Tired of Watching Our “Elected Elite” Get Richer By The Day, While We Barely Scrape By?

[vertical_spacing height=”20″]

Give me 10 minutes and you’ll see how a government-sanctioned “cheat sheet” lets you stake a claim on opportunities once reserved solely for the eyes of the D.C. elite.

Opportunities to grow your wealth

17x… 34x… even up to 71x revealed below…

Fellow Investor,

Public service is something often done out of the desire to serve our great nation… to help our fellow man.

Unless you’re a member of D.C.’s “elected elite,” that is.

Then, it’s an opportunity to grow your wealth by leaps and bounds.

Unless you’ve been living under a rock, you’re likely well aware that over half of U.S. Congress members are millionaires…

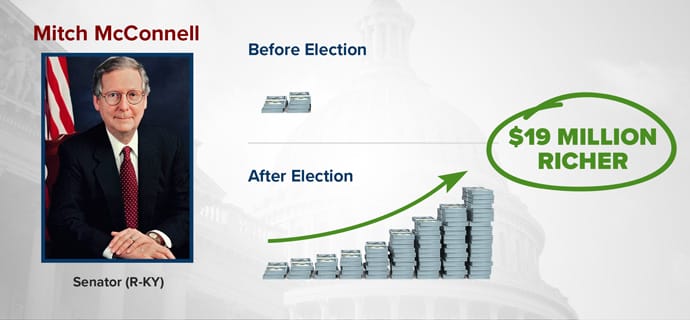

But have you ever wondered why so many members of Congress stick around in office, long after they should have retired? (McConnell… Pelosi… I’m looking at you both.)

While no one can say for sure… I believe the most likely reason is the insane amount of access they have.

Access to information members of the public NEVER lay eyes on…

Information and insights that they’re able to then use to generate obscene amounts of cash in the markets.

I’ve been digging… and uncovered EXACTLY what they’re buying, holding, and selling… along with the outrageous profits they’re bringing home in the process.

And best of all… I’ve boiled the investments down to the “crème of the congressional crop” when it comes to top-tier opportunities you can take action on today…

Similar plays allowed some of these elected elites to rocket every $5,000 into $85,000, $10,000 into a massive $340,000, or $20,000 into a wallet-stuffing $1.42 million.

Of course, I knew being a member of Congress came with immense privileges…

But I was floored to find that the biggest perk isn’t the pay… the pension… or even the healthcare plan.

No, this perk — the gift of almost unlimited access — is like a gift from the heavens. Because it gives them the opportunity to make stone-cold fortunes… time and time again.

For example…

- Senator Ron Wyden’s (D-OR) net worth has soared over $5.5 million since joining Congress in 1996…

- Senator Ted Cruz (R-TX) has added nearly $1.4 million to his net worth since joining Congress in 2010…

- Senator Tom Harkin (D-IA) has grown over $14.8 million richer since joining the Senate nearly 40 years ago…

- And Senator Mitch McConnell (R-KY) has grown over $19 million richer since joining Congress in 1984.

No doubt about it, for many members of Congress, entry into D.C.’s political elite is their golden ticket to wealth from relatively humble means.

In 2008, Representative Judy Chu (D-CA) was worth less than six figures. A decade later after serving in Congress, her net worth had grown to $7.1 million.

Representative Collin Peterson’s (D-MN) net worth in 2008 was just $123,500. Since joining Congress, it has ballooned to $4.2 million.

And Senator Roy Blunt (R-MO) has watched his net worth skyrocket from $602,000 to $10.7 million over the last decade since joining Congress.

The examples are nearly endless…

So I ask you… does being elected to Congress somehow make you a better investor?

Or is it more likely that they get to see the answers to the test in advance?

I think we both know the answer to that question.

Does that sound fair to you? Of course not — but it happens ALL THE TIME. It’s one of the reasons why politicians are the least trusted people in our country…

It’s also why there’s never a shortage of people throwing their hat in the ring to become one…

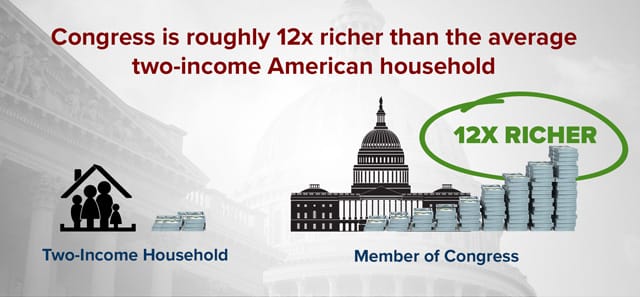

And when you consider the typical member of Congress is roughly 12x richer than the average two-income American household… it’s no wonder they’re so hesitant to give up their seats…

But, let me back up a moment and make one thing perfectly clear… I’m not here to try and gin up outrage at our elected officials.

There’s enough of that going around without my help.

And the simple fact of the matter is… bitching about it isn’t going to change things.

Which is why I’d rather show you how to tap into the same money-making opportunities that were once only available to the elected elites in their “top secret” closed-door meetings.

It seems only fair to me…

After all, the government is by the people, FOR the people, is it not?

They work for US — so there’s no reason you and I shouldn’t have access to the same wealth-building opportunities they do.

My team and I have done some digging. And we’ve uncovered the very best of these opportunities…

EXACTLY what Washington power brokers are buying… selling… and holding.

And as I’ll show you in just a moment… when you act today and follow along with them, you’ll have the chance to grow your wealth alongside them as they rake in 17x… 34x… even up to 71x returns.

How can I be so sure they’ll keep raking in the cash?

The dark secret that drives Congress?

Rules for thee, not for me.

Quite simply: there’s one set of rules for us…

And another set of rules for members of Congress… the “elected elite.”

In other words, they’re seemingly allowed to get away with things that at the very least would raise a few legal eyebrows (if they’re not considered outright criminal) for you or me.

Case in point…

On January 24, 2020, the Senate Committees on Health and Foreign Relations held a closed-door meeting with a few Senators to brief them on the emerging threat of COVID-19.

Following the briefing, Senator Kelly Loeffler (R-GA) and her husband, Jeffrey Sprecher, Chairman of the New York Stock Exchange, sold nearly $3.1 million in stock…

And over the next few weeks they would go on to sell at least $18 million more in stocks right before the global pandemic sent the markets crashing down.

What’s more, on the very same day as the Senate Health Committee meeting, they bought around $250,000 in Citrix, a tech company which produces remote-work software — just weeks before the virus made working from home the new norm.

While many other investors lost their shirts and were left to pick change out of their couch cushions, these two laughed all the way to the bank.

Coincidence? Astute knowledge of the markets and perfect timing?

I’ll let you be the judge.

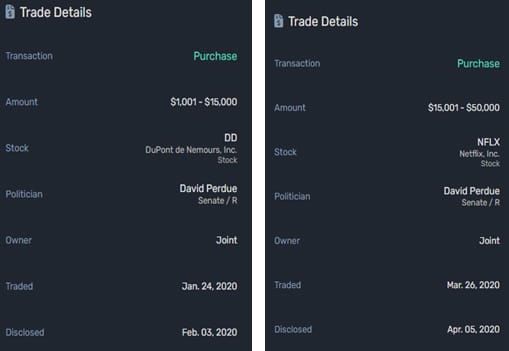

Then there’s Senator David Perdue (R-GA), who, on the very day of the closed-door meeting on the looming threat of COVID-19, sold $825,000 in stock.

Afterward, over a series of ten transactions, he bought $185,000 in Dupont (which makes personal protective equipment) and $50,000 in Netflix, right as it experienced a record surge in traffic from people staying in.

Now, can I be sure that they used the intel from this closed-door meeting to pad their bottom lines?

No — and even if they did, they would NEVER admit it.

But when members of Congress simultaneously make big trades on stocks that are directly impacted by a meeting they were a part of…

It lights up my B.S. detector like a pinball machine.

(And even makes me wonder why they don’t work on Wall Street.)

But not to worry. Perdue’s spokeswoman let it be known that, “Since coming to the U.S. Senate in 2015, Sen. Perdue has always had an outside adviser managing his personal finances, and he is not involved in day-to-day decisions.”

Uh-huh…

I MIGHT be able to choke that down as truth… if Perdue was alone.

But the fact is, he’s not the only one involved here.

Just how deep does the dirt go?

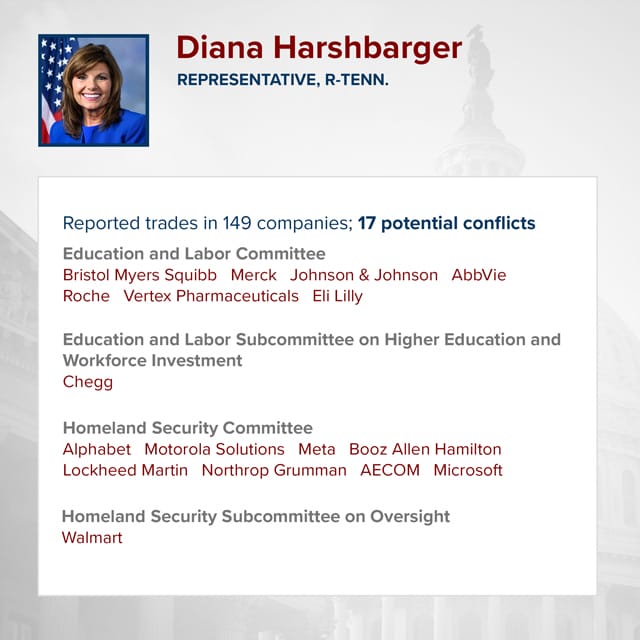

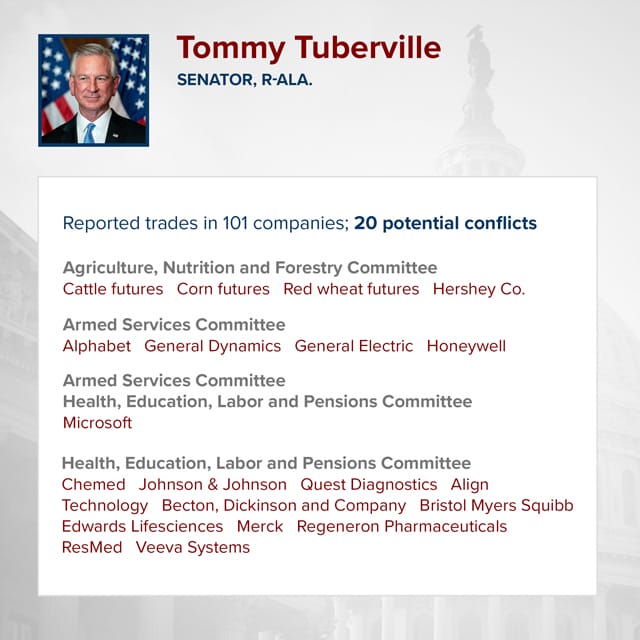

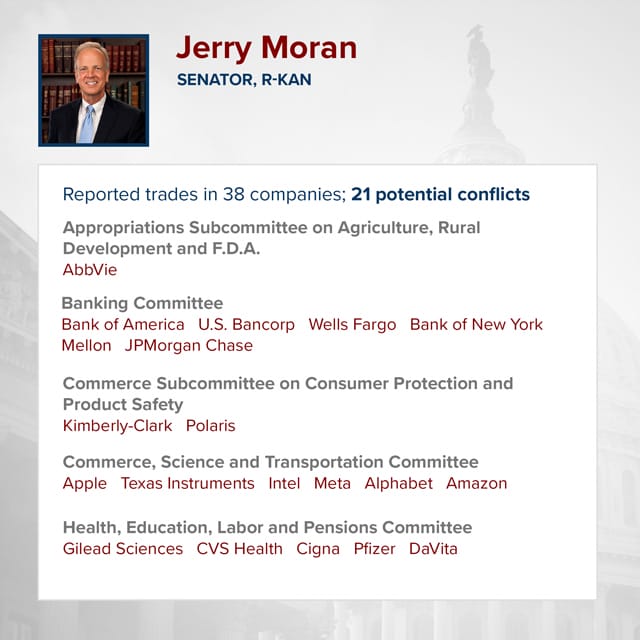

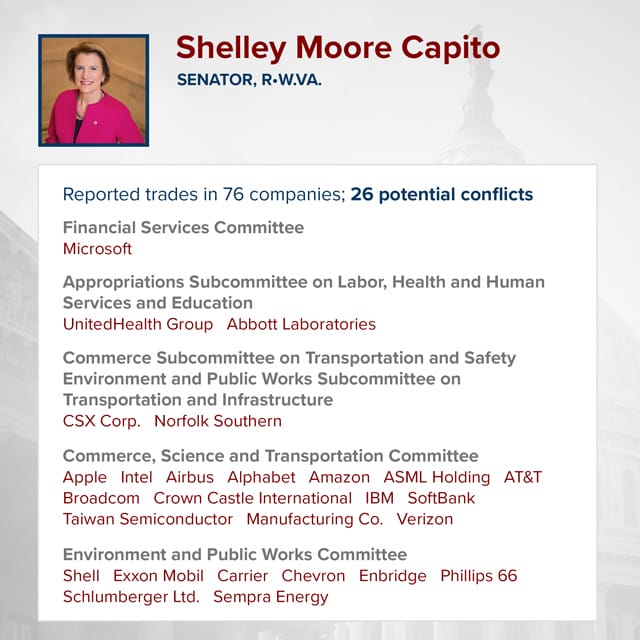

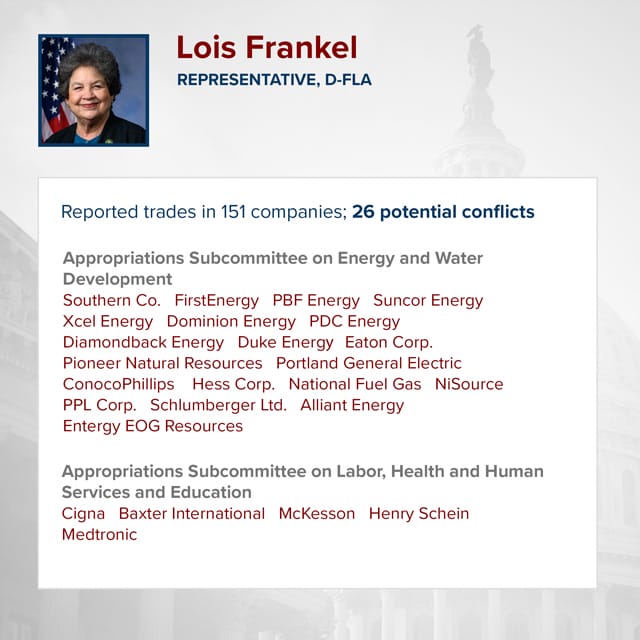

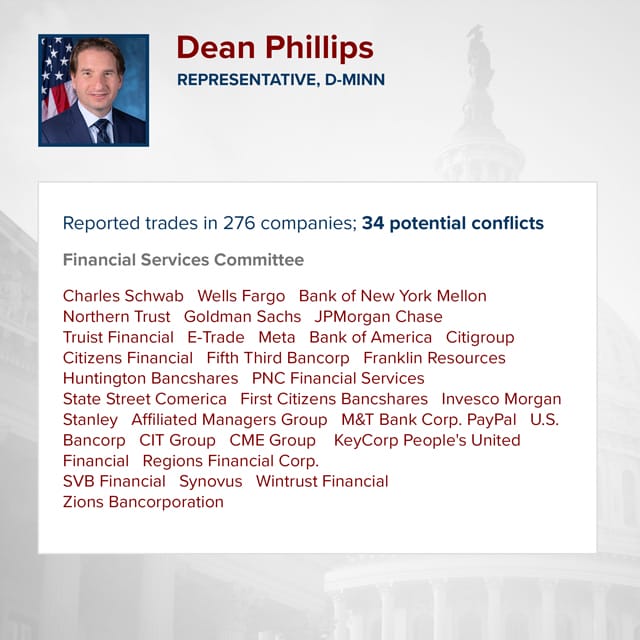

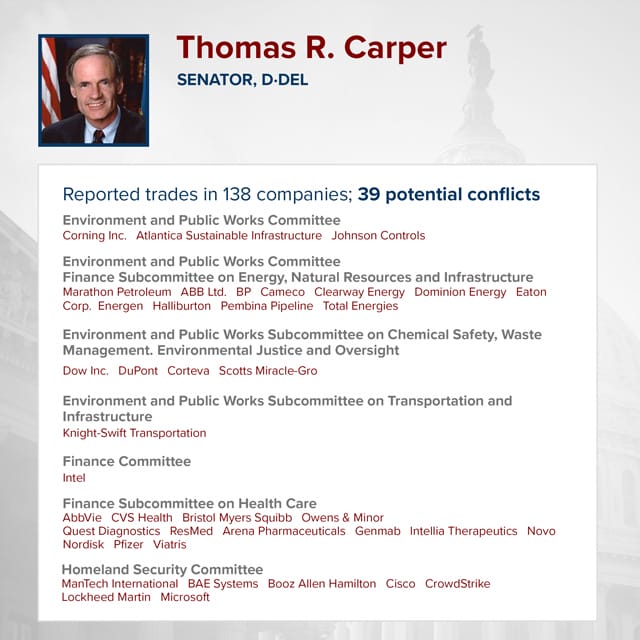

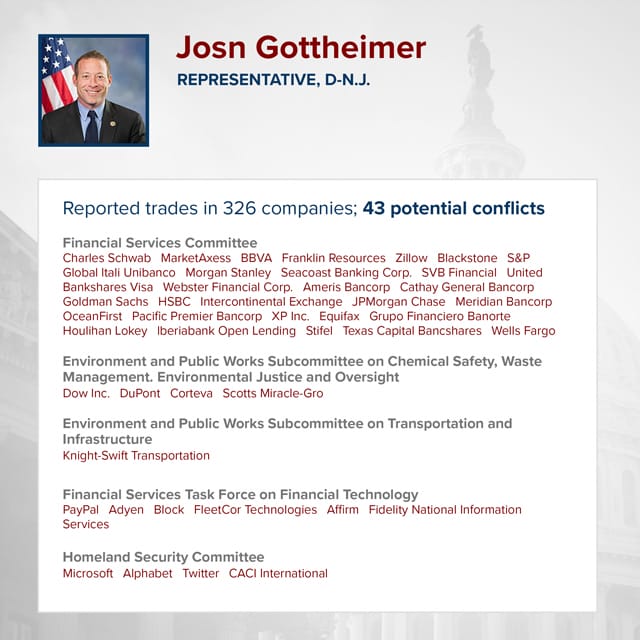

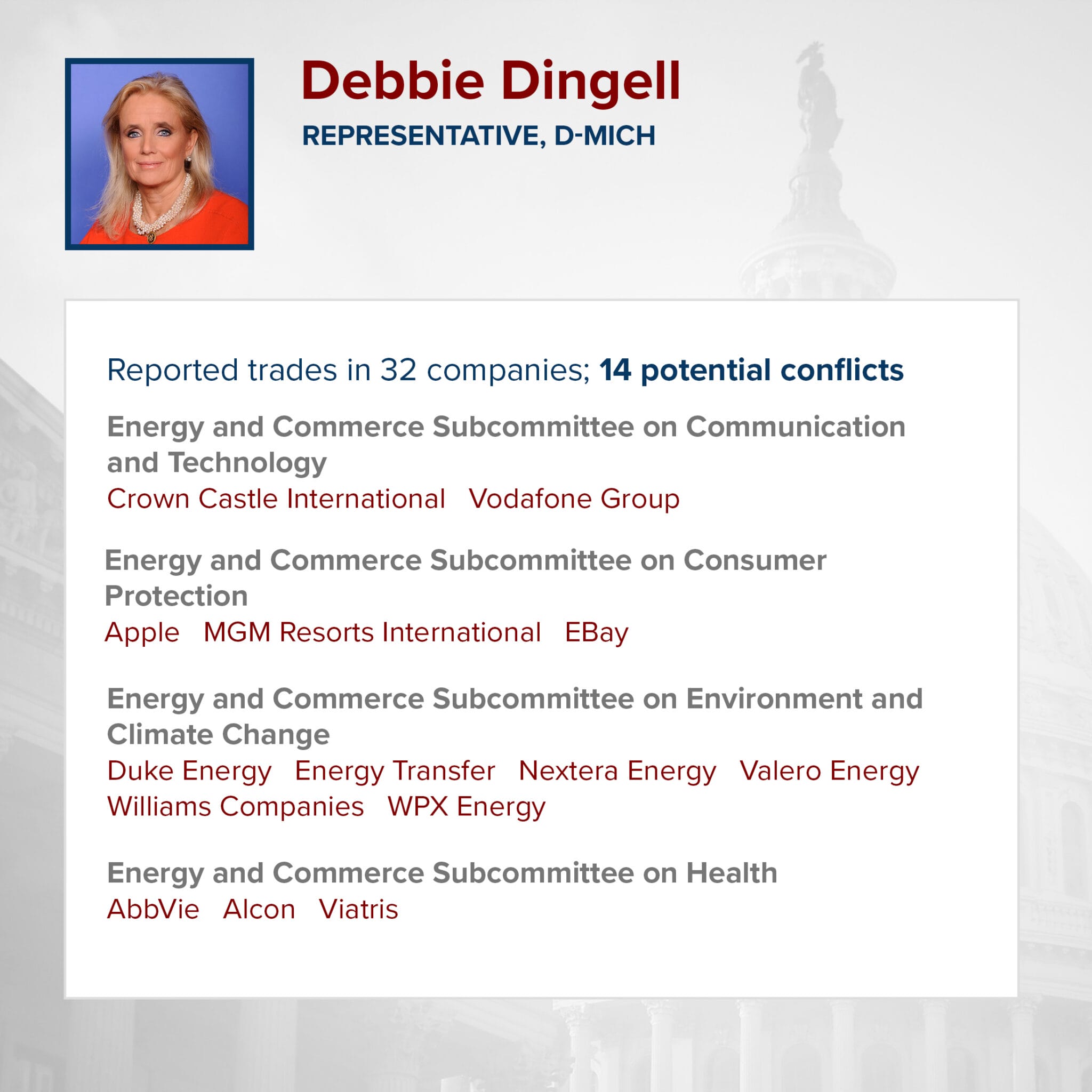

It’s been reported that between 2019 and 2021, 97 members of Congress (or their spouses or dependents) traded in companies affected by the actions of their committees… with over 3,700 potential conflicts of interest. In this two-year period alone.

So let me ask you…

How would YOUR finances look if you knew exactly when to buy and when to sell stocks well ahead of major developments?

How different would your life be?

Well, for one thing, if you tried doing this with non-public information — like these senators seem to be doing — you’d probably be in jail right now.

For anyone else… this would likely be considered insider trading, and it’s illegal.

Unless you’re a member of America’s elected elite.

Then, it’s just another day at the office…

With seemingly no repercussions whatsoever — except for a beefier bottom line.

It’s why, even though the S&P 500 fell 18% last year, the holdings of members of Congress outperformed it by an average of 17.5%!

(In just a moment, I’ll reveal several of these holdings — ones that still have market-crushing potential — and which could 17x, 34x, or even 71x your wealth.)

Now to be clear, efforts have been made to put an end to this highly questionable practice.

In 2012, the U.S. Government passed the Stop Trading On Congressional Knowledge, or STOCK Act, which prohibits Congress members from making trades based on privileged information — and requires them to disclose any trades within 45 days.

(You can think of these trade disclosures as a “cheat sheet” which allow the public to see what are supposed to be our nation’s finest are buying and selling.)

The problem is, it’s very difficult to prove that a specific trade stemmed from a specific piece of information — and the ones with the power to stop this questionable tactic also tend to be the ones who benefit the most from keeping them alive.

Talk about having the inmates run the asylum.

Which is likely why there’s never been a single charge filed against anyone in Congress for violating the STOCK Act.

What’s more, dozens of Congress members and their aides have continued to ignore the disclosure requirement.

And why shouldn’t they?

The fine for failing to file one is a measly $200 — the price of a cheap dinner at a fancy D.C. restaurant.

As Senator Josh Hawley (R-MO) said before his fellow Congress members, “This body has a habit of proscribing rules and standards for other people and then not looking to its own problems.”

In an apparent effort to put a stop to this, Senators Hawley and Kristen Gillibrand (D-NY) recently introduced the Ban Stock Trading for Government Officials Act, which would ban stock trading, ownership, and blind trusts for members of Congress… impose heavy penalties for executive branch stock trading… require reporting of federal benefits… and hike penalties for not reporting trades.

In the House, Representative Ro Khanna (D-CA) has also proposed his own plan for banning not just members of Congress, but also their spouses from trading stock.

Sounds ambitious…

Sounds noble…

Sounds good for the American people.

But while I’m not a betting man, I’m willing to wager by the time this message make it to your inbox, these plans will be dead in the water.

Consider: in just one year alone Congress members and their immediate families bought and sold $620 million in assets.

So do you think they’re really going to put much effort into stopping this gravy train?

Not on your life.

But that’s fine… like I said I’m not here to gin up outrage…

I’m here to show YOU how to line your own pockets riding the coattails of our “elected elite” as a sort of divining rod for stocks set to move.

It’s only fair, right?

Congress is getting rich on OUR dime — while ducking the responsibilities we elected them to carry out.

So the way I see it, it’s time to play Robin Hood — and let you skim your fair share of the big profits they’re sinking their teeth into.

In a moment, I’ll reveal exactly how you can do just this… locking in the chance to grow your wealth by 17x, 34x, or even 71x.

But, I’m getting a bit ahead of myself… first I think a proper introduction is in order.

My name is Nathan Slaughter.

My name is Nathan Slaughter.

For the last 16 years, I’ve been helping ordinary investors build massive wealth — without using options, day trading, or taking on any undue risk.

As a younger man, I got my start working for AXA/Equitable Advisors, one of the world’s largest financial planning firms.

Then I honed my research skills at Raymond James Morgan Keegan, where I used my prowess as a stock picker to manage millions in portfolio assets.

While catering to the ultra-rich definitely has its financial rewards, the truth is…

I HATED IT.

Day in, day out… slaving away… missing anniversaries, birthday parties, vacations, reunions, and other family get-togethers just so I could help some fat cat I’ve never even seen face to face add another comma to an already bloated bottom line.

After a few years, I’d had my fill and decided to walk away from the Wall Street life…

But I didn’t quit the investment game completely.

Quite the contrary.

Instead, I joined StreetAuthority, one of the world’s most trusted financial research firms, relied on by over 100,000 readers.

At StreetAuthority, we make it our mission to uncover profit opportunities other research firms overlook — even if that means diving deep into the underbelly of Washington D.C…

And uncovering profit opportunities our elected elites would rather keep to themselves.

Speaking of which, I’ve spent the last few weeks doing a deep dive into their “dirty dealings” in D.C.

Sifting through hundreds of trade disclosures…

And NOW I know EXACTLY what they’re buying, selling, and holding.

And you’re about to get access to it.

You could say it’s my contribution to leveling the playing field between our “elected elite” and patriotic Americans like you

After all, they have a huge advantage the rest of us don’t: they know precisely which laws, taxes, subsidies, and regulations are going to affect which companies and how.

It’s why many of them are able to sidestep catastrophes like the “Covid crash”… and why they keep growing their wealth as the rest of us continue to fall behind.

Of course, just because a member of Congress buys a certain stock doesn’t mean you should run out and snap up shares.

They’re just as capable of making mistakes as the rest of us.

(Have you SEEN some of the bills they’ve brought to the table recently?)

It’s why I went the extra mile, closely researching the stocks they’re holding… poring through annual reports and other financial statements…. examining stock charts… and selecting only the most promising of the pack.

You see, discovering the companies Congress members are investing in is just the first step (which gives me the inside track).

But the real money is made when I apply my proprietary filters to these “congressional stock picks”… which whittles hundreds of them to just a handful.

The few that could finally help narrow the gap between “elected elites” and the rest of us.

Some of these elites have skyrocketed their wealth by as much as 71x trading the right stocks… and today is your chance to hop on that profit train alongside them.

They’re no better than we are — which means you deserve access to the same opportunities they have.

And that’s exactly what I’m going to give you today.

Remember, they’ve got insights on the companies affected by legislation coming down the line — and now I’ve got insights on THEM…

Including everything they’ve bought and sold over the last 4 years…

And I’m convinced I’ve found the top movers coming out from under the Rotunda… and exactly how to tap into them.

Companies like…

Stock #1:

Betting on an unstoppable mega-trend

Electric vehicles are hitting the road everywhere you turn — and they’re not going away anytime soon.

Last year, EV sales surpassed 10 million cars for the first time — and are set to blow past 35 million by 2030.

What’s more, the recently passed Bipartisan Infrastructure Law will finance the production of 500,000 EV charging stations and invest over $7 billion in EV battery components.

Surrounded by EVs parked on the White House South Lawn, President Biden declared them a “vision of the future that is now beginning to happen.”

That’s music to the ears of one major company.

Not because it produces road ready EVs.

But because it does something even more crucial — it mines the lithium that their batteries need to function.

No lithium, no EVs.

It’s that simple.

It’s why lithium demand is set to soar 5x between now and 2030…

Putting this miner right in the catbird’s seat.

And with major mining operations on four continents, it’s perfectly positioned to feed the world‘s voracious demand for lithium.

As a matter of fact, it expects to TRIPLE lithium production by the end of the decade.

But that’s not all…

Not long ago, as part of the Bipartisan Infrastructure Law, this miner received a $150 million grant from the Department of Energy to finance the construction of its new lithium processing plant in North Carolina… something that didn’t go unnoticed by members of Congress.

Like Representatives Marjorie Taylor Green (R-GA). She took up to a $15,000 stake in this miner…

Or Deborah K. Ross (D-NC), who bought upwards of $50,000 of its stock right around the time this bill was passed.

What kind of returns could we rake in from this miner?

If its share price surges in lockstep with the 5x growth in lithium demand, we could be looking at a trade that turns every $2,450 into $12,250… every $4,900 into $24,500… and every $9,800 into $49,000.

And if it goes up only half as much? You can still come out with 250% gains — enough to turn every $4,900 into $12,250!

If you think this play sounds thrilling, let me tell you a bit about the next one…

Stock #2:

One man’s trash…

You may not realize this, but the average American throws away 4.5 pounds of trash every day… a big reason why the U.S. produces a whopping 268 million TONS of waste each year.

That’s a LOT of trash — and for one company and its shareholders, an enormous profit opportunity.

Why?

Because this company converts the methane produced from all this garbage into biomethane, a renewable natural gas substitute that it then sells to business and governments looking to reduce their carbon footprint.

Sexy? No.

But if you care about making money, that shouldn’t bother you in the least.

Because this dynamo has outperformed the market nearly 250% over the last 11 years… and has nearly QUADRUPLED its dividend over the last 19 years.

And you can bet there’s more to come… as the company plans to bring 17 new renewable natural gas projects online by 2026, in addition to the 16 it currently operates.

What’s more, it’s set to be a big beneficiary of the Inflation Reduction Act, which, for the first time, provides major tax incentives and credits to the entire biogas production industry.

You think certain members of Congress noticed?

You bet they did.

It’s likely why between the two of them — Senator Thomas R. Carper (D-DE) and Representative Richard W. Allen (R-GA) — bought nearly $65,000 of this company’s stock in the months surrounding the bill’s passing!

Stock #3:

A Big Boon for Small Business

Running a small business can be tough — really tough.

It’s why only a third of small business owners say they can afford to offer retirement plans… while 8 in 10 say they can’t match the benefit packages offered by big companies.

For many, hurdles in costs, compliance, and administration in trying to do so are just too much.

But thanks to Congress, that’s about to change.

It didn’t receive much fanfare at the time, but with the passage of the Setting Up Every Community for Retirement Enhancement, or SECURE Act, employers can now receive tax credits for setting up retirement plans for their employees.

Obviously this is a win for both employers and employees. But for ONE company in particular, it can only mean massive profits.

Why?

As one of the nation’s largest retirement planners, it helps small businesses put together the right plan for their employees and navigate the SECURE Act’s rules and regulations.

And with a potential market of over 33 million small businesses in America to serve, it’s bound to be busy for a LONG time.

Producing both stellar retirement plans for small businesses owners and their employees, while also delivering outstanding returns for investors.

Speaking of which, over the last ten years it has absolutely clobbered the S&P, delivering more than 300% gains!

And has more than QUADRUPLED dividend payouts during this time.

Small wonder why elites like Congressman Rick Larsen (D-WA) and former representative (now Undersecretary of Defense) Gilbert Cisneros have added nearly $30,000 of its stock to their portfolios!

And that’s just the tip of the iceberg.

There are four more blockbuster opportunities like these — all owned by D.C. insiders — that I can’t wait to share with you, including:

- A world leader in green energy production that has nearly tripled dividend payouts over the last ten years, handing out $12,870 for every 1,000 shares held…

- An established player in robotic surgery dominating the nexus between healthcare and AI…

- A major payment processor perfectly positioned to profit from the post-Covid surge in international travel, and…

- A major oil refiner that has outperformed its peers over the last ten years, turning every $10,000 into $52,000…

I’ve put together all the details on these 7 stocks — including their names and ticker symbols — in a special new briefing, The Rotunda Report: How to Siphon Congress’s Monster Profits for Yourself.

I’ve put together all the details on these 7 stocks — including their names and ticker symbols — in a special new briefing, The Rotunda Report: How to Siphon Congress’s Monster Profits for Yourself.

And I want you to have it, absolutely free.

Imagine being able turn every $10,000 into $177,000… $340,000… or $710,000.

If this sounds incredible, just remember that this is EXACTLY what certain members of Congress have been doing with their stocks.

Senator Roy Blunt (R-MO) turned his $602,000 into $10.7 million in just 10 years…

A 17.7x return.

Representative Collin Peterson (D-MN) entered Congress in 2008 with just $123,500. Now he’s worth $4.2 million…

A 34x return.

And Rep. Judy Chu (D-CA) entered Congress with less than six figures. A decade later she was worth $7.1 million…

That’s a 71x return!

These are absolutely staggering returns.

Think about it… a 17.7x return would turn a small investment of $5,000 into over $85,000…

A 34x return would send that same $5,000 soaring to $170,000…

And a 71x return like Rep. Chu has enjoyed? It would turn your $5,000 into a whopping $355,000!

And if you racked up “only” half as much as Roy Blunt, Judy Chu, or Collin Peterson?

You’d STILL be light years ahead of most other Americans.

What would that mean for you?

Being able to finance a first-class education for your grandchildren… take a five-star pleasure cruise around the Mediterranean… or maybe buy that vintage 1971 Camaro you’ve always had your eye on.

Whatever it is, the seven “D.C. insider” stocks you’ll discover today can make it happen.

And it’s why I believe, if you’re serious about safely building your wealth by leaps and bounds, you owe it to yourself to discover them by grabbing The Rotunda Report: How to Siphon Congress’s Monster Profits for Yourself.

When you do, you’ll discover their names and ticker symbols — and how to play them for maximum gains.

You’ll know what price to buy under… the profits we’re shooting for… and a full rundown of each stock and why D.C. creeps are snapping up shares.

Discover the Market’s Biggest Opportunities—

Long Before They Hit the Headlines

I want to give this report to you, a $199 value, absolutely free (plus SO MUCH MORE).

All I ask in return is that you accept your no-risk membership to my financial advisory service, Capital Wealth Letter.

Now, I certainly don’t want to give you the impression that we only focus on congressionally-traded stocks here.

Because our mission at Capital Wealth Letter goes deeper: to bring you the market’s BIGGEST opportunities — long BEFORE they hit the headlines…

Giving you the ability to lock in on them early and ride them for a shot at massive profits.

We’re not just looking to beat the market here — our goal is to introduce profit opportunities that can generate truly life-changing returns.

Like the kind you’ll find in The Rotunda Report: How to Siphon Congress’s Monster Profits for Yourself.

There’s only so much Wall Street’s supercomputers and their “rocket scientist programmers” can do to uncover opportunities like these.

To find them requires good old-fashioned investigative research — poring over disclosure forms… sifting through stocks charts… and burning the midnight oil scouring through financial statements.

That’s the kind of thoroughness and hard work that’s that no supercomputer can match… and that’s just too unsexy for many of Wall Street’s boy geniuses.

But here at Capital Wealth Letter we settle for nothing less. And at the risk of sounding like I’m bragging… it’s worked like a charm.

Because we’ve been able to help investors bag big winners like these:

- 90% on Arrowhead Pharmaceuticals

- 96% on Starbucks

- 105% on Tencent Holdings

- 113% on Okta

- 158% on Intel

- 164% on Reata Pharmaceuticals

- 299% on PayPal

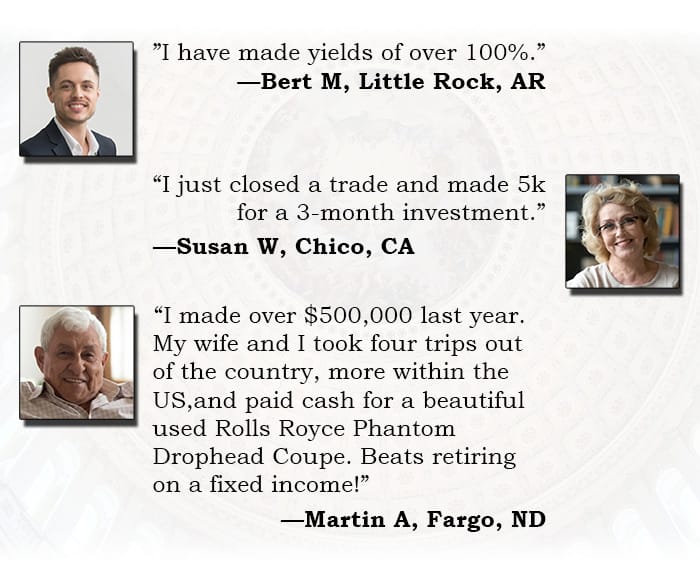

And it’s the reason so many of my readers have taken time out of their busy lives to send in notes like these:

*Results not typical. For details see our disclosure page linked below.

Now, Martin’s experience is definitely one for the record books and there’s no guarantee yours will be similar to any of these folks.

It’s true what they say…

When it comes to investing, regardless of the trades you take on, NEVER invest more than you’re OK walking away from.

But I hope you’re starting to see how Capital Wealth Letter is helping change the lives of real people — and how it could change yours, as well.

But I hope you’re starting to see how Capital Wealth Letter is helping change the lives of real people — and how it could change yours, as well.

Because at Capital Wealth Letter, we relentlessly focus on one singular objective — making you the most money with the least amount of risk.

It’s why when we smell opportunities that can help you do just this, we go after them — no matter where they lead.

I can’t wait for you to see for yourself what Capital Wealth Letter can do for you.

So let me show you everything you get as soon as you join and claim your copy of The Rotunda Report: How to Siphon Congress’s Monster Profits for Yourself:

12 Monthly Issues of Capital Wealth Letter

Once a month I’ll send you an in-depth report with a new opportunity to grow your money. Every issue is packed with easy-to-buy investment recommendations that can help surpass your wildest expectations of building wealth.

It may be an exciting stock… a fast-growing cryptocurrency… or some other high-profit potential situation you’ll discover before most investors get a chance to read about it in The Wall Street Journal or on Yahoo Finance.

24/7 Members’ Only Website Access

You’ll have total access to our private, password-protected, members-only website. Here you’ll find the full library of financial research behind each of my recommendations.

The members’ area includes all my regular monthly Capital Wealth Letter issues, as well as the Special Opportunity Reports, like our briefing behind Starlink’s secret partner and how tapping into it today could 9x your money.

But that’s not all — you’ll also have full access to our three model portfolios.

Our holdings are divided into 3 distinct categories, with a portfolio for each:

- The Game-Changers Portfolio — Here you’ll find the most innovative and high-profit potential investment opportunities that have passed my detailed analysis.

- The Main Portfolio — Holds our core stalwart stocks we’ve held for years (many of which are still a buy) alongside newer companies we believe will hand us profits for years to come.

- The Crypto Portfolio — Whether you’re a crypto pro or you’ve barely got a handle on what a bitcoin is… you’ll find our top recommendations (along with a complete no-nonsense breakdown on each opportunity) in the world of cryptocurrency.

Inside each of them, you can track our current gains from the time they were recommended. And all positions have a clearly listed buy-up-to price, so you can easily see which ones you can still get into.

Intraday FLASH Alerts

You’ll get regular updates on our positions and on any new opportunities I come across.

The markets move quickly, so as part of your membership, the moment I’m made aware of something that affects one of our holdings, I’ll send you a Profit Alert with full instructions on the exact action you need to take. The markets never sleep and neither does Capital Wealth Letter.

VIP Concierge Service

You’ll also have a trained team of professionals dedicated to Capital Wealth Letter to help you get the most out of your membership.

If you have any questions about your membership or any other concerns at all, my VIP Concierge team is ready to help you. All you have to do is pick up the phone or send an email and we’ll take care of you.

And as a new member you’ll receive an exclusive bonus: free access to…

StreetAuthority Insider

Each week we’ll show you the newest opportunities and investments collected from all our StreetAuthority financial research staff… before the public ever hears about them. This service is included with your subscription at no extra cost.

Lock In Massive Savings Now

I’m certain you’ll be so thrilled with everything you’re receiving from me you’ll want to stay with Capital Wealth Letter for the long haul.

Which is why I’ve made it possible to receive a whole year of Capital Wealth Letter at a very steep discount.

Now, you might be expecting a service chock full of massive profit opportunities I’ve shown you today to cost a small fortune — maybe a few thousand dollars.

Many Wall Street firms would happily charge you this much for half the money-making intel I want to share with you starting today.

But I left Wall Street behind a long time ago…

I’m no longer chained to some corporate protocol that requires me to benefit the company at the cost of the investor…

I can finally give average Americans the insights and information needed to make profitable trades in the crazy market we’re living through, without repercussions for failing to meet some “quota.”

And I’m not going to let price be the one thing that stands between you and profits.

Which is why a full year of Capital Wealth Letter normally runs just $129.

Given the fact that you’ll receive multiple profit opportunities during the year — each of which has the potential hand you double, triple or quadruple-digit gains — I think you’d agree that’s a pretty fair deal.

Still… I think it could be even better.

Which is why — through this special offer only — I’m slashing 70% off the regular membership price.

Which means, today, an entire year of Capital Wealth Letter is yours for only $39.

[vertical_spacing height=”20″]

[button_1 text=”I%20WANT%20IN” text_size=”32″ text_color=”#ffffff” text_font=”Tahoma;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#fe8700″ styling_gradient_end_color=”#ffac35″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sacwl-rotunda”/]

[vertical_spacing height=”20″]

Imagine… for less than dinner for two at the local burger joint, you’ll have the opportunity to tap into opportunities that could grow your wealth 17x… 34x… even 71x!

Sound like a sweet deal? Well, I’ve got something even sweeter when you decide to extend your stay…

Double Your Savings and Get 7 More Money-Making Reports

When you sign on for two years of Capital Wealth Letter right now, not only will you save $180, but, in addition to The Rotunda Report: How to Siphon Congress’s Monster Profits for Yourself, you’ll receive 7 more blockbuster reports, any one of which has the potential to dramatically supercharge your wealth:

- How to Profit up to 886% from “Starlink’s Secret Partner” ($99 value)

- Sky-High Profits: How to Bank Big Gains from a Booming New Market ($99 value)

- Retire Rich on the “Tesla of Space” ($99 value)

- How the Explosion of Smart Devices Can Flood Your Account With Cash ($99 value)

- The 5G Revolution: 3 Stocks for Six-Figure Profits ($99 value)

- 7 Legacy Assets to Own Forever ($99 value)

- 7 Loser Stocks to Dump Now ($99 value)

That’s $693 in free bonuses that can be yours — at absolutely zero risk!

[vertical_spacing height=”20″]

[button_1 text=”Grab%20Your%20Free%20Bonuses%20Now” text_size=”28″ text_color=”#ffffff” text_font=”Tahoma;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#fe8700″ styling_gradient_end_color=”#ffac35″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sacwl-rotunda”/]

[vertical_spacing height=”20″]

No matter which route you choose, rest assured that you’ll be protected by my…

Double-Barreled Money-Back Guarantee

Because when you take me up on this opportunity to siphon Congress’s profits for yourself, along with locking in an entire year of access to Capital Wealth Letter, you’ll have a full 90 days to make sure it’s everything I promised it would be.

That means, no matter how much money you’re making, if you’re dissatisfied for any reason whatsoever, just let my customer service team know by Day 90 and we’ll give you back every penny you paid to join.

And as a “thank you” for give us the opportunity to earn your trust, all the issues you’ve read and reports you’ve received are yours to keep.

Even if it’s past the 90-day mark — I’ve still got your back!

Simply let us know you’re unsatisfied with your membership and you’ll receive a refund for the unused portion of your membership.

In other words — risk nothing and keep everything!

Now you have two choices:

- Ignore this rare opportunity to profit from opportunities once reserved for the D.C. elite — and so much more — and constantly wonder about what might have been.

- Risk absolutely nothing to try my service and claim multiple opportunities to make double- and triple-digit gains, just like thousands of other Capital Wealth Letter investors have done.

So which is it going to be?

You need to act fast.

An offer this generous won’t be around much longer.

And once it’s gone, it’s gone. You may never see it again.

So do yourself a favor and click the orange button below now.

Sincerely,

Nathan Slaughter

Chief Investment Strategist

Capital Wealth Letter

[vertical_spacing height=”20″]

[button_1 text=”Click%20Here%20Now” text_size=”32″ text_color=”#ffffff” text_font=”Tahoma;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#fe8700″ styling_gradient_end_color=”#ffac35″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sacwl-rotunda”/]

[vertical_spacing height=”20″]

Copyright © 2023 StreetAuthority, a division of Capitol Information Group, Inc. All rights reserved.