever!

So as far as I (and, incredibly, the government) is concerned, turnabout is fair play… and 100% legal.

So what exactly is this “cheat sheet” that makes it possible to share in Wall Street’s outrageous profits… and just how much could be in store for you?

I’ll reveal everything you need to know in just a moment… but first, there’s something I think you should understand about how Wall Street really works…

And how, no matter what happens to the rest of us, they always seem to come out on top and richer than ever.

Like looking over the shoulders of the world’s most influential money managers

It comes down to this…

Big Wall Street hedge funds and billionaire traders have all sorts of information that’s “hidden” from public view.

But to them, it’s an open secret discussed candidly in meetings from New York City to Los Angeles.

They have the inside track on every upcoming merger, takeover, and turnaround — long before they happen.

They also have lobbyists crawling all over Washington, D.C., eager to stuff cash into the back pockets of America’s most powerful lawmakers.

So they know — and sometimes control — exactly which new laws and regulations are going to impact which companies and industries and how…

Long before they go into effect.

It’s why big Wall Street firms always seem to get in on the ground floor of promising stocks early — and then sit back and wait for everybody else to find out about them and push the share prices to the moon.

Cashing out for monster gains and leaving what can only be described as “investing scraps” for the rest of us.

Just think about it: how different would YOUR life be if you had Wall Street’s connections, inside information, resources, and financial muscle?

What if you could get in on the ground-floor of the same stocks as Wall Street’s top traders — and skim some of the profits for yourself?

How would that affect your ability to rapidly build wealth?

What would you do with all the extra cash in your account?

Maybe spend a week at a five-star luxury resort on the French Riviera… buy that vintage 1971 Chevy Camaro you’ve always had your eye on… or finance a first-class education for your grandchildren.

Imagine being able to get in on the ground-floor stocks that billionaire investors like Jim Simons… Ray Dalio… Carl Icahn… or Paul Tudor Jones all believe are on the verge of something BIG.

Now, in the real world, to partner with someone like Icahn you’d need to make a minimum hedge fund investment somewhere in the neighborhood of $500,000.

That leaves most of us out in the cold.

But here’s the good news…

Not long ago, it seems like of all things, our own government finally realized how unfair this kind of early access is to the rest of us.

Prompting the Securities and Exchange Commission to come up with a new rule…

Section 13F of the Securities and Exchange Act mandates that Wall Street firms with assets over $100 million must DISCLOSE their private holdings in a special form called the 13F Disclosure Form.

It’s like being able to take a peek over the shoulders of the richest, most successful traders and corporations on Wall Street.

Think about it — when you know exactly what the top dogs on Wall Street are buying, you can quietly move in and add shares to your own portfolio, often before other mainstream investors catch wind of it and send shares skyrocketing.

Get in before they gobble up shares and all you have to do is sit back and watch as your profits soar to the moon.

This, essentially, is what the 13F form allows you to do.

It’s like getting the answers to tomorrow’s test… or having your own personal Wall Street “cheat sheet.”

One that could double your money or more… over and over again.

Of course, as you can imagine, Wall Streets’ heavyweights are none too happy to be forced to divulge every dirty detail behind their dealings.

They think of it as “stealing” or giving an unfair advantage to the little guy.

I call it leveling the playing field.

And it’s time to do exactly that.

“Piggyback” off Wall Street’s richest traders… without paying them a dime

People like Bill Ackman of Pershing Square Capital (net worth: $3.5 billion).

Ackman is an activist investor who buys large chunks of shares in underperforming companies… and then uses his influence as a major shareholder to make management turn things around.

It’s how he was able to start Pershing in 2004 with just $54 million… and deliver $11.6 billion in gains in just 10 years… making him and his clients fabulously wealthy along the way.

Of course, being an actual client of Pershing isn’t cheap. In addition to a 1.5% annual fee, it also charges a performance-based fee, which starts at 20% of the increase in net asset value.

But thanks to the 13F disclosure form, you don’t need to be an actual client of Pershing and pay those outrageous fees to share in all of its wealth creation.

Because I’m going to show you how to do it for free!

Case in point: if you examined Pershing’s 13F in late 2011, you would have seen that it bought a stake in Canadian Pacific Railway.

At first glance, most investors would likely overlook this rail company which mostly transports grain and coal — and doesn’t appear any different than dozens of other rail lines that crisscross North America.

But dig just below the surface and you’ll find something incredible.

Canadian Pacific is the only Class 1 railway serving the energy-rich Canadian Oilsands, the Bakken Formation, and the Marcellus Shale Formation, connecting all three to key energy markets across Canada and the northeastern United States.

Without it, all the oil and gas unlocked from these sands and formations might as well stay in the ground.

Now, Canadian Pacific was never a “hot stock,” even back in 2011, during the height of North America’s energy boom.

It certainly wasn’t the kind of sexy business being touted by the talking heads on CNBC.

But, unlike them, Bill Ackman knew it had value he could unlock.

It’s why over the next five years, the stock soared 153%.

More than double the S&P 500’s return in the same time frame.

Turning every $10,000 into $25,300 — enough to finance a first-class vacation to Aruba for you and your spouse… with enough left over to possibly hop over to Bermuda for a few days on the way home.

Think you might have gotten into Canadian Pacific too if you saw a name like Ackman’s making a move back then?

If you’d had access to his 13F disclosure form and the insight to make your move, you could have.

And it wouldn’t have been the only time you could have followed him to favorable returns.

Ackman is so skilled at creating wealth for himself and his investors, that he’s able to do it even in the direst of circumstances… like the 2008 financial crisis.

Does the name General Growth Properties ring any bells?

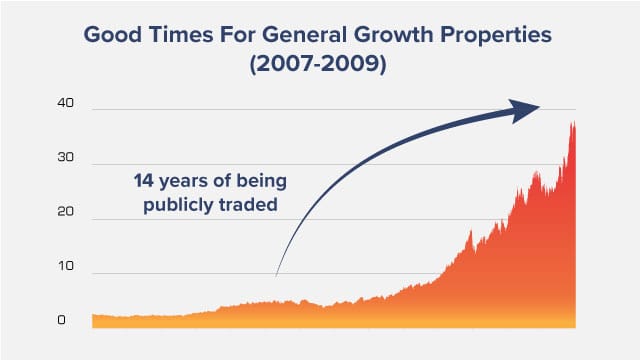

For a long time, General Growth Properties was the second-largest shopping mall operator in the United States.

Seen as an unshakeable behemoth for its first 14 years of being publicly traded, its stock went up like this:

Good times were had by all its investors.

Then came 2007 — and the beginning of the Great Real Estate Meltdown.

The company was in trouble — it had no way to refinance its short-term debt — and the drop in real estate prices left it with no way to raise cash from sale or financing.

The writing was on the wall for everyone to see.

And boy did they, see — between 2007 and 2009, its stock plunged from $36 to just 42 cents.

In April 2009, General Growth Properties finally filed for bankruptcy — at the time, the largest real estate bankruptcy in American history.

For most investors, it was a time to move on and lick their wounds.

But for Bill Ackman, it was a mega-profit opportunity.

During this time, as revealed by Pershing’s 13F form, he bought a $60 million stake in General Growth Properties.

While investors everywhere were heading for the exits, Ackman smelled a profit opportunity.

He believed he could help it recover — and by 2014, it did.

That’s when he sold more than $1 billion in shares and said the investment “turned $60 million into $1.6 billion.”

That’s a 2,666% gain!

Now not every investment Ackman makes does this well, of course, and I tend to err much more on the conservative side, but…

Imagine if you had access to Pershing’s 13F form and invested alongside him.

Cashing out at the same time would have turned every $1,000 into $266,600… every $2,500 into $666,500… and every $10,000 into $2.666 million.

And Ackman is just one example of Wall Street’s top traders you could be piggybacking off right now.

I dig up profit opportunities like this all the time.

There’s also Stanley Druckenmiller (net worth: $6.4 billion).

Some of the monster gains he and his investors are sitting on include Meta (+128%)… Nvidia (159%)… and Vertiv Holdings (+315%).

That’s enough to turn every $2,500 stake in Meta into $5,280… every $5,000 Nvidia stake into $15,900… and every $10,000 in Vertiv Holdings rockets into $41,500.

Just think about how much different your life would be if you were holding just a handful of Druckenmiller’s holdings.

With the 13F form, you could have known when Stanley Druckenmiller entered EACH of these positions… and then simply slip in behind him and scoop up the profits for yourself.

Then there’s Jim Simons — the “Quant King” (net worth: $28.1 billion).

Some of the big winners he and his investors are sitting on right now include:

- Verisign +117%

- ELF Beauty +194%

- Molina Healthcare +233%

- Novo Nordisk A/S +335%

Now, again, not every trade these heavy hitters make turns out this well.

Sometimes they lose money. (We’re all human, after all.)

But if you’re going to invest, doesn’t it make sense to follow right along with those who are experts at doing so?

Folks who win far more than they lose…

And the same billionaire titans who have a long track record of creating wealth for themselves and others?

Why pay outrageous fees to a money-manager who has no hope of equaling, let alone beating the market?

Especially when you can use the 13F form to piggyback off of the world’s greatest investors for free?

After all, just a few successful trades from the likes of Ackman, Druckenmiller, or Simons could be all you need to retire in bliss.

I like to think of the 13F form as a kind of “cheat sheet”…

Making it possible for you to move as they move… and profit alongside them.

Now to be clear, when I say alongside them, unfortunately I don’t have a spy camera in Jim Simon’s office… so we’re not trading with them in real time.

These 13F forms are released roughly 45 days after the end of each quarter.

But while they lack the benefit of live trading, you’re only missing out on a fraction of the trade (it’s better to be a little late to the game than to not show up at all!)…

And you’re seeing exactly what they’re up to… without having to pay them a dime.

I can’t think of a better way to set yourself up for success (and massive profits) than by riding the coattails of those who do it better than anybody else.

Speaking of which, I’ve been combing through the most recent 13F forms… and I’ve zeroed in on 3 stocks that could easily be the next big winners…

Each of which has the potential to double your money. Maybe a whole lot more.

I’ll get to them in just a moment, but first, allow me to introduce myself.

My name is Nathan Slaughter.

My name is Nathan Slaughter.

For the last 16 years I’ve been helping ordinary investors build massive wealth — without having to trade options, day trade, take on any undue risk, or pay outrageous brokerage fees.

I got my start working for AXA/Equitable Advisors, one of the world’s largest financial planning firms.

Then I honed my research skills at Raymond James Morgan Keegan, where I managed millions in portfolio assets.

While catering to the rich has its financial rewards, the truth is…

I HATED IT.

I was slaving away… missing anniversary dinners, birthday parties, and other family get-togethers just so I could help some fat cat I’ve never even seen face to face add another comma to his already bloated account.

After a few years, I’d had my fill and decided to walk away from the Wall Street life… but I didn’t quit the investment game completely.

Quite the contrary actually.

Instead, I joined StreetAuthority, one of the world’s most trusted and fiercely independent financial research firms… relied on by over 100,000 readers.

My mission here is simple… help regular investors just like you get rich from the exact same profit opportunities once reserved for only my most elite clients.

Just like the kinds of opportunities once reserved for the elite clients of traders like Bill Ackman, Paul Tudor Jones, and Jim Simons.

The very kind that the 13F disclosure form continuously reveals.

In fact, I’ve combed through their latest disclosures and pinpointed three massively undervalued stocks these investing titans are holding — and they all hold the potential to double your money in the very near future.

13F Profit Opportunity #1:

The Vegas Jackpot

Just a few years ago, the Supreme Court knocked down federal restrictions on sports betting across the United States.

Since then, sports betting has become legal in 36 states. And it’s only a matter of time before it sweeps the entire country… creating new fortunes for sportsbook operators, gamblers… and more importantly for investors like you.

In fact, last year, operators collected $7.6 billion in revenue. And this year they’re expected to collect $20 billion.

That’s a stunning 163% increase.

One major Las Vegas entertainment and leisure complex is already making its move to grab a huge chunk of this revenue for itself… recently acquiring the third largest sportsbook operator in America.

And to make it easier for players all over the world to participate, it created a smartphone app they can use to wager on sports games anytime, anywhere.

Given that this behemoth is already one of the most popular casinos and resorts in Las Vegas, its big leap forward into sports betting stands to further enrich investors, who have seen nearly 1,100% returns over the last nine years.

One of these investors is David Tepper.

If the name rings a bell, it’s because with a net worth of $18.5 billion, he’s one of the richest, most successful investors on the planet.

His hedge fund, Appaloosa Management, has delivered returns of more than 25% each year for the past thirty years.

If you were an Appaloosa client, you could have turned a small $10,000 into at least $8 million!

It’s why, when Tepper picks up shares of a company like the one I just shared with you, my profit-radar lights up like a pinball machine.

13F Profit Opportunity #2:

Double Your Money On the “Amazon of Pet Supplies”

Tepper’s performance brings to mind the track record of another all-star billionaire investor, Steve Cohen (net worth: $19.8 billion), who over a 21-year period averaged 25% annual returns for his investors.

I’ve been dissecting his hedge fund’s 13F and saw he recently sank his teeth into a company that could easily double his money — and yours.

Let me explain…

Americans love pets.

It’s a big reason why nearly 70% of U.S. households own one.

And better still, they love pampering them.

Last year, Americans spent a whopping $136.8 billion on their pets… and this year that number is set to climb to $143.6 billion.

All this is music to the ears of one company.

Why?

Because it sells over 100,000 different kinds of pet products — everything any type of pet could conceivably need.

There’s food, of course. And not just for dogs and cats, but fish, birds, hamsters, reptiles, and horses.

It also runs a full-service pharmacy for pet prescriptions… as well as toys, crates, litter, grooming supplies, harnesses, and anything else you think your furry friend might need.

Even better: this company can deliver them all to its 20 million customers in two days or less.

It’s why I like to think of it as the “Amazon of pet supplies.”

And why I believe it has the potential to deliver at least 100% returns to savvy investors (like Steve Cohen — and you) in the near future.

13F Profit Opportunity #3:

Save the Oceans AND Set Yourself Up For A Tidal Wave of Returns

The third profit opportunity I’ve uncovered comes from the portfolio of David Einhorn, Founder and President of Greenlight Capital.

Einhorn is one of the most successful activist investors ever — always willing to go to extreme ends to unlock shareholder value.

It’s why, while the S&P plunged 18% last year, Greenlight Capital delivered a stunning 36.6% return to investors during the same time.

And since its founding in 1996, Greenlight Capital has delivered 2,300% gains, nearly tripling the S&P 500.

That’s enough to turn every $100,000 into $2.3 million!

Now, there’s one play within Greenlight’s portfolio I’ve zeroed in on…

One I believe could double your wealth — at a minimum.

It’s a company that has developed a world-saving new technology.

Today it’s trading for under $2.00 — but I don’t expect share prices to stay there long!

Let me explain…

Plastics are essential to almost everything in our modern world. We simply can’t live without them.

But there’s a problem.

This material is also one of the world’s biggest pollutants, found everywhere from the bottom of the sea to the top of Mount Everest.

In fact, up to 12.7 million metric tons of plastic are discarded into the world’s oceans each year.

What’s worse is that this plastic is completely non-biodegradable.

Making it a pollutant that will never go away.

But that’s about to change.

Why?

Because one innovative bioplastics company has developed a method to make plastic products that are 100% biodegradable and compostable — without compromising on functionality.

Their plastics, made of canola oil, biodegrade in both oxygen-rich and oxygen-free environments. They do not need heat, moisture,or an industrial composting plant to break down.

As a matter of fact, they break down almost anywhere — a waste treatment facility, the ocean, or even in home compost piles.

And they do it in as little as 12 weeks after they’re discarded!

With the world growing ever more conscious of the impacts of discarded plastics on wildlife and the environment, this company’s biodegradable plastic could hold the answer.

Some big hitters certainly think so.

As a matter of fact, this tiny company is already in a partnership with Pepsi to create compostable packaging for its snack brands.

It’s also in partnerships with Mars Wrigley, Starbucks, Nestle, and Bacardi to develop and sell its biodegradable plastics for their packaging, straws, and bottles.

And you can still get in for around $2!

Small wonder why David Einhorn is so fond of this innovator!

Small wonder why David Einhorn is so fond of this innovator!

You’ll find all the details on this 13F profit opportunity — along with the 2 others I just shared — in a special briefing I’m calling The Wall Street Cheat Sheet: Three 13F Profit Plays That Could Double Your Money.

Inside, you’ll discover the names and ticker symbols of the top three 13F profit plays I’m tracking today… and why I believe each of them has what it takes to double your money in the coming months.

Discover the Market’s Biggest Opportunities — Long Before They Hit the Headlines

I want to give this report (a $199 value) to you absolutely free… plus SO MUCH MORE.

All I ask in return is that you accept your no-risk membership to my financial advisory service, Capital Wealth Letter.

Now, I certainly don’t want to give you the impression that we only focus on 13F forms here.

Because our mission at Capital Wealth Letter goes deeper: to bring you the market’s BIGGEST opportunities long BEFORE they hit the headlines…

Giving you the ability to lock in on them early and ride them for a shot at massive profits.

We’re not just looking to beat the market here — our goal is to introduce profit opportunities that can generate truly life-changing returns.

Like the kind you’ll find in your copy of The Wall Street Cheat Sheet: Three 13F Profit Plays That Could Double Your Money.

Now, not every 13F disclosure trade is destined to double your money.

That’s where I come in. Because I burn the midnight oil sifting through all the stock charts, disclosure forms, and financial statements… applying my own proprietary analysis to ensure you only get the best of the best.

That’s the kind of thoroughness and hard work that no supercomputer can match… and it’s just too unsexy for many of Wall Street’s boy geniuses.

But here at Capital Wealth Letter we settle for nothing less.

And at the risk of sounding like I’m bragging… it’s worked like a charm.

Because we’ve been able to help investors bag big winners like these:

- 90% — Arrowhead Pharmaceuticals

- 96% — Starbucks

- 105% — Tencent Holdings

- 113% — Okta

- 158% — Intel

- 164% — Reata Pharmaceuticals

- 299% — PayPal

And results like these are the reason so many of my readers have taken time out of their busy lives to send me notes like these:

Now, Martin’s experience is definitely one for the record books and there’s no guarantee yours will be similar to any of these folks.

It’s true what they say…

When it comes to investing, regardless of the trades you take on, NEVER invest more than you’re OK walking away from.

But I hope you’re starting to see how Capital Wealth Letter is helping change the lives of real people — and how it could change yours as well.

Because at Capital Wealth Letter, we relentlessly focus on one singular objective — making you the most money with the least amount of risk.

It’s why when we smell opportunities that can help you do just this, we go after them — no matter where they lead.

I can’t wait for you to see for yourself what Capital Wealth Letter can do for you.

So let me show you everything you get as soon as you join and claim your copy of The Wall Street Cheat Sheet: Three 13F Profit Plays That Could Double Your Money.

So let me show you everything you get as soon as you join and claim your copy of The Wall Street Cheat Sheet: Three 13F Profit Plays That Could Double Your Money.

Once a month I’ll send you an in-depth report with a new opportunity to grow your money. Every issue is packed with easy-to-buy investment recommendations that can help surpass your wildest expectations of building wealth.

It may be an exciting stock… a fast-growing cryptocurrency… or some other high-profit potential situation you’ll discover before most investors get a chance to read about it in The Wall Street Journal or on Yahoo Finance.

You’ll also receive…

24/7 Members’ Only Website Access

You’ll have total access to our private, password-protected, members-only website. Here you’ll find the full library of financial research behind each of my recommendations.

The members’ area includes all my regular Monthly Capital Wealth Letter Issues, as well as the Special Opportunity Reports (like the one you’re receiving today), which will be in your inbox the moment you agree to take Capital Wealth Letter for a test drive.

But that’s not all, you’ll also have full access to Three Model Portfolios. Our holdings are divided into 3 distinct categories, with a portfolio for each:

- The Game-Changers Portfolio: Here you’ll find the most innovative and high-profit potential investment opportunities that have passed my detailed analysis.

- The Main Portfolio: Holds our core positions — both stalwart stocks we’ve held for years (many of which are still a buy), alongside newer companies we believe will hand us profits for years to come.

- The Crypto Portfolio: Whether you’re a crypto pro or you’ve barely got a handle on what a bitcoin is, you’ll find our top recommendations (along with a complete no-nonsense breakdown on each opportunity) in the world of cryptocurrency.

Inside each of them, you can track our current gains from the time they were recommended. And all positions have a clearly listed buy-up-to price, so you can easily see which ones you can still get into.

Intraday FLASH Alerts

Intraday FLASH Alerts

You’ll get regular updates on our positions and on any new opportunities I come across.

The markets move quickly, so as part of your membership, the moment I’m made aware of something that affects one of our holdings, I’ll send you a Profit Alert with full instructions on the exact action you need to take.

The markets never sleep and neither does Capital Wealth Letter.

VIP Concierge Service

You’ll also have a trained team of customer service professionals dedicated to Capital Wealth Letter to help you get the most out of your membership.

If you have any questions about your membership or any other concerns at all, my VIP Conciergeteam is ready to help you. All you have to do is pick up the phone or send an email and we’ll take care of you.

And as a new member you’ll receive an exclusive bonus…

Free access to StreetAuthority Insider

Each week we’ll show you the newest opportunities and investments collected from all our StreetAuthorityfinancial research staff… before the public ever hears about them. This service is included with your subscription at no extra cost.

Lock-in Massive Savings Now

I’m certain you’ll be so thrilled with everything you’re receiving from me you’ll want to stay with Capital Wealth Letter for the long haul.

Which is why I’ve made it possible to receive a whole year of Capital Wealth Letter at a very steep discount.

Now, you might be expecting a service chock full of massive profit opportunities like I’ve shown you today to cost a small fortune — maybe a few thousand dollars.

Many Wall Street firms would happily charge you this much for half the money-making intel I want to share with you.

But I left Wall Street behind a long time ago…

I’m no longer chained to some corporate protocol that requires me to benefit the company at the cost of the investor…

I can finally give average Americans the insights and information needed to make profitable trades in the crazy market we’re living through, without repercussions for failing to meet some “quota.”

And I’m not going to let price be the one thing that stands between you and profits.

Which is why a full year of Capital Wealth Letter normally runs just $129.

Given the fact that you’ll receive multiple profit opportunities during the year — each of which has the potential hand you double, triple or quadruple-digit gains — I think you’d agree that’s a pretty fair deal.

Still… I think it could be even better.

Which is why — through this special offer only — I’m slashing 70% off the regular membership price.

Which means, today, an entire year of Capital Wealth Letter is yours for only $39.

[button_1 text=”I%20WANT%20IN%20NOW” text_size=”26″ text_color=”#ffffff” text_font=”Tahoma;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”40″ styling_height=”24″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#fe8700″ styling_gradient_end_color=”#ffac35″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sacwl-13f”/]

Imagine… for less than dinner for two at the local burger joint, you’ll have the chance to tap into multiple opportunities that could double your wealth or more!

Sound like a sweet deal? Well, I’ve got something even sweeter when you decide to extend your stay…

Double Your Savings and Get 7 More Money-Making Reports

When you sign on for two years of Capital Wealth Letter right now, not only will you save $180, but, in addition to The Wall Street Cheat Sheet: Three 13F Profit Plays That Could Double Your Money, you’ll receive 7 more blockbuster reports, any one of which has the potential to dramatically supercharge your wealth:

- How to Profit up to 886% from “Starlink’s Secret Partner” ($99 value)

- Sky-High Profits: How to Bank Big Gains from a Booming New Market ($99 value)

- Retire Rich on the “Tesla of Space” ($99 value)

- How the Explosion of Smart Devices Can Flood Your Account With Cash ($99 value)

- The 5G Revolution: 3 Stocks for Six-Figure Profits ($99 value)

- 7 Legacy Assets to Own Forever ($99 value)

- 7 Loser Stocks to Dump Now ($99 value)

That’s $693 in free bonuses that can be yours at no extra charge!

[button_1 text=”Grab%20Your%20Free%20Bonuses%20Now” text_size=”26″ text_color=”#ffffff” text_font=”Tahoma;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”40″ styling_height=”24″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#fe8700″ styling_gradient_end_color=”#ffac35″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sacwl-13f”/]

No matter whether you make the best choice and join us for two, or only sign on for one year… rest assured that you’ll be protected by my…

Double-Barreled Money-Back Guarantee

Because when you take me up on this opportunity to siphon Wall Street’s profits for yourself, along with locking in full access to Capital Wealth Letter, you’ll have a full 90 days to make sure it’s everything I promised it would be.

That means, no matter how much money you’re making, if you’re dissatisfied for any reason whatsoever, just let my customer service team know by day 90 and we’ll give you back every penny you paid to join.

And as a “thank you” for give us the opportunity to earn your trust, all the issues you’ve read and reports you’ve received are yours to keep.

Even if it’s past the 90-day mark — I’ve still got your back!

Simply let us know you’re unsatisfied with your membership and you’ll receive a refund for the unused portion of your membership.

In other words — risk nothing and keep everything!

Now you have two choices:

- Ignore this rare opportunity to peek over the shoulder of Wall Street’s wealthiest investors, potentially doubling your money (or more) three times — and constantly wonder about what might have been.

- Risk absolutely nothing to try my service and claim multiple opportunities to make double- and triple-digit gains, just like thousands of other Capital Wealth Letter investors have done.

So which is it going to be?

You need to act fast.

An offer this generous won’t be around much longer.

And once it’s gone, it’s gone. You may never see it again.

So do yourself a favor and click the orange button below now.

Sincerely,

Nathan Slaughter

Chief Investment Strategist

Capital Wealth Letter

[button_1 text=”Click%20Here%20Now” text_size=”26″ text_color=”#ffffff” text_font=”Tahoma;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”40″ styling_height=”24″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#fe8700″ styling_gradient_end_color=”#ffac35″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sacwl-13f”/]

[vertical_spacing height=”20″]

[vertical_spacing height=”20″]

Copyright © 2023 StreetAuthority, a division of Capitol Information Group, Inc. All rights reserved.