*** Congress To Hold Critical Vote Within Weeks ***

The First “Marijuana Domino” Is About To Fall…

Here’s How To Turn A Tiny $5,000 Stake Into

$112,343 As Marijuana Prohibition Comes

To A Screeching Halt!

Dear Reader,

It doesn’t matter whether you’re for it or against it…

Marijuana legalization is coming. It will be here sooner than you think. And it’s bringing with it the most explosive growth we’ve seen in our generation.

In 2018, legal cannabis sales generated $10.4 billion and employed more than 250,000 Americans—even while it was federally illegal.

CNBC reports the industry is on track to create an additional 250,000 jobs by 2020.

And Forbes estimates the North American cannabis industry will generate $47.3 billion by 2027.

Marijuana is no longer something Americans can ignore. It’s NOT going away.

The end of prohibition has created a once-in-a-lifetime investment opportunity for all Americans. And like all once-in-a-lifetime opportunities, this one will make some investors wealthy beyond their dreams.

I want you to be one of them.

I’ve discovered a pot stock investing technique you can use to turn a small $5,000 stake into $112,343 before the end of the year…

Without gambling your life savings on no-name penny stocks…

Without the anxiety of wondering if the company will still exist six months from now…

And without throwing hard-earned money down the drain on the market’s latest, overpriced “hot stock” that’s almost certain to tank on the next piece of negative news.

Instead, you’ll be following in the footsteps of America’s elite one-percenters… using the same techniques they’ve used to build generational wealth for centuries.

What I’ll share with you today is a technique 99% of Main Street investors have never heard of…

Or even thought about because the information simply hasn’t been available to them…

You see, people closer to the action—corporate CEOs and directors, lobbyists, and Washington lawmakers—have better information than the investing public. And they get access to it long before we do.

That information allows them to build wealth faster than everyone else in the country… day-in and day-out, year-after-year.

It’s not fair. And today… I’m doing something to change it.

If you stick with me for the next few minutes, I’ll reveal exactly how I get inside the heads of wealthy CEOs and their teams of Ivy League educated experts…

How I apply their investing methods to do the hard work of picking the perfect stocks…

And how I’ll put them to work for you as well… giving you the opportunity to add six-figures or more to your retirement account in the next 12 months.

Follow me closely and all you’ll have to do is tap a few ticker symbols into your online brokerage account. Then go for a round of golf. Or maybe tennis.

The profits will take care of themselves.

These “Investors” Can’t Afford

To Make Mistakes…

Imagine you’re CEO of a $42 billion company…

And you’re solely responsible for deploying the company’s capital so it provides a better-than-average return for your shareholders not only this year… but also for the next 10 to 20 years.

Resting on your shoulders are the expectations of the company’s Board of Directors, its employees, and hundreds of thousands of shareholders around the globe.

A bad decision can cost you your job, your reputation, and your multi-million dollar compensation package.

That’s a heck of a lot of pressure.

If you were this CEO and had to pick a single cannabis company to partner with, how would you approach it?

Would you toss a bunch of names in a hat, pick one out at random, and write a huge check to the lucky winner?

Of course you wouldn’t. No rational person would.

Instead, you’d send a team of your smartest and most-trusted employees away to research the industry and put together a short list of its most-promising companies.

Then… you’d work your way down the list.

You’d call up the CEO of the first company and have a heart-to-heart conversation.

You’d very likely get on a plane, fly to the company’s head office, tour the facilities, meet the management team, have an extended dinner with the CEO at one of the city’s finest restaurants, and maybe even go for a round of golf.

You and your highly-paid team of financial analysts would do everything in your power to make sure you invested in the right company.

You’d leave no stone unturned.

And if the smallest detail didn’t smell right…

You’d drop the company like day-old fish and move on to the next one on your list.

There’d be too much at stake personally and professionally for you to risk making a bad decision.

What I’ve just described above is exactly the position Rob Sands—then CEO of Constellation Brands—found himself in before he wrote a $4 billion check to Canadian cannabis producer Canopy Growth in 2018… taking a 38% stake in the company.

What are the chances the beer brewing giant will let Canopy Growth fail?

They’re pretty close to zero.

When you see a CEO make a $4 billion investment in a company many people had never heard of, you have to ask…

What did they know that the investing public didn’t? And, how did they know it?

Those are the questions I’m going to answer for you today.

You see, when the average working-class American buys stock in a company, they very often do it based on the advice of a broker, a “tip” from friend, or a sound-bite they’ve heard on the evening news…

Not based on a thorough financial analysis performed by a team of Harvard MBAs… and maybe even a trade secret or two the company’s CEO let slip after an expensive bottle of wine.

Constellation Brands’ investment in Canopy Growth was a big deal.

But by no means was it a one-off.

Right now, all across the food and beverage, pharmaceutical, and tobacco industries, big players are aggressively shopping for cannabis partners.

Just like you, they’ve seen Canada legalize marijuana federally in 2018… the first developed country in the world to do so.

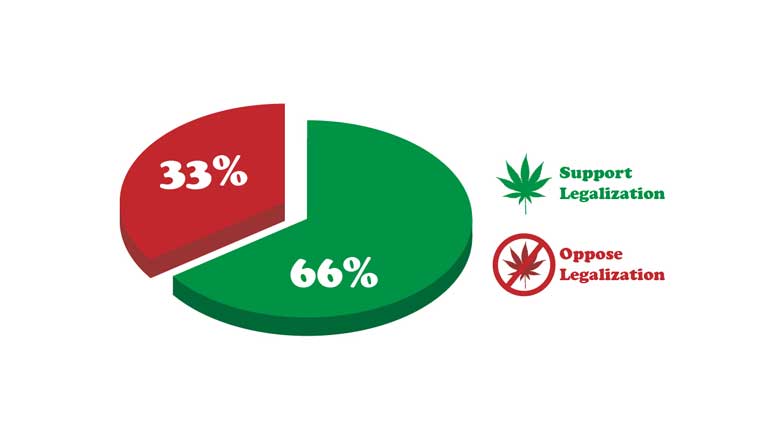

They know 66% of all Americans favor legalization—the highest rate in the history of our country.

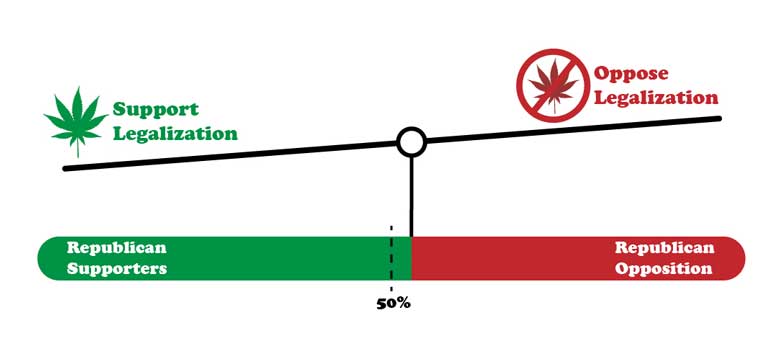

They’re fully aware that, for the first time ever, the majority of Republican voters are in favor of legalization.

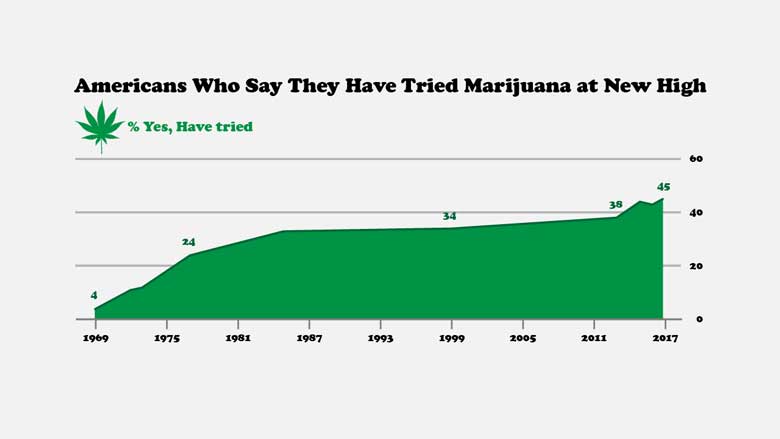

They know that 45% of Americans say they’ve tried marijuana in their lifetime—the highest rate in history.

They’ve seen former House of Representatives Speaker, John Boehner—previously on record as being “unalterably opposed” to legalization—become director of Acreage Holdings—a major player in the cannabis industry.

They’ve seen former House of Representatives Speaker, John Boehner—previously on record as being “unalterably opposed” to legalization—become director of Acreage Holdings—a major player in the cannabis industry.

They’ve witnessed Colorado’s Republican Senator Cory Gardner—who opposed his own state’s legalization in 2012—partner with Democratic Senator Elizabeth Warren on the STATES Act to give individual states the authority to legalize marijuana without federal interference.

They know that virtually all 2020 Presidential candidates—both Democrat and Republican—support legalization.

They’ve seen Senate Majority Leader Mitch McConnell champion the Farm Bill in 2018—legalizing hemp farming and CBD production.

They’ve seen Senate Majority Leader Mitch McConnell champion the Farm Bill in 2018—legalizing hemp farming and CBD production.

And in March, even Attorney General William Barr joined the party… publicly stating he’d prefer, “to permit a more federal approach so states can make their own decisions” on marijuana.

American voters on both sides of the political aisle have made their wishes known.

Some of the country’s most powerful and influential lawmakers have changed their minds about marijuana.

And legalization is one of the few political issues Republicans, Democrats, and Independents agree on.

These facts aren’t tiny breadcrumbs scattered along a forest trail leading toward legalization.

They’re huge highway billboards.

They’re all pointing in the same direction. And they’re all screaming one message…

“The End of Marijuana Prohibition is Coming”

Constellation Brands’ $4 billion investment in Canopy Growth may have been the single biggest partnership the marijuana industry has seen so far.

But it’s certainly not the only one. Corporate CEOs have been on a buying spree recently… gobbling up North America’s top cannabis growers, processors, and distributors.

Thankfully, there are a few outstanding companies they’ve overlooked. It’s these “sleepers” that could add six-figures to your account this year. And in just a minute, I’ll reveal exactly who they are.

But first, let me introduce myself.

I’m Genia Turanova…

And I’m Chief Investment Strategist at StreetAuthority.

And I’m Chief Investment Strategist at StreetAuthority.

I’m going to take a wild guess that I’m different from the financial “gurus” you’re used to hearing from.

For starters, I didn’t attend a fancy Ivy League college.

I haven’t written any best-selling books.

I don’t appear regularly on CNN, Bloomberg, or MSNBC.

And you’ve most likely never seen my name in the Finance section of the New York Times, Wall Street Journal, or Barron’s.

The fact the mainstream media almost completely ignores me is a very good thing. Without millions of people watching my every move, I’m able to fly below-the-radar and uncover “hidden gem” investments long before other analysts do.

Finding hidden gems early means my readers get first dibs on the very best investment opportunities in the market. They tend to appreciate that!

I’ve been active in the world of economics, finance, and investing for the better part of 20 years. And I’ve spent the majority of that time analyzing markets and securities, managing client portfolios, and recommending stocks to my readers.

I could try to wow you with my education and credentials but I prefer to let my investment results speak for themselves.

Here are just a few examples:

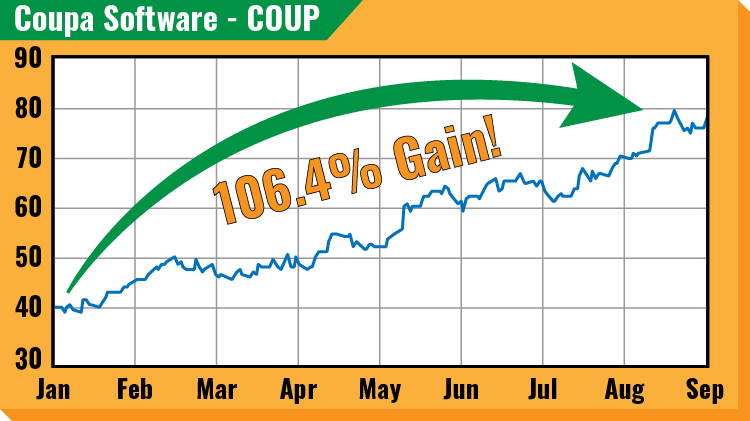

106.4% on Coupa Software (COUP)…

96.7% on 2U (TWOU)…

155.8% on Twilio (TWLO)…

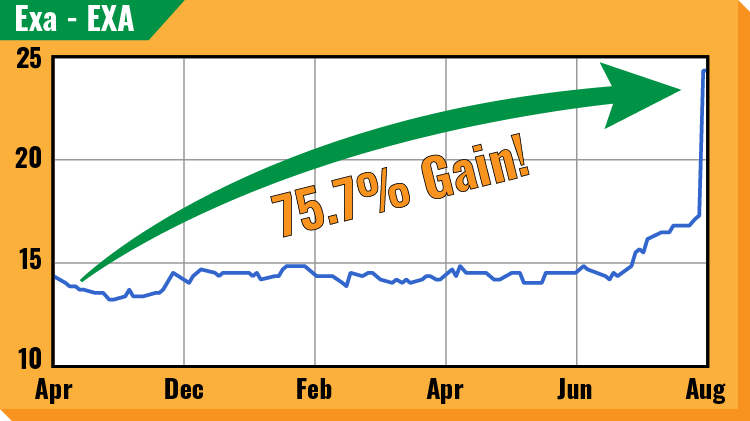

75.7% on Exa (EXA)…

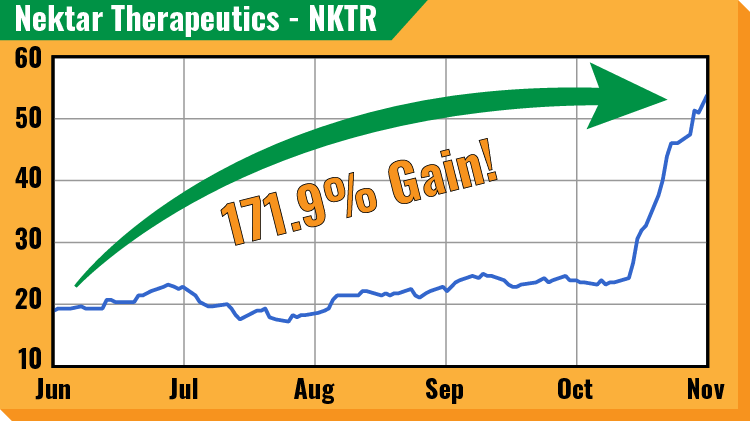

And 171.9% on Nektar Therapeutics (NKTR)…

If you’d followed my lead and invested just $5,000 into each of these companies, right now you’d be sitting on $55,325.

One of the questions I’m often asked is this…

“What’s your secret for generating these stellar returns year-after-year?”

Well, one technique that works very well is what I call the “CEO Investing Method.”

It’s a technique that rarely fails me. And right now—when we could be only months away from marijuana legalization—it’s more important than ever to think like a CEO when picking cannabis investments.

In this report, I look at the entire marijuana industry through the eyes of a corporate CEO…

Filter it down using almost 20 years of expertise…

And reveal the three absolute best opportunities in the market to add six-figures to your investment account within the next 12 months.

You see, it’s extremely rare for an illegal drug to become legal for recreational use. So there aren’t a lot of historical examples to follow.

But there is one. And it affected our country in a major way during the 1920s and 30s.

So in planning the timing of our marijuana investments, it helps to use…

Alcohol Prohibition As A Roadmap

If you don’t currently own marijuana stocks… few people would blame you.

After all, the industry is still in its infancy, profits are almost non-existent, and stock prices are volatile.

On top of that, it’s difficult to tell which companies will still be around 12 months from now.

All of that is enough to make many investors gun shy. Fear will make them sit on the sidelines for the next six months and see how things play out.

That’s completely the wrong approach!

The correct approach is to buy the right pot stocks, today. Here’s why…

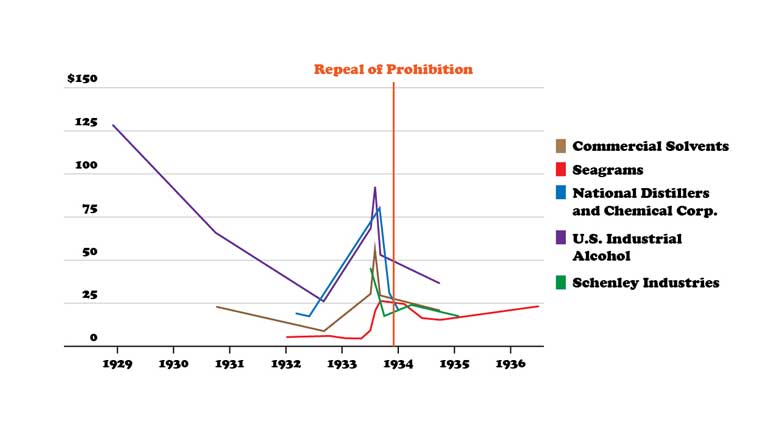

It’s been almost 86 years since an illegal “drug” was legalized in America. That happened in 1933 when alcohol prohibition ended.

Now, you might suspect alcohol company stocks went ballistic in December of that year when President Roosevelt signed the proclamation officially legalizing alcohol.

But that’s not what happened.

Instead, stock prices of alcohol companies like Seagrams, National Distillers, and U.S. Industrial Alcohol peaked in July 1933… a whole five months before prohibition was officially repealed.

As you can see in the chart above, stock prices fell off sharply in the months following the July peak.

The lesson to take away from this is a simple one…

Markets don’t wait for ribbon-cutting ceremonies and ticker tape parades.

They react as soon as there’s certainty the big day is coming.

And based on my research, we could be just a few weeks away from being certain marijuana will be legalized.

If the market’s reaction to the end of alcohol prohibition is any indication, NOW is the time to buy pot stocks. The wait-and-see approach could reduce your returns by as much as 80%.

If you have concerns over what stocks to buy or how to time your sales so you maximize profits…

I want you to put those concerns out of your mind completely.

Picking stocks and timing the market is my job. And I’m very good at it.

So, if you’ll stick with me for a few more scrolls of your mouse, I’ll reveal everything you need to know to add $112,343 or more to your investment account before the marijuana “dominos” start to fall.

The “CEO Investing Method” Explained

A little earlier, we discussed the $4 billion investment Constellation Brands made in the marijuana producer Canopy Growth.

Here are just a few examples of other investments, partnerships, and joint ventures that have come together over the past year:

Tobacco giant Altria—makers of the Marlboro brand—took a 45% stake for $1.8 billion in Canadian marijuana producer Cronos Group.

Swiss pharmaceutical giant Novartis AG entered a global partnership with Canadian pot company Tilray Inc. to distribute its products in geographies where marijuana is legal.

AB InBev—producers of Budweiser, Corona, and Stella Artois—also invested $67.5 million in Tilray.

Molson Coors entered into a joint venture with HEXO Corp. to produce and market cannabis-infused beverages starting in the Fall of 2019.

While it’s not surprising for “drug” companies in the alcohol, tobacco, and pharmaceutical industries to be interested in marijuana, they’re not the only ones forming pot partnerships.

In early 2019, Martha Stewart announced she was partnering with Canopy Growth to develop a line of CBD-infused products for pets and humans.

In early 2019, Martha Stewart announced she was partnering with Canopy Growth to develop a line of CBD-infused products for pets and humans.

Scotts Miracle-Gro invested $450 million in a company called Sunlight Supply, a distributor of gardening supplies including hydroponic (i.e. water without soil) technologies that are popular with marijuana growers.

Even soda giants Pepsi and Coca-Cola are considering partnerships with marijuana producers…

Pepsi’s Chief Financial Officer, Hugh Johnson, recently said, “We will look at it very critically.”

And Coca-Cola—the fourth-most valuable company on the planet—has reportedly met with several pot producers, engaged in “serious talks,” and was “pretty advanced down the path” of closing a deal with Aurora Cannabis.

In March 2019 the CVS pharmacy chain began selling CBD products in eight states including Alabama, California, Colorado, Illinois, Indiana, Kentucky, Maryland, and Tennessee.

And in early-April, Cresco Labs announced the largest-ever public marijuana acquisition in its $825 million purchase of Canadian producer Origin House.

This list is just a small sampling of the deals being announced every few weeks in the “wild world of weed.” But the message here is crystal clear…

The world’s most successful companies are going all-in on pot.

None of them would risk their revenues or reputations without being 100% certain legalization is coming. And soon.

What corporate CEOs are doing right now isn’t gambling. Instead, they’re investing in what will become a $47.3 billion industry that could return 10, 100, or even 1,000 times the amount they spend today.

But the question remains, how do you use this information to put six-figures in your investment account?

It’s a great question and right now is the perfect time to answer it.

I arrived at my three perfect pot picks by putting myself in the shoes of a corporate CEO—someone whose livelihood and reputation depends on picking the right partner.

CEO Pot Stock Selection Criteria

When I last counted, there were 139 listed marijuana companies whose stock you can buy today through almost any broker.

As you’ve seen, a dozen or more of them have already partnered with global beverage, pharmaceutical, and tobacco brands. That still leaves well over 100 companies for us to consider.

Of the 100+ remaining, only a small handful were able to pass my strict “CEO” selection criteria. Here are the tests I used to analyze them:

- Growth: It’s uncommon for early-stage startups in a new industry to make money during their first few years of operation—even some of the bigger cannabis producers are still “in the red.” So, what I want to see are signs the company is progressing toward profitability… that includes higher year-over-year sales and lower year-over-year expenses.

- Value: The company’s stock has to be fairly priced. A smart CEO won’t invest a single penny in a company unless its stock price represents good value when compared to its direct competitors. This can be difficult to determine when a company has no profits but revenue growth rates help a lot.

- Media Coverage: By far, the best investments are often companies that haven’t yet drawn a lot of media attention. By the time your Great Aunt Ruth knows a company’s name, it’s likely too late to buy its stock cheaply. When I find a promising company that doesn’t yet have 10 pages of Google results, I take a much closer look.

- “X-Factor”: I get excited when I find a company that has “something special.” It can be a patent, a proprietary process, higher profit margins, intellectual property, or some other unique characteristic that differentiates it from its competitors. An X-Factor like this can turn a good company into a great investment.

- First Dibs: Looking through my CEO lens, I don’t want to share my investment with another big brand. I want to be first in. I want to lock in my shares at the lowest possible price and squeeze out the maximum possible return.

As I’ve said, it’s not easy for a company to meet all five criteria.

But the harder I have to work to find the perfect pot picks, the less chance another CEO will beat me to the punch.

I don’t mind someone drafting on my success. I just don’t want to draft on theirs!

Timing Is Critical…

The First “Marijuana Domino” Could Fall Within Weeks

A key piece of marijuana legislation could be signed into law within a few short weeks.

I call this law, the first “marijuana domino.” And here’s why it’s important…

As it stands today, any bank that opens an account for a marijuana company can be prosecuted for violating federal money laundering and drug laws.

This is true even in states where cannabis is legal.

The fact they can’t apply for a loan, write a check, or even deposit funds prevents marijuana companies from being considered legitimate businesses in America.

It means they have to keep huge stacks of cash lying around under lock and key… making them prime robbery targets.

They even have to pay state and federal income taxes in cash.

These factors are big problems for marijuana companies.

They’re also big problems for a lot of investors.

With all these negatives, you might think it’s a good idea to play it safe… to wait and see how things play out in Congress over the next few months before investing.

That’s 100% the wrong way to look at this opportunity. Here’s why…

On March 29th, the House Rules Committee voted 45 to 15 to approve the “Marijuana Banking Act.”

In simple terms, this act will make it legal for banks to deal with marijuana businesses.

The next step is for the act to be voted on by the House of Representatives.

Chair of the Rules Committee—Rep. Jim McGovern—recently told reporters a House vote on the Act is likely to happen “within the next several weeks” and he expects “it will pass with an overwhelming vote.”

Chair of the Rules Committee—Rep. Jim McGovern—recently told reporters a House vote on the Act is likely to happen “within the next several weeks” and he expects “it will pass with an overwhelming vote.”

This means Senate and Presidential approval could happen very shortly thereafter.

Once the Marijuana Banking Act passes, here are the other “dominos” that are likely to fall quickly:

- Marijuana companies will open bank accounts and take out loans to hire more staff, expand production, and open more retail stores. This will make existing companies more profitable.

- There will be immediate pressure on the IRS to allow pot companies to deduct regular business expenses. This will increase profitability of the entire industry overnight.

- More cannabis companies will get listed on U.S. stock exchanges.

- Some of the larger companies will be added to indexes and investing benchmarks like the S&P 500, Russell 1000, and others.

- Billions in institutional money will pour in… officially making marijuana a legitimate, All-American business.

This last point is critical.

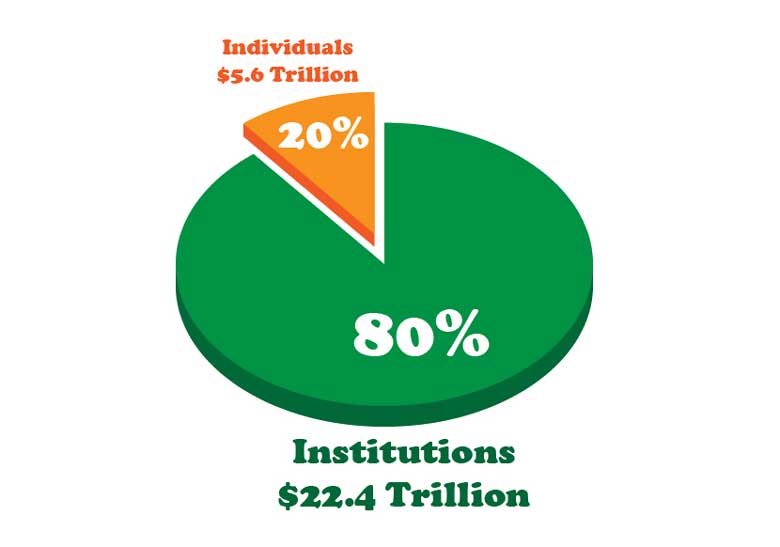

Hedge funds, mutual funds, investment banks, and other institutions are responsible for 80% of the entire U.S. stock market.

That’s over $22 trillion.

But right now—because of the legal situation—financial institutions can’t invest any of that money in marijuana stocks.

Trust me… every last one of them is crouched at the starting line waiting for the crack of the starter’s pistol.

My guess is, the House vote on the Marijuana Banking Act act will be that starter’s pistol.

And as soon as it goes off, billions of dollars will pour into marijuana stocks creating a frenzy in the market.

Financial institutions have no choice but to wait for the outcome of the vote.

But you don’t. You’re free to sink as much money as you want into pot stocks right now.

It doesn’t matter whether you love or hate the Democrats. Representative McGovern has nothing to gain from lying to Americans about the timing of the House vote on the Marijuana Banking Act.

That’s why it’s important you act quickly.

Investors who bet on the right cannabis companies today will have the opportunity to generate life-changing fortunes.

And because you’re reading this report right now, you’ll have all the information you need to take advantage of this opportunity… before it’s too late.

My Top 3 Pot Picks:

The Industry’s Best Of The Best

I’ve spent hundreds of hours researching the pot industry and its top-performing companies.

For every company I’ve analyzed, I’ve applied my five CEO criteria. As a reminder, here they are again:

- Growth

- Value

- Media Coverage

- X-Factor

- First Dibs

Very few companies pass all five tests. But the ones that do get my full attention.

I’ve compiled the very best-of-the-best into a report I call The CEO’s Guide To Pot Investing: Generate Up To $112,343 From The End Of Marijuana Prohibition and in just a minute, I’ll tell you how to get a copy in your hands today.

But if you’re curious about what’s inside, here’s a sneak peak at my top picks…

CEO Pick #1

My first pick flies well below the radar. You won’t find much press on them and there’s a better than average chance you’ve never heard their name.

Trust me… that’s a good thing!

Despite being relatively unknown, the company has footprints in Canada, Washington State, California, and New York.

In a market whose product will eventually become a commodity—after all, pot is pot— this company’s management team has made an excellent decision…

Instead of focusing on producing massive quantities of marijuana, they’ve placed more emphasis on building a “wellness brand.”

The global wellness industry already generates $4.2 trillion annually and it’s forecasted grow by 6.8% a year into the foreseeable future.

By positioning themselves as a wellness brand instead of a “pot company,” they keep a lot of doors open… including the ability to pivot smoothly into other health and wellness products should that ever make sense financially.

The company has made some acquisitions of its own and now has over 300 retail stores throughout the U.S.. In addition, their online direct-to-consumer sales have grown organically by 300% over the last 12 months.

This is exactly the kind of company I like to recommend—small, growing rapidly, and a prime candidate for partnership or acquisition by a larger company.

I share full details of this “CEO Pick” in “The CEO’s Guide To Pot Investing” along with its ticker symbol and outlook for the next 12 months.

CEO Pick #2

This company is one of the most diverse, multi-state cannabis operations in the country. And it’s increasing in size every few months…

They’ve spent several years plowing almost all their excess cash into buying real estate, cannabis growers, processors, and dispensaries across the country.

The company has a strong, experienced management team with an aggressive strategy to become the number one player in the marijuana industry.

If that’s where the story ended, this firm would be a no-brainer investment. However…

I’ve recently discovered the company has a deal in place to sell all of its assets to a larger pot producer… but not until marijuana becomes federally legal.

Until prohibition officially ends, the market won’t know how to respond to this information.

Thankfully… you will. And unlike the hundreds of billions in institutional money that has to remain on the sidelines, you can act on this information today.

I recommend taking a decent stake in this company as soon as you possibly can.

I reveal all the details about this soon-to-explode stock in “The CEO’s Guide To Pot Investing.”

CEO Pick #3

Pick #3 is very much off-the-beaten path. Even with its name and ticker symbol, you’d still have trouble finding news about this company.

I love finding hidden gems like this one. Getting in before a global brewing or pharmaceutical company writes them a billion dollar check could make the difference between a 100% return and a 10,000% return.

Unlike our other picks, this company isn’t in the business of growing, handling, or processing marijuana.

Instead, it provides cannabis producers with real estate, facilities, greenhouses, irrigation equipment, and product distribution channels.

And because pot growers aren’t able to raise money through banks right now, this company lends money to licensed cannabis growers in exchange for payback of the loan and partial ownership of the borrower’s company.

Putting on my CEO hat, what I like a lot about this company is they’ve built a diversified portfolio of assets. So even if not all their investments work out, the few that do could become major players when prohibition ends.

This pick essentially allows you to become a Marijuana Venture Capital investor. Holding its stock is much less like investing in a single listed company and more like investing in a dozen or more small cannabis startups.

I reveal all the details in “The CEO’s Guide To Pot Investing.”

CEO Bonus Pick

I tried hard to limit this special report to just three picks.

But I couldn’t help myself. I had to over deliver. It’s in my blood.

So, I’m going to include a fourth, bonus pick I’m really excited about.

I see this company as more of a long-term, blue chip play. And it’s a little different than the first three I’ve described today.

The company has already consummated a partnership with a large global brand and together, they plan to launch their first products in Canada later this year.

It has subsidiaries operating in the medical marijuana space in Europe, South America, Australia, and Africa.

And with its recent cash influx, the company is ideally positioned to gobble up smaller cannabis producers, invest heavily in R&D, and become a major global player as marijuana prohibition comes to end in America and elsewhere.

Once pot is legal and the industry begins to consolidate, I predict this company will be at the top of the mountain with a small number of real competitors.

Needless to say, I’m incredibly excited by this company’s prospects over the next twelve months and I can’t wait to share it with you.

You’ll discover all the details about this gem in my special report, “The CEO’s Guide To Pot Investing.”

I Want To Send You This Report Today, Absolutely FREE

It’s not an exaggeration to call what’s happening right now a Marijuana Revolution.

It’s not an exaggeration to call what’s happening right now a Marijuana Revolution.

Revolutions create change. And change creates opportunity.

A little earlier, I showed you how alcohol stocks exploded in 1933… months in advance of the end of prohibition.

Investors who made the right calls back then created generational wealth—the kind of money that’s still financing the trust funds of their Harvard educated great-grandchildren’s 86 years later.

Think markets are different today? Not by a long shot.

Just look at what happened in Colorado during the lead up to its legalization of recreational marijuana in 2014.

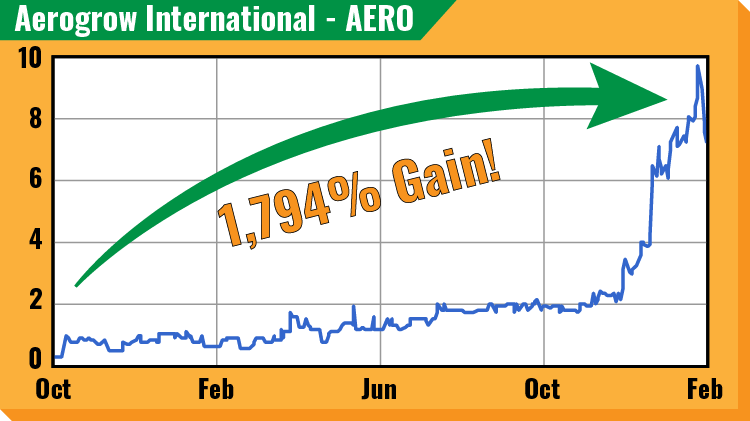

The stock price of Aerogrow International jumped from $0.75 to $9.60, delivering a 1,794% gain:

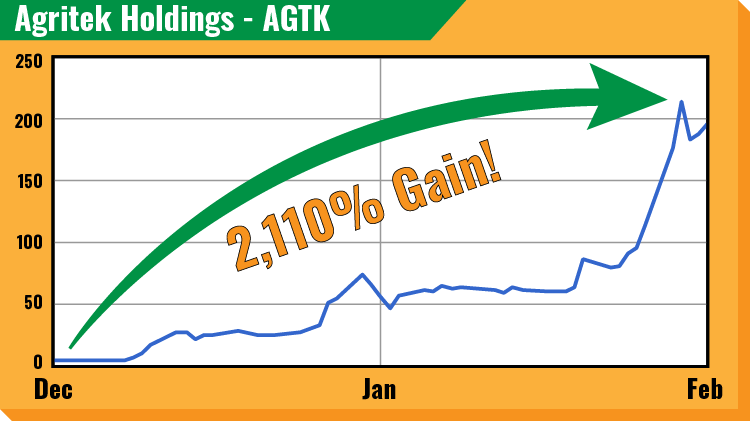

Agritek Holdings shot up 2,110% in just two months…

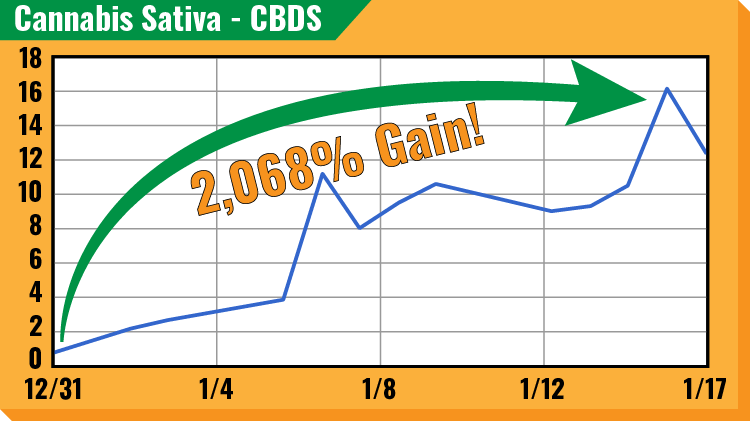

And a company called Cannabis Sativa jumped 2,068% in a little over two weeks…

Impressive gains, aren’t they?

Think Colorado was a one-time fluke?

Here’s what happened in the run-up to marijuana legalization in California:

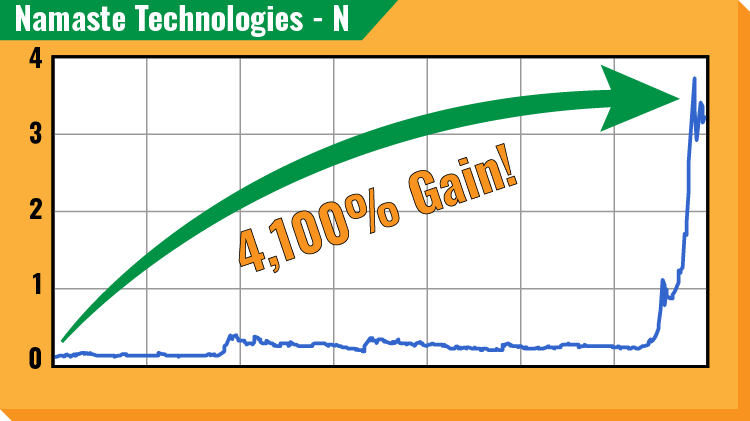

A company called Namaste Technologies jumped 4,100%.

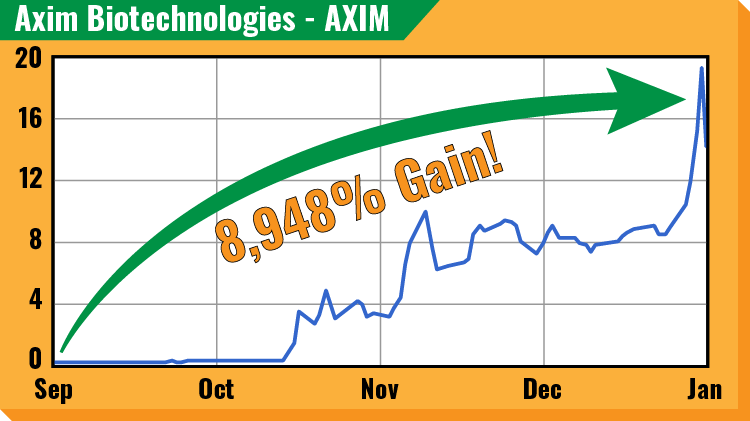

Axim Biotechnologies shot up 8,948%.

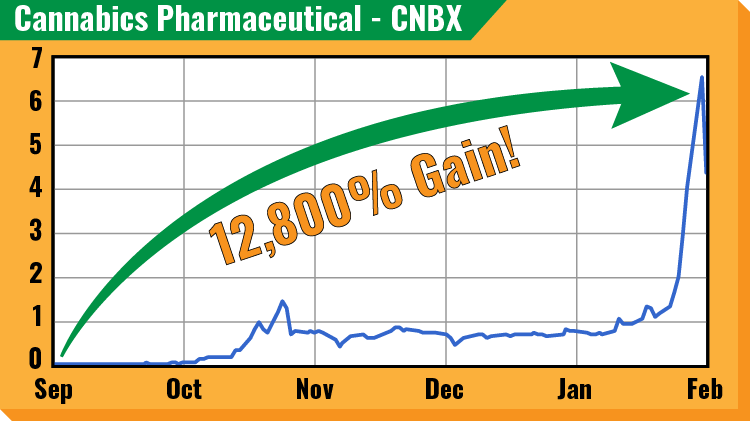

And Cannabics Pharmaceutical leapt an earth-shattering 12,800%.

A $10,000 stake in Cannabics Pharmaceuticals could have turned into $1.29 million… in only six months.

Can I guarantee you’ll see returns exactly like these? Of course not. No one can guarantee investment returns… and you should be wary of anyone who tries to.

But the stock moves we just looked at are 100% real and accurate. And they happened during periods surrounding state-level legalizations.

Imagine the impact federal legalization could have on marijuana stocks.

They could make Colorado and California gains look like miniature blips by comparison.

So when I say the four “CEO Picks” I’ve shared with you today could turn “$5,000 into $112,343 in the next 12 months,” I’m being ultra-conservative.

As you’ve seen from the examples above, $112,343 could be the low end of the scale. You could see five or even ten times that amount.

Look, if I made these CEO Pick recommendations available for sale, I could easily justify charging $1,000 for them.

I mean think about it… a return of $112,343 on a $1,000 investment?

That’s what the kids would call a “no-brainer.”

But “The CEO’s Guide To Pot Investing” isn’t for sale anywhere at any price.

It’s only available here on this web page and only to serious investors who want to make the smartest and best pot investments before legalization is announced.

And because you’re still reading, it’s clear you’re a serious investor who knows a life-changing opportunity when you see one.

So I’m going to send you an additional money-making bonus report today… absolutely free.

Farm Bill Profits: Three Stocks Ready To Explode Up To 1,087% From The Legalization Of CBD

Just before Christmas 2018, Congress passed the Agriculture Improvement Act… also known as the “Farm Bill.”

The Bill updated a lot of agriculture-related legislation. But the most noteworthy update was the legalization of hemp farming.

Like its cousin “marijuana,” hemp has been illegal for the past 81 years… despite containing less than 0.3% THC (the intoxicating chemical in marijuana).

Legalized hemp is great for America on many fronts. It stands to create tens of thousands of jobs in the farming sector alone.

And because the hemp plant has so many different uses including clothing and textiles, food, biodegradable plastics, construction materials, and fuel… legalization is certain to jumpstart thousands of new businesses in dozens of different industries.

New jobs. New businesses. New tax revenues. All of this is hugely positive.

But in addition to legalizing hemp farming, the Farm Bill also legalized hemp’s medicinal compound, CBD (Cannabidiol).

CBD has a number of documented and potential health benefits including treatment of:

- Seizures

- Pain

- Insomnia

- Inflammation

- Anxiety

- Tumor growth

And it accomplishes all of this and more without producing any intoxicating side-effects.

Because it became legal only a few months ago, the market for CBD products is small but growing rapidly. So the timing is perfect for smart investors to be first-in on the most promising CBD stocks.

Here are my top picks:

CBD Pick #1

This is a new-ish but successful health & wellness company who more than doubled revenues during their first five years in business… before ever considering the sale of hemp products.

In mid-2018, the company launched a trademarked line of CBD-infused body lotions, oils, tablets, and beverages in California and saw their stock skyrocket 310% in just six weeks.

CBD Pick #2

This company has a long history in the tobacco industry and the Farm Bill is now allowing them to apply 100+ years of tobacco-growing technology and expertise to large-scale hemp farming.

CBD Pick #3

My third pick is one of the few companies in the entire cannabis industry to already be turning a profit. This one stock could be the CDB pick of the decade.

Two Money-Making Reports…

Yours Absolutely FREE

I want to send you these two reports today:

- The CEO’s Guide To Pot Investing: Generate Up To $112,343 From The End Of Marijuana Prohibition

- Farm Bill Profits: Three Stocks Ready To Explode Up To 1,087% From The Legalization Of CBD

Both can be in your email inbox within 10 minutes.

The seven cannabis picks I share in these reports could easily be worth six-figures to you over the next twelve months.

And they could be worth well over 7-figures in the next three to five years.

That kind of money could let you retire a decade early.

Or if you’re already retired… you can use the extra cash to step up your retirement lifestyle a few notches—buy a second home, take your extended family on a luxury vacation… your options could be endless.

Best of all, I want you to have these reports—and all the money you make from them— absolutely free today when you join my exclusive investment advisory, Fast-Track Millionaire.

Now, I want to be clear…

Fast-Track Millionaire is not a marijuana advisory.

It will come as no surprise that I’m extremely excited by pot stocks right now. But marijuana opportunities are just the tip of the iceberg when it comes to the industries and stocks I follow.

Fast-Track Millionaire offers three distinct investment portfolios designed to help you meet (and beat) your financial goals… no matter how big or small your investment account is today.

First, there’s my Next-Generation Dominators.

The goal of this portfolio is to identify promising young companies that five years from now will be household names worth tens or even hundreds of billions… much like Facebook, Amazon, and Google are today.

My Next-Generation Dominator recommendations are intended to become future blue chip investments with the potential to turn even small stakes in these companies into windfall fortunes over the next five to ten years.

Next, there’s Emerging Tech Leaders.

This is where you’ll find red-hot technology innovators and companies uniquely positioned to take advantage of the latest technology trends.

Finally, there’s my Market Hedges portfolio.

I reserve this category for positions that enable readers to reduce their overall stock market risk while still enjoying all the upside gains from the top-performing recommendations in the other two portfolios.

Across all three portfolios, my Fast-Track recommendations aren’t meant to keep pace with the market… or to just barely meet your expectations. They’re meant to generate life-changing wealth. That’s why I dedicate an entire month to finding the very best opportunities available, documenting my analysis, and sharing it with you.

Here’s everything your Fast-Track Millionaire membership includes…

12 Monthly Issues

Early each month, I’ll send you a detailed report containing my latest breakout investment opportunity. The report contains a full analysis of my recommendation, an industry overview, and my target return for the opportunity. I’ll explain exactly why I’m excited about the company, provide step-by-step instructions on how you can get started right away, and offer additional details to help you maximize your gains.

Early each month, I’ll send you a detailed report containing my latest breakout investment opportunity. The report contains a full analysis of my recommendation, an industry overview, and my target return for the opportunity. I’ll explain exactly why I’m excited about the company, provide step-by-step instructions on how you can get started right away, and offer additional details to help you maximize your gains.

Mid-Month Updates

You’ll also receive a mid-month report summarizing news on our recent investments, how the Fast-Track portfolios are performing, and up-to-the-minute scoops on any new opportunities I’ve uncovered.

You’ll also receive a mid-month report summarizing news on our recent investments, how the Fast-Track portfolios are performing, and up-to-the-minute scoops on any new opportunities I’ve uncovered.

Email Alerts

The moment I learn of important market or company news, I issue an immediate email alert. This email contains all the information you’ll need protect your gains, maximize profits, or prepare yourself to jump on the very next breakout opportunity.

The moment I learn of important market or company news, I issue an immediate email alert. This email contains all the information you’ll need protect your gains, maximize profits, or prepare yourself to jump on the very next breakout opportunity.

Members-Only Website

The moment you join, you’ll receive a secure username and password granting you access to the exclusive Fast-Track Millionaire member’s area. Inside, you’ll find an archive of all past newsletters, mid-month updates, investment alerts, portfolio performance results, and special reports and videos I’ve prepared for you.

The moment you join, you’ll receive a secure username and password granting you access to the exclusive Fast-Track Millionaire member’s area. Inside, you’ll find an archive of all past newsletters, mid-month updates, investment alerts, portfolio performance results, and special reports and videos I’ve prepared for you.

Concierge Hotline

As soon as you become a Fast-Track Millionaire member, you also become part of StreetAuthority’s VIP community with all the special treatment that entails. You’ll get quick telephone and email access to our Customer Service team who are dedicated to answering your questions and resolving any issues or concerns you have regarding your membership.

As soon as you become a Fast-Track Millionaire member, you also become part of StreetAuthority’s VIP community with all the special treatment that entails. You’ll get quick telephone and email access to our Customer Service team who are dedicated to answering your questions and resolving any issues or concerns you have regarding your membership.

An Investment In Your Future

After reviewing the exclusive benefits included in your Fast-Track Millionaire membership, you’re very likely wondering… “How much does it all cost?”

Our regular fee for a one-year membership is $4,000.

I realize that’s not cheap.

Until you consider the six-figure payday you stand to make from the cannabis stocks I reveal in the two free reports you’ll receive today.

Plus… think about the entire year’s worth of monthly stock recommendations, market research, and up-to-the-minute coverage you’ll receive with your Fast-Track Millionaire membership.

When you consider the returns this combination could bring you, I think you’ll agree…

$4,000 is an absolute bargain.

Having said that, I want to make it as affordable as possible for you to try Fast-Track Millionaire so I’m not going to charge you $4,000.

I’ve spoken with my publisher, Jeff Little and gotten approval to make a one-year Fast-Track Millionaire membership available to you today for only $1,999.

That’s 50% off the regular price… a savings of over $2,000.

But there’s a catch…

Jeff agreed to make this exclusive offer available only to the first 100 people to take action today.

As soon as the 100 seats are gone, a Fast-Track Millionaire membership goes back to its regular price of $4,000 a year.

And if an opportunity to save $2,000 isn’t enough to convince you, you’ll want to know about…

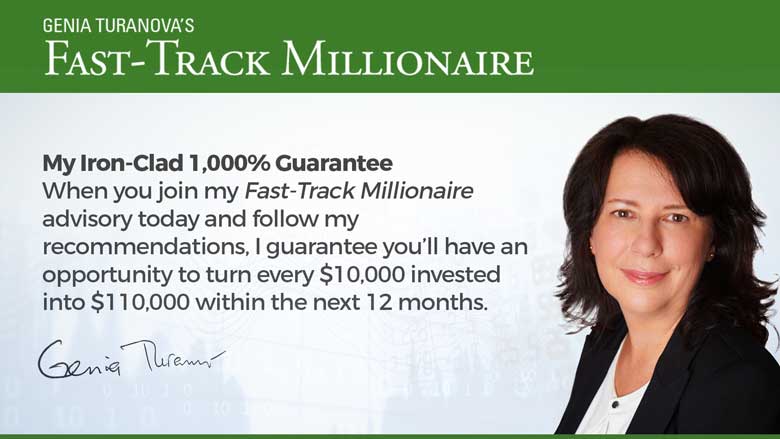

My 1,000% Satisfaction Guarantee

I’m so confident in my work…

That I’m guaranteeing you’ll have the opportunity to bank gains of at least 1,000% in the next 12 months following my recommendations.

That’s good enough to turn $10,000 into $110,000.

What happens if I fall short on that promise?

Simply place a quick call to our Concierge Hotline and let us know… and we’ll give you a second year of Fast-Track Millionaire free of charge.

You read that right. If I don’t give you the opportunity to bring home gains of 1,000% in the next twelve months, you’ll get a second year’s membership absolutely free.

A guarantee like that may sound like I’m putting my neck on the line.

But the reality is, I’d never offer such an outrageous guarantee unless I was 100% certain I could deliver.

I couldn’t afford to…

If every one of the 100 new Fast-Track Millionaire members I accept today came looking for their second year of membership free…

It would cost my publisher $199,900.

Trust me… he wouldn’t be happy about that.

It’s Decision Time…

Right now, you’ve reached a crossroads. You’re about to move down one of two paths…

Path A: Join Fast-Track Millionaire right now and save $2,000.

On this path, you’ll get instant access to “The CEO’s Guide To Pot Investing” and “Farm Bill Profits” and with them, an immediate opportunity to invest in seven of the best cannabis stocks in the industry BEFORE the market goes into a frenzy. Plus, over the next twelve months, I guarantee to deliver an opportunity to generate at least a 1,000% return.

Path B: Close your browser and ignore this opportunity completely.

Then, a few weeks from now—when the House passes the Marijuana Banking Act by a landslide and pot stocks explode overnight—you’ll kick yourself for missing out on the biggest investment opportunity of our lifetime.

A lot of people have faced decisions like this.

And those who’ve chosen wisely have transformed their lives and the lives of their loved ones… forever.

I’ve been analyzing the economy and the financial markets for close to 20 years…

Trust me when I say, the end of marijuana prohibition is an opportunity we’re not likely to see again in our lifetime.

Investors who own the right stocks when the first domino falls could become millionaires overnight.

I want you to be one of them.

But one last word of warning… you’ll need to act quickly.

As Representative McGovern has told reporters, a House vote is likely to happen “within the next several weeks” and is expected to pass “with an overwhelming vote.”

As Representative McGovern has told reporters, a House vote is likely to happen “within the next several weeks” and is expected to pass “with an overwhelming vote.”

When that happens, pot stocks are likely to explode as Wall Street, Main Street, and anyone else with a brokerage account loads up on the shares of every pot company in existence.

The end of marijuana prohibition is coming.

You can use this once-in-a-lifetime opportunity to get wealthy beyond your dreams.

Or you can sit on the sidelines and watch as millions of average Americans become millionaires… on the very same stocks you could have bought today for pennies.

If you miss the opportunity to get in to my CEO Pot Picks at today’s prices, well…

You may not get a second chance.

Don’t let this opportunity slip away…

Click the button below and join Fast-Track Millionaire today.

To your wealth,

Genia Turanova

Chief Investment Strategist

Fast-Track Millionaire

[button_1 text=”Get%20Started%20Now!” text_size=”28″ text_color=”#000″ text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#dedede” styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FFCB00″ styling_gradient_end_color=”#FFCB00″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-safm-domino”/]

Copyright © 2019 StreetAuthority, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review StreetAuthority’s terms and conditions and privacy policy pages.