[vertical_spacing height=”20″]

Worried you’ll run out of money in retirement?

The Key to an Extra 6 Figures In Your Portfolio Is Contained in THIS Message

Give me just 6 minutes… and you’ll discover a simple plan designed to add an extra 6 figures to your retirement in the next 60 months.

What would an extra $100k, $200k, $300k do for your retirement?

Imagine waking up one morning with your biggest worry about money wiped away… replaced by a feeling of freedom that only comes with real financial peace of mind.

That’s what’s on the table today.

Just one conservative stock could turn into a lifetime of wealth…

In far less time than you’d think!

Imagine the peace of mind you’d feel with that much extra cushion added to your account.

You could actually relax and maybe even start enjoying the retirement plans you’ve been making a little earlier than expected.

You’re about to see how to get your hands on a breakthrough Wealth Plan designed to take just a small slice of your portfolio and turn it into a comfortable, growing nest egg…

With high and rising income that beats out inflation, recessions, depressions, or anything else the market decides to throw at us… in just 60 months.

It’s a retiree’s dream scenario…

Give me the next 6 minutes and it could become YOUR reality.

I’ll introduce you to a bunch of retired folks today who did follow my lead and made hundreds of thousands of dollars…

Some of whom are finally enjoying life for the first time.

You can put yourself on the same path after reading about this plan.

And before you know it, thoughts like, “Oh, do I need to take a second job in retirement” or telling your spouse, “We need to cut back on our travel this year…”

Could vanish forever.

That’s critical…

Because cutting back…

Or working until you literally can’t anymore…

That’s not why you scrimped and saved every penny you could put your hands on over the last 30+ years.

Instead…

I’ll show you how one simple strategy that shells out all the extra income you could possibly need (and more than you’ll even know what to do with) in just 60 months…

Any investing “newbie” can put this plan to work, right now… but it’s no less exciting for even the most seasoned investing “vet” once you see just how fast the money grows.

But the best part?

This isn’t some risky “pie in the sky” investment you’re buying… and you’re not betting the farm on one idea.

With this “choose your own adventure” style of investing…

Setting aside $25,000, $50,000, or even a bold $100,000 out of your 401k or IRA is more than enough to put this plan into action… and hand you outsized returns.

You could start this plan with less if you’re tentative or more if you want to maximize your income… that is a personal choice I’ll leave to you.

Simply take whatever sized slice of your portfolio you’re comfortable putting into it (of course, the more you put in the more you stand to make)…

And follow the 4 steps I’ll share today over the next 60 months.

What exactly is in it for you when you put money to work with this 60-Month Plan?

Just ONE stock in this 60-Month Plan could’ve added over $432,000 to your retirement

That’s right…

Following the 4 simple steps inside my 60-Month Wealth Plan…

You could’ve watched your account balloon from $100,000 to $532,000 on a relatively unknown pipeline play based out of Tulsa, OK.

A $432,000 increase….from a single stock… in just 60 months!

That averages out to a growth of $7,215 per month across that timeframe…

And if $100,000 is too big a bite to take…

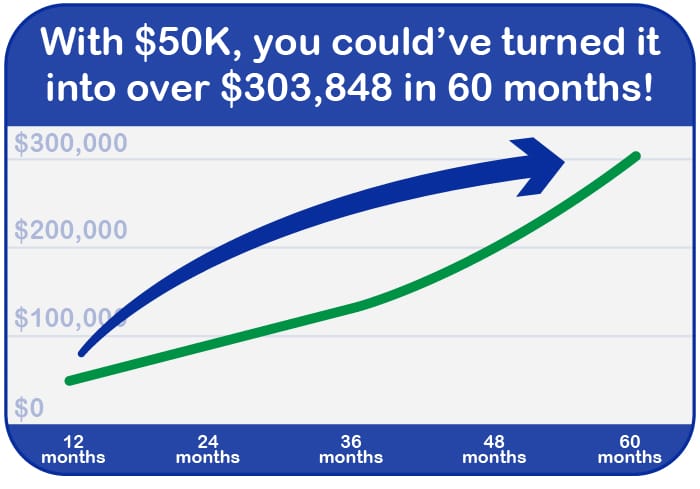

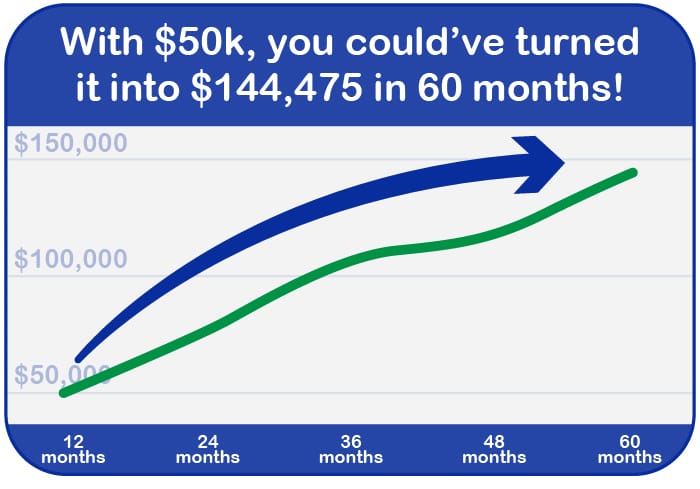

Carving out $50,000 would still allow you to enjoy…

A $258,000 boost to your portfolio balance.

Heck, even if you only had $25,000 to start…

Following the 4 steps to my 60-Month Plan…

Would’ve given you the chance to bring home an extra $165,000.

Better yet, each of those returns came in without the stress of having to make “big” trades… weaving in and out of stocks like a NASCAR driver… or dealing with complicated options.

These are the types of opportunities available right now in my model portfolio…

And any one of them could be used in my 60-Month Plan.

But since this is new for you, I do have one opportunity in particular I recommend you start with. Because according to my calculations, a 60-Month Plan with this stock could turn $25k into $159k.

I’ll share the stock with you after I reveal the 4 steps to the 60-Month Plan.

Start a 60-Month Wealth Plan today… and you’ll be in good company…

Some subscribers have let me know they’ve made upwards of $300,000/year from my recommendations.

Take a look…

These are real testimonials we’ve received.

And while we haven’t asked to see the portfolios of these folks…

I can guarantee they are readers of mine and that they sent these notes in because they’re excited my recommendations worked for them.

Like Patrick from Yuma, Arizona, who says he makes over $300,000 each year…

Think about that.

Being a surgeon means being on-call 24/7. You’re away from your family at inconvenient times…

Then, he retires and is generating MORE money than when he worked; only now, he has all the time in the world to spend with his family at the same time.

It’s an incredible story.

I know it’s hard to envision this scenario playing out for yourself… and I’m not promising you’ll make as much as Patrick…

But after you see my strategy start working for you, it’ll *click* in your head.

Just ask Michael from Winona, Michigan.

He claims…

Michael’s free from ever having to work again. Imagine the mental peace of never having a boss again!

So many retirees are being forced back into the workforce after leaving during Covid… and now must return due to runaway inflation.

But you don’t have to suffer the same fate.

Because my 60-Month Wealth Plan is designed to create a safety net during both bullish and bearish markets.

I’m sure Steve from Walnut, California would agree… because he makes $57,000 a year from my recommendations:

As you can imagine, there’s no “one size fits all” for how much extra wealth you can make in retirement.

Everyone starts in a different place… the key is to get started.

Whether you only have $1,000 to put towards the plan… or $100,000+.

No matter how much you’ve stashed away… with just 4 simple steps, you can start multiplying that cash each month.

In fact, you could’ve followed this 60-Month Wealth Plan with this retail REIT…

With this startup lender…

That same $50,000 in a plan on this casino REIT…

And padded your account with a six-figure windfall from each one…

This recommendation I made for an oil company at the bottom of March 2020 would’ve grown your account to $135,000 in just 36 months too!

I want to get you started on your own path to this kind of wealth today…

But before I reveal the 4 steps to my 60-Month Wealth Plan…

Let me first properly introduce myself…

I built the 60-Month Wealth Plan to help retirees never run out of cash.

My name is Nathan Slaughter.

My name is Nathan Slaughter.

I’m the Chief Investment Strategist at StreetAuthority — one of America’s most trusted independent financial publishers.

We’ve been around and sharing our investment research for over 20 years… and I’m proud to say I’ve been right here, helping investors find profits through thick and thin for most of that ride.

But that wasn’t always the case.

I “cut my teeth” on Wall Street as a financial advisor for years. I got a good look at the dirty dealings behind closed doors… and it wasn’t pretty.

Here’s the truth…

What you want and what Wall Street wants are very different.

That’s the cold, hard truth… and likely confirms what you already knew.

Still, I did pretty well on Wall Street despite not being great at the slick-talking sales guy schtick. That’s just not my personality.

I’m a self-professed number-cruncher obsessed with financial stats.

And, not to pat myself on the back too much, I’m dang good at it.

So much so, my success allowed me to end my 9-5 commute into the city…

Now, I spend my days in my comfortable home… overlooking the mountain tops… enjoying nights and weekends with my family.

Heck, some “workdays” you might even catch me out fishing on the lake. I’ll even bring along some company earnings reports to read while I wait for a bite.

The stock market has allowed me to leave the hustle and bustle of city life behind years ago. I now live in the mountains with endless hiking and fishing right outside my door.

That’s how I approach life.

I’m not looking to buy a yacht or a private plane.

I’m on the lookout for solid stocks that can make me a lot of money and allow me to live comfortably, I’ve worked too hard, for too long…

I just want to relax in comfort and finally enjoy life…

And many of my readers can relate. They want comfort and the freedom to do what they want.

Being a numbers man, I’m not letting the emotions of the market get in the way of my analysis.

You just can’t.

Numbers don’t lie.

Yet, many who follow the “golden rules of retiring” you’ll hear the talking heads on TV or even their asset-hungry wealth managers spout off about are being led astray.

I can’t let that happen.

Most Americans don’t realize THIS fatal flaw in their retirement plan… is a ticking time bomb

I’ve run all the calculations I could think of.

For many, retirement is quickly climbing out of reach.

They just don’t know it.

Take any 30-year retirement projection charts and spreadsheets your advisors have made…

Print out your “4% withdrawal” rate schedule…

And shove them into the nearest trash can.

Let me be straight with you for a minute… because this might be your future talking to you.

My 60-Month Wealth Plan could help you add an extra 6 figures to your retirement. I just showed you half a dozen examples if you even just started with $50k.

A few readers who follow my picks do well, and some have told me they’ve made as much as $300,000 a year (not everyone will).

At the same time, I also want to show you what happens if you do nothing and continue on the path others may have put you on.

I’m talking about the path where they tell you it’s possible to predict what your portfolio will look like in 20 to 30 years.

Here’s the truth…

There’s NO possible way to predict what’s going to happen over the next few decades.

It’s why I don’t have a 360-Month Wealth Plan. 60 months is as far as I can conservatively project.

They tell you the 4% rule is “safe.”

Sure, on paper this fancy chart from an advisor showing you how “safe” it is to withdraw that $40,000 each year for 30 years without going bust LOOKS good.

But does it account for an unforeseen health scare?

What about needing to move across the country to be near family?

What happens when a recession hits and stocks go stagnant… or worse?

Are you “safe” then?

There’s no way someone can predict any of these things decades in advance

If you could, you’d be a millionaire.

Putting all your trust in a “30-year withdrawal plan” is as absurd as betting on who will win the Super Bowl in 30 years.

And yet a majority of Americans make this exact mistake.

You just don’t know what you don’t know.

Want to guess how many of my clients suddenly needed liquidity when the tech bubble burst?

They didn’t heed my advice and wanted to invest in all the popular tech stocks. So everything was good for two years…

But they ended up selling stocks at rock-bottom prices as many of those “hyped-up” names cratered, fading into obscurity.

And during the Great Financial Crisis, I heard of people flash-selling their cute 3-bedroom homes in order to cover their margin calls.

That 4% “rule” goes right out the window when times get tough.

Let me show you just how quickly things can go off the rails…

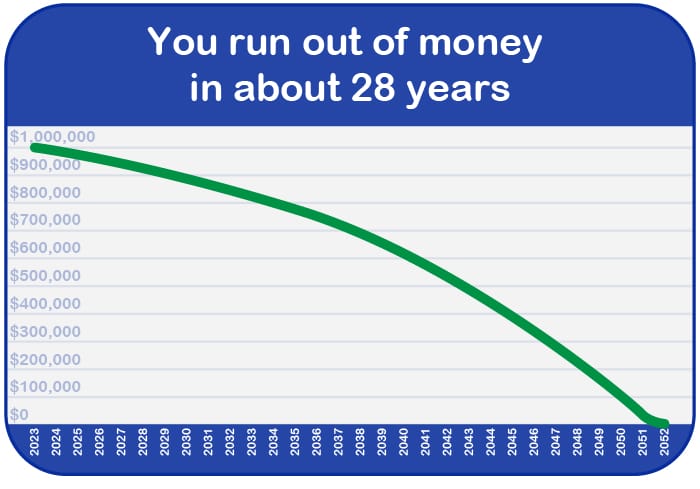

Let’s say you’re a retiree with $1 million in savings.

According to the 4% rule, you plan to withdraw $40,000 in the first year of your retirement and adjust that amount each year for inflation.

You run out of money in about 28 years…

And that’s if — and only if — you dodge every single obstacle in life and can skate by spending just $40k (adjusted for inflation) each year.

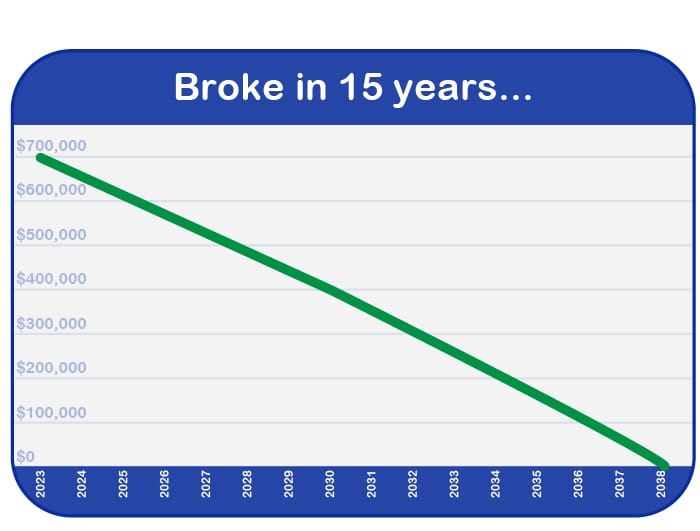

However, let’s say that the stock market experiences a significant downturn in the first few years of your retirement.

Your portfolio value drops by 30%, reducing your hard-earned savings down to $700,000.

“$700k is still a lot,” you say.

Despite this, you continue to follow the 4% rule each year.

If your portfolio value continues to decrease, retirement withdrawals would begin to eat into your principal, reducing the amount of money you have to generate future income.

If the market doesn’t recover quickly, or if it experiences even further downturns, your savings could be depleted much faster than anticipated.

You’re looking at being out of money within the next 15 years…

It’s a vicious downward spiral to zero.

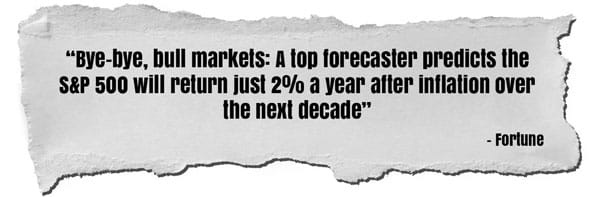

And the current market outlook isn’t bright.

Top experts believe over the next decade investors could see lower returns…

The World Bank calls it a “Lost Decade” for stocks.

If stocks go sideways or down, those 4% withdrawals will rip your portfolio to shreds… and that’s before any of life’s little surprises crop up.

Like a tragedy that requires you to write a massive check…

Kids need help paying bills…

And medical care is astronomical…

It adds up fast.

Soon, you’re back to counting pennies like a schoolboy.

Or let’s say you’re taking out 4% per year and inflation is 2%… but your investments are only coming in at 3-4%.

That downward spiral is the big problem advisors won’t tell you while they bilk you for asset management fees.

Their math doesn’t add up:

4% withdrawals per year + 2% inflation = 6% needed to maintain living

A 3% return means you’re taking out double what you should.

And if inflation is even higher than 2% (in 2022, it was 9%)… your returns would be even worse!

You need MORE money… a cushion to protect yourself and help get you through all of life’s “little surprises”

That’s exactly what my 60-Month Wealth Plan is designed to do.

It’s a new way to think about your retirement.

Imagine what you could do with an extra $100,000, $200,000, $300,000 from just one 60-Month Wealth Plan… it would help you weather some of the financial storms life throws at you without worrying whether you’ll run out of money in retirement.

Because you aren’t drawing down your portfolio for day-to-day expenses.

But please don’t think my 60-Month Plan is some untested, “flash in the pan” system.

I’ve helped readers like you through the tech bubble, the Great Recession, the bull market of the last decade, and more.

For example, on March 19, 2020… with the market in absolute free fall…

I sent out this alert…

I called buying the bottom of the 2020 crash by 1 day (bottom was March 20th)

In it, I recommended stocks like:

- A natural gas company (ticker for subscribers only) — those who held enjoyed 211% gains in 11 months

- Brookfield Property Partners (BPY) — investors who stayed in banked 88% in 9 months

- Fidelity National Finance (FNF) — non-sellers rode it up 112% in 14 months

- Paychex (PAYX) — it went up 122% in 17 months for those who held

- An energy infrastructure company (ticker for subscribers only) — up 125% in 9 months

This is what you get when you focus on the numbers, analysis, and the fundamentals of a strong company…

Not the emotional headlines.

It was the same at the end of 2021…

The market was soaring. Most of my picks during this boom were big winners.

I had stocks like ConocoPhillips up 88% that year, Oneok boomed 71%, John Hancock Financial Opportunities Fund jumped 51%… just to name a few.

However, I wasn’t popping champagne…

I warned my readers about the exuberance in the market at the end of 2021…

and I nailed it again.

My analysis said the market would soften…

And, like butter in the sun, that’s exactly what it did.

If you think my research and rationale only work in a bull market… think again.

60-Month Wealth Plan Step #1 of 4:

Buy THIS special type of dividend stock

Look, the 60-Month Wealth Plan is not about buying the next Tesla or Netflix in its infancy and taking it for that white knuckle rollercoaster ride — hoping for huge gains (and more often than not, falling far short).

Instead…

You’re buying solid, conservative dividend stocks.

There’s no swinging for the fences or hoping for some big FDA drug approval to go through.

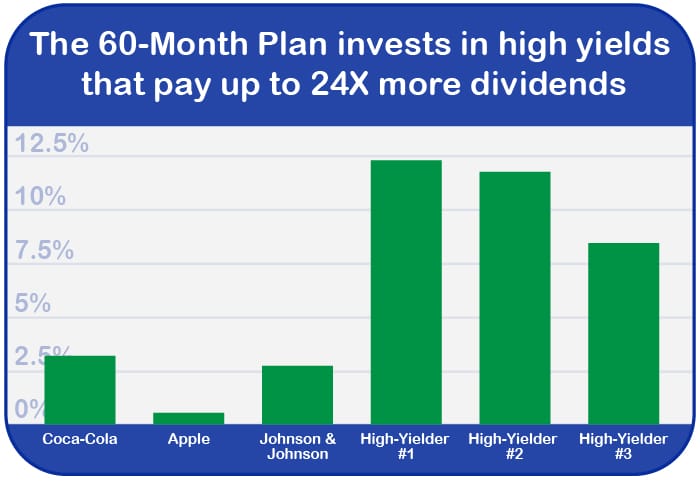

You’re not investing in stalwart stocks like Coca-Cola or Johnson & Johnson, either.

You’re buying energy stocks, financing companies, and federal real estate dividend stocks.

Investments most folks have never heard of.

In fact, the #1 dividend stock I’ll share today for your 60-Month Wealth Plan is not an ordinary blue-chip you’ll see featured on CNBC.

The type of dividend stocks you need for the 60-Month Plan all have a single, unique quality.

They’re high-yield dividend plays.

Dividend stocks that pay up to 12% yields. That’s 24X more income than Apple (a multi-trillion company) pays.

And nearly 6x more than Coca-Cola.

What’s that add up to for YOU?

After 60 months with this Tulsa pipeline… you’d be able to generate $3,552 per month!

How’s that possible? Because in addition to handing out over $400,000 in gains, this stock also pays out a hearty dividend…

Which means, after you complete the 60-Month Wealth Plan, you’d be able to “flip a switch” and go from growing your gains to raking in up to $3,552 per month in extra income…

Of course, to get to that point, you’d need to have followed all 4 steps of my 60-Month Plan… to the letter.

But it would be worth it because $3,552 per month can go a long way…

Add in the average Social Security check at $1,781 per month…

You’re collecting over $63,996 in income per year.

That’s a lot of cash to pay the bills.

These stocks pay great income… but that’s not our goal with the 60-Month Wealth Plan.

Let me explain…

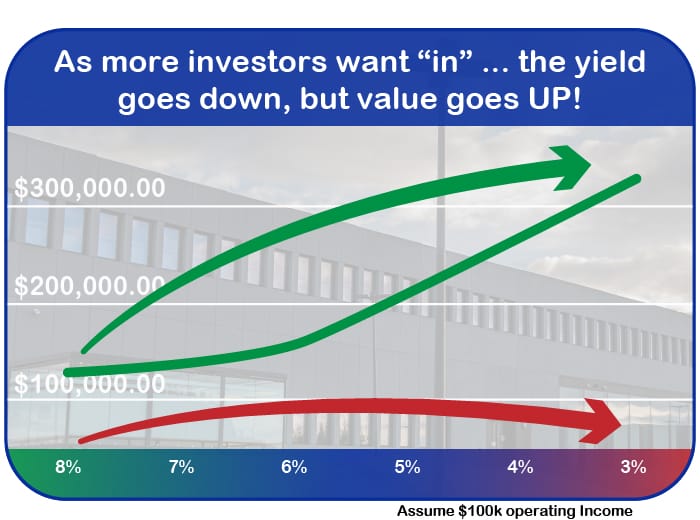

See, most people want their dividend yields to go UP, so they generate more income.

Seems like a solid, logical tactic… right?

My strategy takes that idea and turns it on its head…

You want these high-yield dividend stocks for the 60-Month Plan to go DOWN!

Because as the dividend yield goes down… your wealth actually goes up!

What I’m about to show you makes almost no sense to 99% of investors out there… but is KEY to maximizing our wealth with this plan.

Let me explain…

60-Month Wealth Plan Step #2 of 4:

Use “Yield Compression” to increase the value of your stock

Like I said, inside this unique plan, we actually want our dividend yields to go DOWN — not up.

In other words, you want to invest in a stock when it’s in position to “compress” its yield.

As in… the yield is about to plunge.

This flies in the face of everything you’d think (and what most of us have been taught)…

“Why the heck, Nathan, would you want to make less income than last month?”

After all, the point of the 60-Month Wealth Plan is to grow your money.

What’s going on here?

“Yield Compression” actually forces your stock to go up in value.

It’s a tactic I “stole” from the commercial real estate market…

And KEY to maximizing wealth in your 60-Month Wealth Plan

What does commercial real estate have to do with our 60-Month Plan?

A lot more than you’d think… and NO, this isn’t just some fancy spin on REIT investing.

See… unlike residential properties, commercial real estate is valued based on the income the property produces, NOT by comparable sales in the surrounding area like you would use to value your own home before selling it.

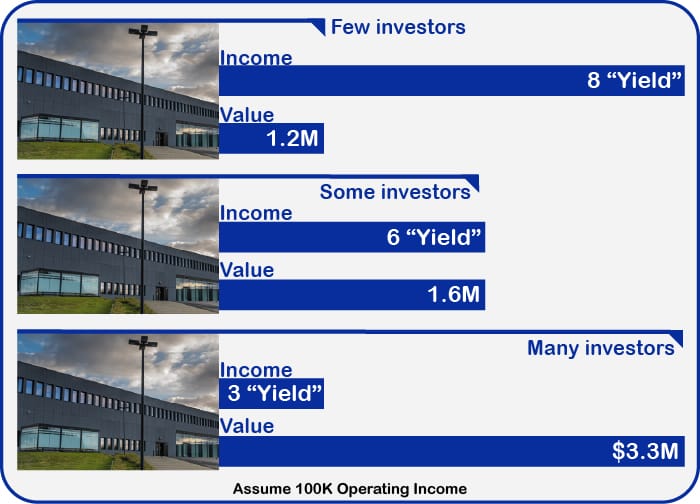

So, say an Amazon warehouse produces $100k in net income…

If you wanted to buy that warehouse all cash and produce an 8% yield…

The property would be valued at $1.2 million.

(You get that number by dividing $100,000 by 8%.)

$1.2 million is not bad… but it gets better.

As the property stabilizes, gains steady income, and good tenants… the investment becomes less risky.

More buyers will want this safe asset to invest their cash.

This demand, in turn, drives the price of the warehouse up. Supply and demand.

People love safe money.

But the caveat here is… “safer money” actually drives yields down.

Risky investments pay higher yields… lower-risk assets pay lower yields.

But if you can buy low risk investments when they’re trading for a high yield… you make money when the yield drops.

(This is the secret to why the 60-Month Wealth Plan works so well.)

So, if more buyers bid on this Amazon warehouse…

And they’re happy to only receive 6% returns each year (not 8%), the property value would go UP!

So, even if the property still only nets $100k in profit…

The value goes up to $1.6M even though it now only pays a 6% return.

Because $100,000/6% = $1.6 million.

Sound a bit backwards?

It gets crazier.

In 2021, with free government stimulus money flowing like wine… you’d see a commercial property being sold for a 3% yield…

That’s how desperate people were to place cash anywhere and everywhere.

For a bit of perspective… at a 3% yield the value of that property would shoot all the way up to $3.3M!

That’s almost triple the value compared to an 8% yield.

Because $100,000/3% = $3.3 million.

Values accelerates the more “safe” a property is.

This works in both real estate and bonds… so I thought,

“This could work for dividend stocks too!”

That’s how it is with some of your biggest dividend payers in the world, including Coca-Cola and even Apple now.

These blue-chip stocks have shot up in value, and now sit paying 1-3% dividends for the rest of their days.

These blue-chips are safe bets that chug along.

Famous investors like Warren Buffett make $9 billion a year in dividends from stocks like Coca-Cola. No work involved.

He’s fine with that because he’s sitting on $325 trillion dollar’s worth of assets.

He’s hungry for the safety and regular cash flow of a steady company

With safe yields like Coke, there are no potential big returns on the share price, as all the juice has been squeezed.

If you plan to generate a lot of profit from high-yields… you need to find them BEFORE they see growth! Not AFTER.

Remember, safe assets will produce low yields. To make real money, you want high-yielders with high potential to become more valuable later.

Which means following a 60-Month Plan may find you buying when no one else is.

When the share price of these high-yielding stocks drop, the yield shoots up.

Pay attention as this is the magic behind it all…

If you can buy a dividend stock at a high yield… collect that cash…

Then watch the yield GO DOWN as the stock price goes up, and you make a lot of money.

Here’s how it works…

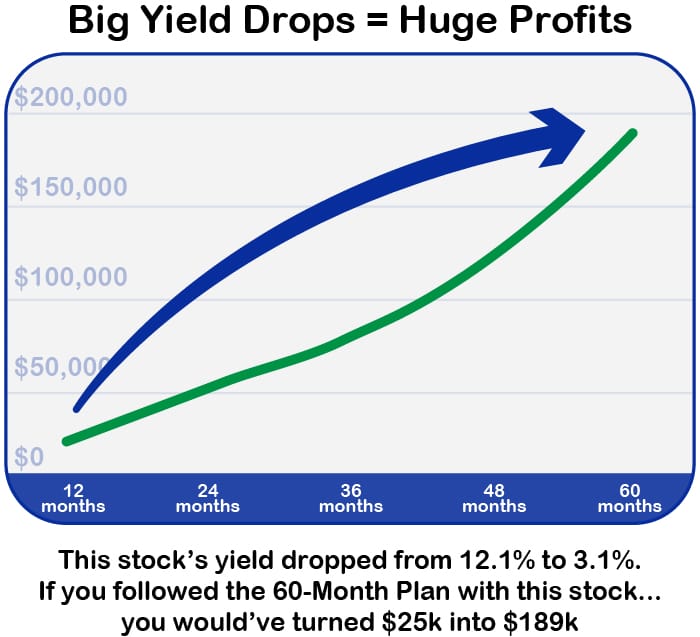

One of my top picks saw their yield drop over time from 12.1% to 4.5%.

While that might not sound good…

It actually works out extremely well for shareholders.

Take a look…

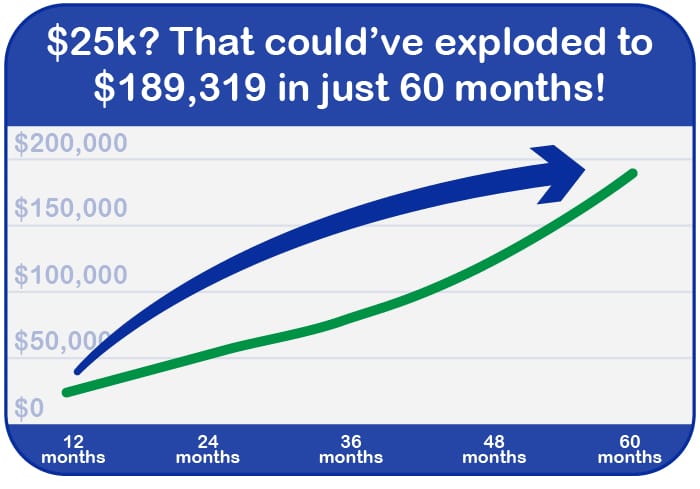

The yield cratered by 66% …

That sounds bad, yet following the 60-Month Plan, that “cratering” yield would have let you walk away with $189k. That’s the power of “yield compression.”

This would be a huge retirement win.

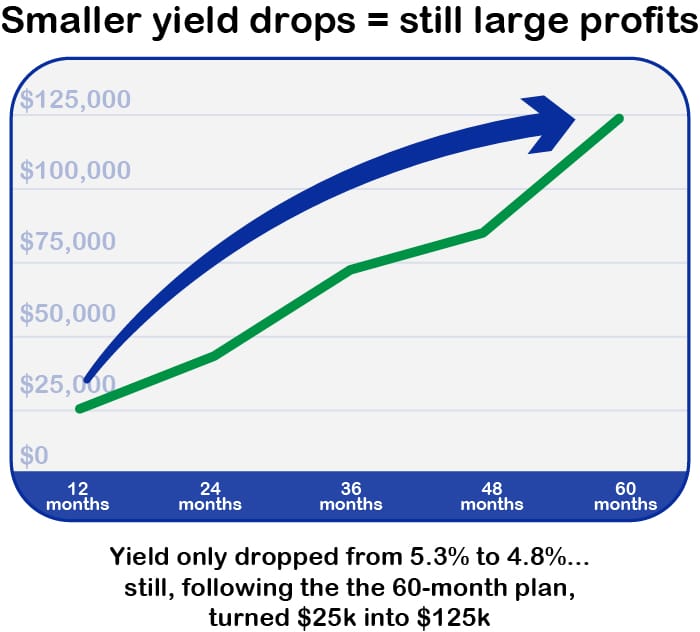

Of course, some of our stocks don’t drop their yield as much… and that’s okay.

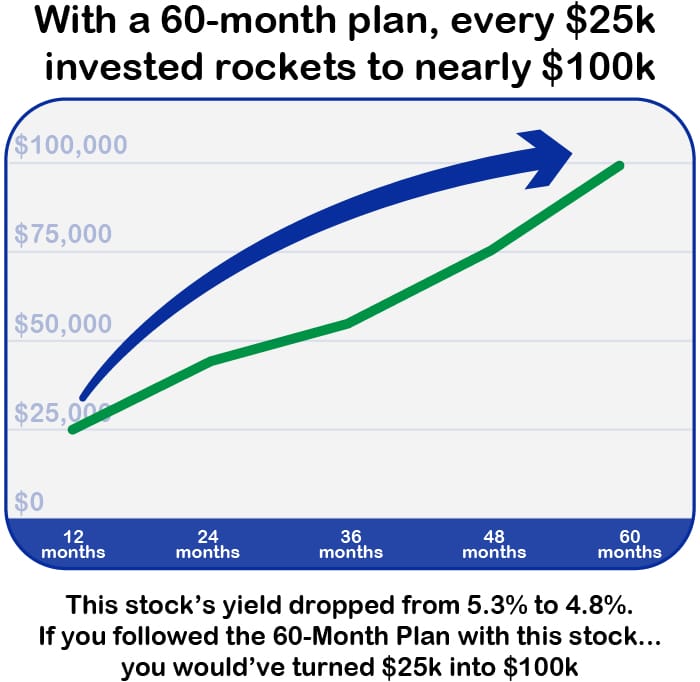

This one stock still would’ve turned $25,000 into $125,000 from 2017-2021… even with the yield only dropping 2.5%.

Even small drops produce profits.

If the company keeps the yield steady even as the stock goes up, it means we’ve caught a double winner…

Here, even though the yield barely moves (from 5.3% to 4.8%) you still make solid profits…

How?

This casino REIT saw its share price go from $19 to $31.

That’s a 63% gain in 60 months.

You’d think the yield would go way down. Instead it’s steady…

How does the yield stay steady?

This might be the very best part of the 60-Month Wealth Plan for retirees…

While your wealth soars thanks to “Yield Compression”…

Your income is going up fast too!

You’re pocketing more money in two ways…

The high-yield dividend stock is likely on sale, so you’re buying it and collecting the high yield…

Then, when the stock finally shoots back up (and the yield compresses), you’re making huge, potential triple-digit gains on the play, again…

Like I did with:

- Covanta (CVA) — up 111% in 13 months

- Triton Int’l (TRTN) — up 108% in 30 months

- American Campus Communities (ACC) — up 153% in 23 months

While you enjoy these gains…

The key is your income is NOT going down as the yield goes down.

Your income is going up!

Because we’re buying strong companies who are growing. Meaning, the stock will continue to go up, cashflow will go up, the dividends have a good chance to go up.

I’ve designed the 60-Month Wealth Plan for you to see automatic INCREASES in your income every single month, for life. (You’ll see how that works in Step 4.)

Take a look at that Tulsa pipeline stock that would’ve generated $432,000 in gains from a $100,000 investment…

At the end of your first year owning the stock, you’d be earning $1,010/month in dividends.

By the time you hit the end of your 60-Month Plan, you’re banking $3,552/month in dividends.

That’s a 252% jump in income! In this instance, the dividend didn’t grow much, but thanks to the 60-Month Plan design, you’re still seeing a massive income boost.

And that casino REIT I showed you earlier? With that one, you’re earning $438/month after your first year.

60 months in, following all 4 steps, and you’re looking at $1,688/month.

More than triple!

See?

Your income is only growing… and it’s fast.

But you need to click a button in your portfolio to make it happen.

That brings me to step three…

60-Month Wealth Plan Step #3 of 4

Use the “DRIP” to gobble up more shares of these “compressed” stocks

(It feels like getting free shares of stock every few months)

You need to utilize the power of the “DRIP” method.

The “DRIP” can literally double your income and returns down the road.

It only takes one click to set up.

What is the “DRIP?”

It’s a “Dividend Reinvestment Plan.”

Whenever you go to buy a dividend stock in your brokerage, 401k, or IRA, you can elect to “reinvest the dividends” you receive each month, quarter, or year.

You click “YES” to set up the DRIP.

That’s it.

You’re now automatically reinvesting your dividends… to buy more shares… which pay more dividends.

It feels like you’re getting “free” shares of these amazing dividend plays. “Free” as in you’re not personally depositing additional cash to buy these shares.

Your dividends are buying them for you.

It happens in the background and without you needing to do anything after you opt-in for DRIP. Simply set it and forget it.

Then, you let your money compound.

Let’s take a look at that Tulsa pipeline again…

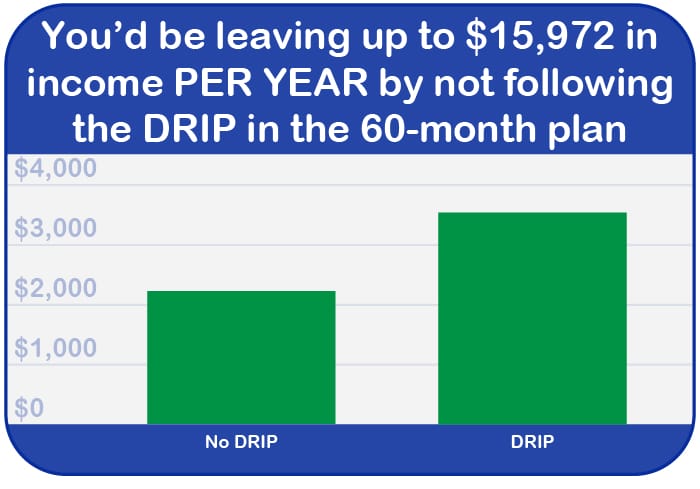

If you decline to use a DRIP with the stock… you’re not generating $3,553/month as you could at the end of the 60-Month Plan…

You’d only collect $2,222 per month…

While that’s still more than the average social security check… you’re leaving $15,972 on the table each year…

That’s $3,326 every month!

Plus, without the DRIP, you’d miss out on multiple 6-figures of growth, too…

There’s no brokerage fees for activating DRIP. So there’s zero excuse not to use it.

The best part?

This passive play grows your income by leaps and bounds… all you do is sit back and watch the money roll in.

Can you imagine willingly throwing out over $3,000 each month for lack of clicking a single button?

One…single… button.

After months of research on my end, you’re now only minutes away from unlocking access to a stock I believe can do just that… growing your wealth by leaps and bounds over the next 60 months, before becoming a geyser of income, gushing out up to $3,000 each and every month.

Here’s how I found it…

How do I find these “Yield Compressed” stocks to DRIP into?

My 15+ year “go-to” criteria has never failed me

I’m not looking for “technical” momentum or any of that trader jargon.

To find high-yield plays that are due for “Yield Compression,” it takes a bookworm, not a gunslinger.

I’m not following trading indicators…

I’m following:

- Cashflow

- Cashflow projections

- Recent earnings

- Debt on the balance sheet

- How long have dividends been paid?

- Has the dividend been rising?

- Executive competence

Here are the core main pieces I looked at to find the #1 stock for your first plan:

- Does this company have products/services that will last for decades?

A high-yield play in newspapers (which are in a death spiral) likely makes no sense…

A run at an insurance company trading for a discount… that’s a win for me.

- Is the management team competent and trustworthy?

You want them looking out for you and your returns. A management team dumping all their shares or playing accounting tricks should be knocked out of your 60-Month Plan for good.

- Can the company weather a storm?

Buying a high-yielder waiting for it to see lower yields likely means buying during a bit of turbulence.

Get comfortable with that.

Still, the company should have the financial horsepower to push through rough waters. That means not having mountains of debt or dwindling cash flows.

You need those cash flows to keep the gains and dividend checks coming.

- Does the company have a large moat?

Having a large moat lies at the heart of my investing philosophy because then the company can weather a storm, has products/services that last, plus likely has a smart leadership team.

This is the real gold you’re looking for.

Companies owning key pipelines in sought-after land…

Companies building complex technology no one else can replicate…

Companies holding mass market share no can wrestle away.

Now answering all these questions requires mountains of research, SEC filings, earnings reports… and these numbers and data can change with the wind.

I’m poring through endless lawyer jargon and thousands of pages from SEC filings to find the diamonds in the rough.

Don’t get discouraged if you don’t have the time or interest in reading these documents…

I do it for my readers every single day. That’s often 7+ hours of reading daily.

Boring, right? Not for me.

Reading earnings reports down by the creek near my mountain house is what I love.

Here’s what I’ve found…

THIS stock is the perfect “starter pick” to kick off your first 60-Month Plan

It’s currently paying a 7.8% yield…

And the stock will need to double share value just to get back to its old yield!

This stock to kick off your first 60-Month Plan used to yield 4.3% for investors.

It’s always hovered near that yield… except one time.

Its yield jumped to 6.2%.

The company is profitable, has an excellent CEO, and is a top monopoly in the utility space…

They’ve been in business for 40 years and record revenue of over $130 bilion…

As you’ve seen… when strong companies with rock-solid financials see their yields skyrocket, they’re typically seen as a good buy.

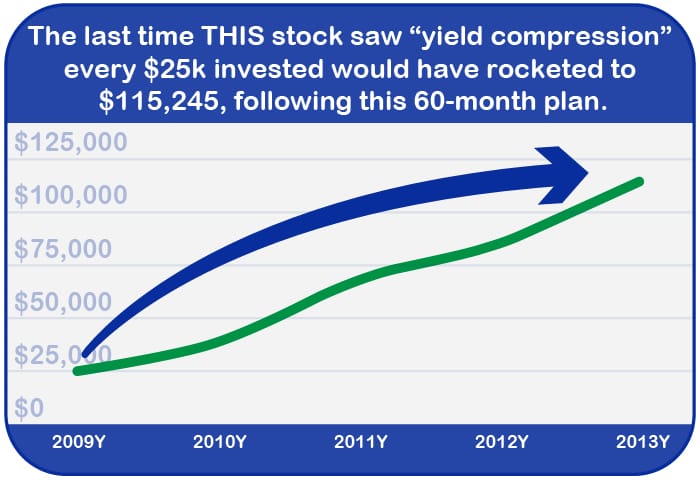

If you bought in 2009, following the 60-Month Wealth Plan, you would’ve turned $25,000 into $115,000 including collecting over $17,133 in dividends in that timeframe.

The yield got pushed back down to 4.3% by 2013 and sat there for years.

Until now…

Currently this stock pays over a 7.8% yield!

Meaning, if it goes all the way back down to 4.3%, the stock will need to 2X…

Plus, the company has raised its dividends every year for the last 25 years, even during recessions.

At a similar dividend hike pace as the past 25 years… this is my #1 recommended stock for you to start a 60-Month Wealth Plan with.

According to my calculations — $25,000 into the plan could turn into $159,000 (or more).

It’s my top pick for you to kick off your first 60-Month Plan.

I say first because that’s not where the story ends…

What happens AFTER 60 Months?

Maybe you’ve saved up enough to never run out of money.

Maybe you’ve saved up enough to never run out of money.

Maybe you stash your gains in even more high-yielders and enjoy even more income to live on.

Imagine having $3,000/month pouring in from just one plan.

Maybe you have 4 or 5 of these plans going at one time!

That’s the potential for upwards of $15,000 per month!

All from one simple, 4-step plan.

Of course, I’m not promising that’s what will happen.

I’m simply showing you the potential when you stick with the plan.

The right stock pays off BIG over 60 months…

The BEST stocks can pay off for even longer!

I have an infrastructure stock in my portfolio that’s been there since December 2011. Held for over 13 years now.

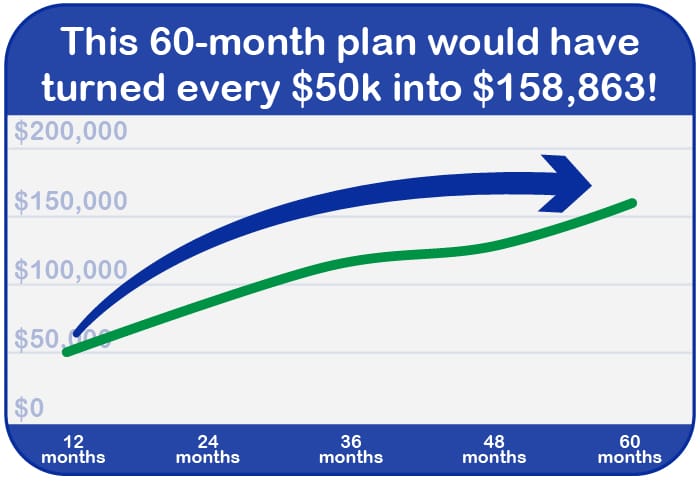

If you had started with the 60-Month Wealth Plan in the winter of 2011 when we opened the position, you could’ve turned $50k into $158,000 through 2016…

But the best stocks you could hold for even longer than 60 months and make even more!

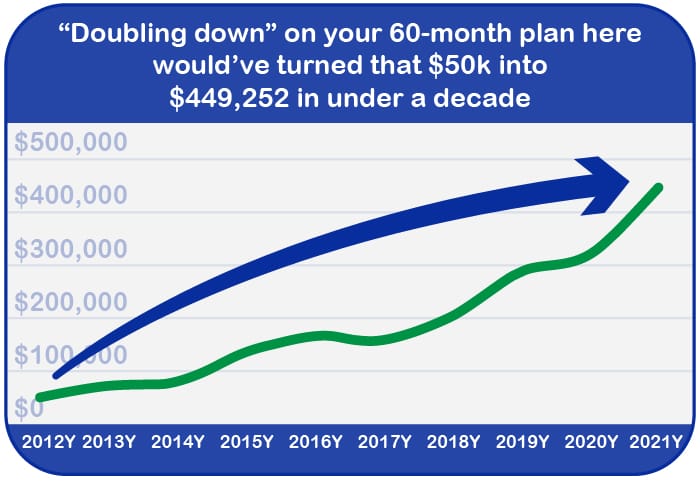

Say you didn’t pull out your $158k after 60 months and just kept following the plan for another 60 months…

Your $50k could’ve grown to $449k in 120 months!

That’s incredible and shows you the power of high-yield investing, the yield would’ve compressed from 12.1% to 5%, and you’re using DRIP…

Only one stock is needed for you to start this for yourself.

The entire 60-Month Plan, including the #1 stock to start with, is in this brand-new free report…

The 60-Month Retirement Wealth Plan

You don’t need a large account…

You don’t need a large account…

And you don’t need to make any risky investments.

All the details on how to generate more wealth each month are tucked away in my brand-new book, The 60-Month Retirement Wealth Plan.

Inside, tear through 20 years of wealth and income investing knowledge learned in the trenches as a financial advisor.

I ran hundreds of retirement scenarios for my income-starved clients. But I wasn’t allowed to share this strategy because it was too passive for the firm and while it would be a windfall for investors, it wouldn’t generate enough commissions for the company…

Fortunately, that doesn’t apply anymore.

Now, you can get your hands on this 60-Month Wealth Plan and put this powerful strategy to work today.

You’ll read more inside about:

- How to set up this plan in your brokerage account or IRA

- When to close out a position and start the next plan

- Where to activate the DRIP in your account

- The automatic wealth-building strategy that makes you wealthier while you enjoy larger and larger checks.

Just start with this 60-Month Plan.

The book is less than 20 pages long.

You can breeze through it in 10 minutes.

And after those 10 minutes, you’ll realize how easy it could be to fund your retirement every single month.

You won’t find this book on Amazon or anywhere else online.

But you will be able to rest easier after reading it…

Splurge guilt-free on trips and eating out without worrying if cash will be tighter next month.

In fact, after you follow this 60-Month Plan, you’ll realize you’re collecting more income every month than you did the month before!

It’s like receiving a raise every 30 days.

However, I never recommend doubling down on 1 or 2 stocks. Diversify a bit… all with the goal of hitting high yields that will go lower!

It was a tough fight to find the top stock to start your first 60-Month Plan with… but why stop at just one stock anyway?

I believe no investor should ever put all their eggs into a single basket…

That’s why, when you join me today I’ll also include a copy of Pressure-Cooked Profits, a brand-spanking new bonus report with 3 more stocks with compressed yields, worth putting into a 60-Month Plan:

That’s why, when you join me today I’ll also include a copy of Pressure-Cooked Profits, a brand-spanking new bonus report with 3 more stocks with compressed yields, worth putting into a 60-Month Plan:

- A stalwart data storage business touting 310+ data centers. The company has raised their dividends for 20 straight years and revenues are still at all-time highs. With 50% upside, their yield is set to drop! (Remember, we want that.)

- The semiconductor superstar taking the world by storm. Normally trading between $70 and $80 and shelling out a respectable yield of 3.5%… rate hikes sent the stock tumbling below $26, shooting the yield to 12%. The stock should bounce back, compressing the yield where it was originally. That’s if the dividend doesn’t move at all. This hidden gem hiked its dividend consecutively for the past 20 quarters… and I wouldn’t be surprised if it kept going.

- A well-known asset manager that just became a “textbook” example of yield compression. They’re debt free with $2+ billion in cash and boast lofty operating margins above 30%. However, recent market jitters have cut the stock in half from $200 to $100, doubling the yield to 4.5%. This company also just hiked its dividend for the 37th consecutive year

That’s 3 more vetted stocks to invest in — 4 in total with my #1 play — meaning if you’re a bold investor you can go big, starting up to 4 separate 60-Month Plans if you want.

But if you’re only going to do one — I’d recommend you start with my #1 pick.

You’d be following the first 3 steps to the 60-Month Wealth Plan:

- Invest in high-yield stocks

- Locate a play that’s seeing “Yield Compression” (meaning, the yield will be dropping)

- DRIP into the stock (meaning, you reinvestment your dividends)

Then, there’s one more step…

It’s one you’ll need the most.

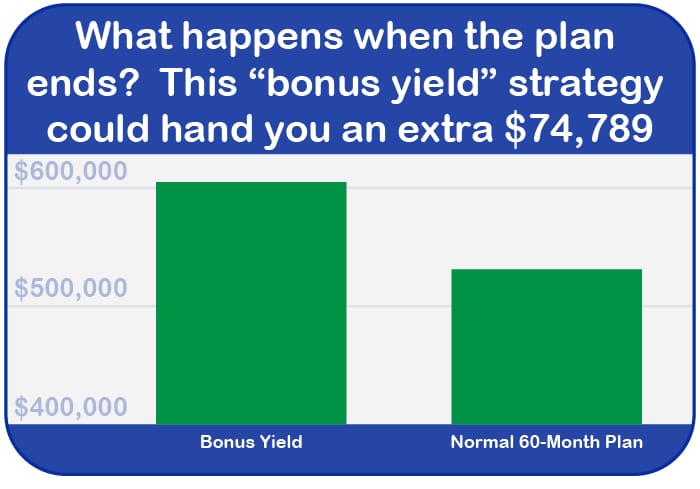

60-Month Wealth Plan Step #4 of 4:

The most important step to increase both your wealth and income by double digits each year

(Skipping this step on one of my recommendations would have left over $74,789 on the table)

I’ll be sharing the final step of the 60-Month Plan inside the book.

You’ll need to pick up a copy in order to see how to increase your wealth and income by double digits… and cut your timeline to 6-figures by almost half.

Step #4 can be on auto-pilot every month…

And with it… you will automatically collect more dividend income every single month. Step #4 guarantees you will turbocharge your results.

By skipping this step, you would’ve left over $74,789 on the table from one of my recommendations.

Step #4 is key for building your wealth faster and collecting more dividend checks.

But, I have one more surprise to build your income even faster too…

It’s a BONUS (and secret) 5th step to maximizing your gains in retirement.

BONUS STEP #5: This is the step that can get your account from a 6-figure portfolio into a 7-figure portfolio after you complete your first 60-Month Plan.

All while following the same principles I lay out with the 60-Month Plan today.

Not only that, but you’ll also earn more income than if you stopped at Step 4.

For example, with the Tulsa pipeline stock you could earn $1,957 per month in income after 60 months if you stopped at Step 4.

Step 5?

You’re generating $3,357 per month instead!

I’ll include this secret step at the very back of the book.

You’re going to want to see this.

Starting today…

Earn more wealth…

Earn more income…

Earn back more of your life for you and your kids…

Get every update on your 60-Month Plan stocks in my flagship newsletter, High-Yield Investing.

(We’ve been helping retirees grow their wealth since 2004.)

High-Yield Investing is the first place I tell folks to go for investing in dividend stock plays.

This newsletter has boasted an incredible track record since 2004… and we have no plans of stopping.

Check out just some of the total returns I’ve shown readers:

- 264% — COP

- 108% — TRTN

- 153% — ACC

- 111% — CVA

- 123% — OKE

These are all just from the past 3 years!

Of course, these are the top gainers. We have losers, too. Our win rate (without including dividends) is 62% the past 3 years in the most volatile market in recent history.

However, our picks over the last 20 years continue to beat the market.

Our goal for High-Yield Investing is to help you build a retirement account that grows your wealth and income every single year no matter what’s going on in the markets.

Our goal for High-Yield Investing is to help you build a retirement account that grows your wealth and income every single year no matter what’s going on in the markets.

With two decades of proof… this incredible tool has been a calm guide for investors through the turbulence of 2008, 2018, 2020…

Not to mention, acting as a “kick-in-the-pants” reminder to BUY during the good times.

Every month, you’ll receive a brand-new issue with 12 pages of in-depth research, new buys, sell alerts, market warnings, and more.

Get new alerts and insights every single month… like to pick up shares of this monthly dividend-payer!

Not only that…

You receive access to 5 premium portfolios each designed with a specific purpose in mind:

5 different portfolios to pick from depending on where you are in retirement

- Lifetime Wealth Generators: Your biggest potential winners. We have open winners up to 582% gains right now.

- Undiscovered Yields: Trusts, REITs, MLPs, you name it. High-yield plays that pay out a lot of consistent, steady income.

- Yield Quadruplers: My “highest” yield portfolio with one stock paying out up to 12.4%

- Five-Star Funds: These are funds that are great for protecting cash. The goal is for steady income with little capital appreciation.

- High-Yield International: Diversify with international dividend stocks if you’re overweighted in U.S. stocks.

You can dial your risk up or down, depending on where you are in retirement.

Don’t worry… every single pick comes with my detailed analysis so you can quickly decide which stocks make sense to use for your 60-Month Plan or to simply buy-hold-and-sit.

You have all the freedom (it’s your money after all), but I’m here to guide you every step of the way…

I won’t be updating the portfolio for your specific 60-Month Plan you start… I’ll only let you know when I recommend buying or selling a stock.

And you won’t believe how little it costs you to get access to this valuable research and the 60-Month Wealth Plan.

Your first month of dividends could pay off your entire membership

I’ll show you high yielders up to 12%…

Even with a $25,000 portfolio in that stock, you could throw off $3,000 per year buying that stock today. Yes, right now.

Yet, a subscription to High-Yield Investing doesn’t go for $3,000…

The regular price is just $129 per year!

I’ve shown you examples following the 60-Month Wealth Plan where $25k could turn into $189k, which is incredibly valuable.

That’s why I feel I could ask for $1,000 to get access to the 60-Month Retirement Wealth Plan… and people wouldn’t hesitate to buy it now.

But I’m not letting anyone have it for $1,000. Or any amount for that matter. The only way you can get access to it is by subscribing to High-Yield Investing.

Better still, when you join right now you won’t even pay $129… because I’m about to give you a massive discount when you claim the 60-Month Plan and promise you’ll start using it.

Click the button below and you’ll be taken to a secure page to get access to the plan and everything else High-Yield Investing has to offer.

I’ll throw in a bonus income strategy that could pay off your subscription 50 times over

Join now and I’ll also throw in this bonus report…

Join now and I’ll also throw in this bonus report…

Bonus Monthly “Yields” on Your Stocks.

You can potentially earn an extra $1,000 per month on a $100,000 account if you follow the strategy inside this report.

Meaning, you could earn potentially double the yield you get from just buying the high yields in my portfolio.

That extra thousand bucks, used inside the 60-Month Wealth Plan, could add an extra $74,789 to your account balance by the time the 60th month rolls around.

I’ll show you everything inside:

- Find out how this little-known strategy can supercharge your returns, even in a flat market.

- Discover how it could turn your stagnant stocks into a cash-generating machine.

This free bonus is valued at $197…

But it’s 100% free when you become a High-Yield Investing subscriber.

Best of all you’ll have access to the caliber of financial research that’s helped make some regular investors — good people just like you — a stone-cold fortune.

My subscribers have had a shot at millions in income following my picks.

You’ve already heard from subscribers making hundreds of thousands of dollars per year…

Meet more of them here.

Like John from Topeka, Kansas.

John’s making more in passive income than most folks do in a 40-hour per week job. He’s living retirement on his own terms following exactly what I lay out in the newsletter.

Here’s Larry from Davie, Florida.

Matt from Hartford, Connecticut is taking home 6-figures.

*Results not typical. For details see our disclosure page linked below.

Imagine taking home $100,000 per year in dividend income.

And while nothing in the markets is guaranteed — over 10 years, that’s an extra $1 million in the bank.

Probably more as High-Yield Investing is designed to increase your income each month… especially if you follow the 60-Month Wealth Plan.

Because as high-yielding stocks see their yields go down… our equity is up and so is the cash flow!

All the stocks you need are at your fingertips.

Start with High-Yield Investing today.

Here’s everything you get with High-Yield Investing.

Join now for a 70% discount ($1,588 of value… for just $39)

- Monthly issue with new alerts, market warnings, investing ideas, and more. It’s emailed to your inbox every month like clockwork. 12 pages of in-depth content on your stocks. I share market predictions, buy/sell recommendations, and updates on our companies’ earnings as they release.

- A dozen special reports valued from $99 to $197 each… free to you as a member. That’s over $1,588 in value as free bonuses. Included: 5 Income Stocks to Own Forever and 3 High-Yield REITS that are Recession-Proof.

- Mid-month alerts: I’ll send any updates and alerts that can’t wait until the next issue. I’ll also answer any pressing questions you send in.

- Full access to 20+ years of research: Get FREE access to High-Yield Investing’s password-protected, private website. You can dig through issues stretching back 20 years. giving you a treasure trove of ways to “goose” your portfolio and generate thousands of dollars in extra income every year

- Unlimited and unparalleled customer support: We have a 5-star customer service team if you have questions or concerns about your membership.

The best offer for the 60-Month Wealth Plan and High- Yield Investing is right here.

I told you the normal retail price is $129/year.

However, if you promise you’ll begin using the 60-Month Plan right now to set your retirement up…

I’ll knock 70% off the price right now.

Meaning, for just $39 today…

You get the 60-Month Wealth Plan, a 12-month subscription to High-Yield Investing, over a dozen bonus reports (including the new one below that gives you names of stocks paying bonus “yields”), and 20 years of historical tips and analysis.

Again, you can pay off that $39 in a month with the payouts from just one high-yield dividend stock.

Skip doing all the stock research yourself and I’ll hand you a roadmap for generating an extra cushion of wealth and income in retirement.

You can do that with High-Yield Investing.

And I’m not done yet!

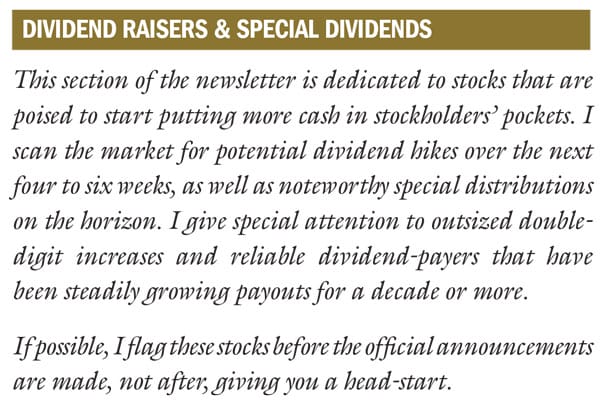

Like a cherry on top, I’ll show you how to put bonus dividends in your pocket with my subscriber-favorite “Special Dividends” section.

This is one of my subscribers’ favorite sections…

Because in this section of the newsletter, I release tips on when a stock may pay a huge special dividend or is about to bump their payouts.

These are payments on top of the dividends you’ll already receive.

In 2023, I sent an alert to collect a massive $15 special dividend being paid in a couple weeks… without watching the market you would’ve missed it.

Another time, I tipped readers off on a special dividend that was over 6X the normal payout for the stock.

Want an alert of a bonus $15 dividend payout? I did that in 2023.

I also share when I sniff out which stocks will give a nice boost to their dividend.

One grocery stock I recommended said they would raise their dividend… and they did by 12% the next quarter.

These bonus payouts are a way to pad your account with extra income as your 60-Month Wealth Plan is growing.

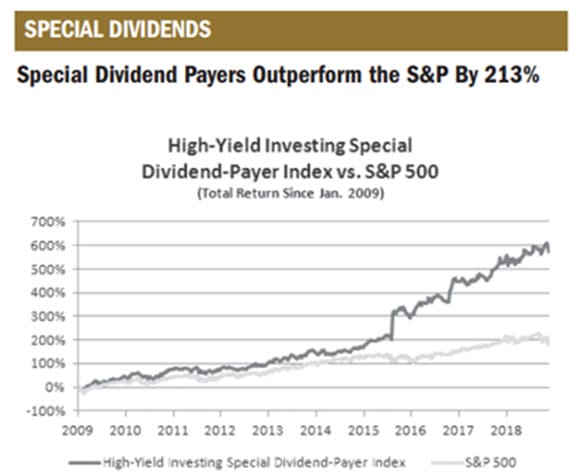

Special dividends outstrip the S&P by a wide margin — so much it’ll make your eyes water.

This is a free bonus inside High Yield Investing… access to special dividend opportunities

Collect more income from these bonus dividends if you want!

It’s all included for just $39 as a subscriber to High-Yield Investing.

You’re backed by a 90-day moneyback guarantee.

If after 90 days, you aren’t happy, simply call our customer care department to get a full refund and keep my 60-Month Wealth Plan as a free gift for trying out High Yield Investing.

Click the button below and claim your 70% off discount on the next page.

You’ll be redirected to a secure page to enter your information and start your subscription.

Imagine a retirement free of worrying about trading stocks or endless reading of financial news.

Leave worrying about your income to me.

Go enjoy some time with your family.

You didn’t work for 30+ years to spend your golden years taking another job or tossing and turning… stressing if you’re about to run out of money in 5 years.

Many retirees have no plan…

Or they outsource their plan to a financial advisor whose sole goal is for you to give them more assets to manage.

Get confident in your investing, even if you’re new to it.

You don’t need any experience to use the 60-Month Wealth Plan…

Enjoy your retirement years and let me take care of finding the very best high-yield dividend stocks on the planet.

That’s my promise to you.

My 60-Month Wealth Plan is easy to follow, only requires a small piece of your portfolio, and can potentially generate thousands of dollars for you each month.

Click the button below and join now for 70% off the regular price…

[button_1 text=”Get%20Started%20NOW” text_size=”32″ text_color=”#ffffff” text_font=”Verdana;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”Y” text_shadow_vertical=”1″ text_shadow_horizontal=”0″ text_shadow_color=”#ffffff” text_shadow_blur=”0″ styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#082e9d” styling_gradient_end_color=”#1844c3″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sahyi-60monthplan”/]

Welcome to High-Yield Investing!

Nathan Slaughter

Chief Investment Strategist

Copyright © 2024 StreetAuthority, a division of Capitol Information Group, Inc. All rights reserved.