[vertical_spacing height=”40″]

Who Needs Capital Gains When You’re Pulling in 11.1% a Year in Dividends?

We’re locking in $11,100 a year for every $100,000

we invest… and our dividends keep growing.

See how your dividend can blow past

your original stock price. It just might change

the way you think about investing forever…

Dear investor,

I’ve got good news for every income investor in America…

If you’re sick and tired of 10 long years of near-zero interest rates, your troubles are over.

In fact, as you’re about to see, you can start earning a double-digit yield on your money tomorrow.

Because the truth is, anyone with the initiative to stick their nose into corners of the market that lazier investors ignore…

Can find dozens of safe ways to make 10x more than what CDs or T-bills will pay them.

There are certainly plenty to pick from…

Right now, 72 North American stocks yield more than 10%.

37 yield more than 12%.

And 21 yield more than 15%!

Sure, a few of them are junk… but plenty of them are solid businesses that have posted rising earnings for decades.

Take REITs for instance. These aren’t ticking time bombs of toxic derivatives.

They’re bricks and mortar, throwing off rents that go right into your pocket.

All you need is a handful of stocks like these and you can set yourself up for life.

Buy the right cash cows now and you may be tempted to hang up your investing spurs, sit back and just watch your dividends roll in forever.

Win the Race Before You Start

We income investors look at the market a bit differently than “regular” investors.

It’s not the price of an asset that interests us, it’s how much cash it throws our way.

For an income investor, it’s the cash in your pocket at the end of the year that counts.

And I think it’s fair to say that my followers have been more than happy with the cash in their pockets recently.

Because the sectors we cover are delivering some of the highest yields on the planet.

We’re finding plenty of reliable double-digit yielders out there… meaning you can beat the stock market’s historical return of 9% a year right out of the gate in dividends alone!

We’re locking in annual payments on three of our holdings of $11,100, $10,000, and $9,200 for every $100,000 we invest.

We’re not promising you a thrill a minute here. Some of the cash cows we find are actually pretty boring companies.

For example, a while back we discovered a fertilizer producer that was yielding 11%!

This firm sells ammonia and nitrates to farmers throughout the mid-west.

Not exactly a glamorous business.

But because its revenue is almost recession-proof, it meant predictable cash flows and steadily growing dividends for us.

Another dull money-maker for us was a food distributor based in New Jersey.

It was yielding almost 7% when we bought it in 2010… and although the economy wasn’t on fire, people always need to eat.

So its earnings remained strong, and by the time we sold two and a half years later, we had tripled our money, racking up a 199.8% total return.

It’s a similar story with Sun Communities, which operates trailer parks.

Again, hardly a flashy “new economy” business.

We sold it in 2017 for a 141.5% capital gain. Add in our dividends and we walked away with a 186.8% total return — another near triple.

If you’d like more Steady Eddies like these — plus a steady stream of stocks, funds, and other investments with abnormally high dividend yields — then I urge you to read on…

You’ll see why high-yielding securities tend to plow steadily ahead in every economic climate… and exactly where we’re finding the most bullish opportunities now.

The Most Crucial Investment Decision of All

All the research we conduct at High-Yield Investing keys off the most underrated wealth-building tool in all of investing: the dividend.

Although little-respected and often ignored, more than 150 years of data prove that owning dividend-paying stocks — and then reinvesting those dividends — beats all other investment approaches hands down.

The fact is, the most crucial investment decision you’ll ever make is whether to reinvest your dividends.

Few people realize what a difference this simple decision makes.

Over the decades, dividends have contributed 41% of the total return delivered by the S&P 500. This makes a massive difference over the long haul.

Anyone who invested $10,000 in the S&P 500 in 1960 would have $3,845,730 today — as long as they reinvested the dividends!

If they didn’t, they’d have just $627,161 — a shortfall of more than $3 million.

Underestimating the awesome edge income-paying securities give you is the biggest mistake you can make in your investing life.

Dividends not only require executives to use capital efficiently, they also send a clear message that management is treating shareholders right by paying them the profits they deserve as co-owners of the business.

What’s more, a steady stream of dividends indicates that a company keeps straight books.

You can hide a lot of bad news with tricky accounting, but you can’t fake dividends.

Meanwhile, don’t forget that the tax code still favors dividends over regular income…

Unlike ordinary income, which is taxed up to a rate of 37%, the most you pay on your dividends is 20%.

And if you’re like 98% of investors, you lose only 15% to the taxman.

Dividends: Your Secret Weapon

Dividends are truly the forgotten heroes that have made countless investors rich.

When people talk about the massive gains common stocks have racked up over long holding periods, what they’re really talking about is the phenomenal juggernaut effect of reinvested dividends.

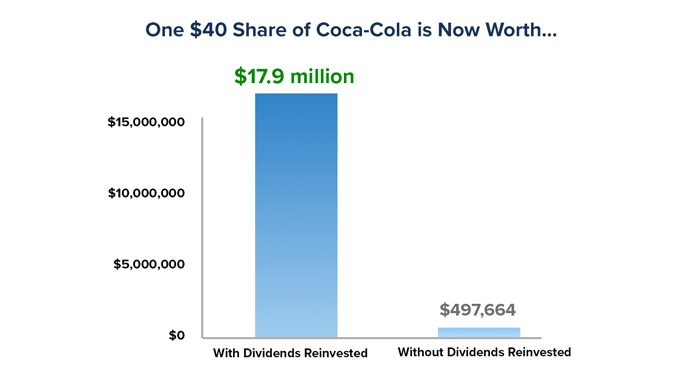

Look at the history of Coca-Cola. It went public in 1919 at $40 a share. As I write this, each of those single $40 shares is worth $497,664.

But that’s not even close to the whole story. With its growing dividends reinvested, it’s worth a stunning $17.9 million. (By the way, that original $40 share is now also throwing off $529,840 in dividends a year!)

Bottom line: Dividends matter big time. And increasing them matters even more.

When dividends grow unusually fast, you can make staggering profits… even if the share price never budges.

Your dividend check can eventually grow so large that it even surpasses the original price you paid for the stock!

Higher Yields = Higher Safety, Too

Another key reason dividend-paying investments have clobbered the competition is because they fare so much better during bear markets.

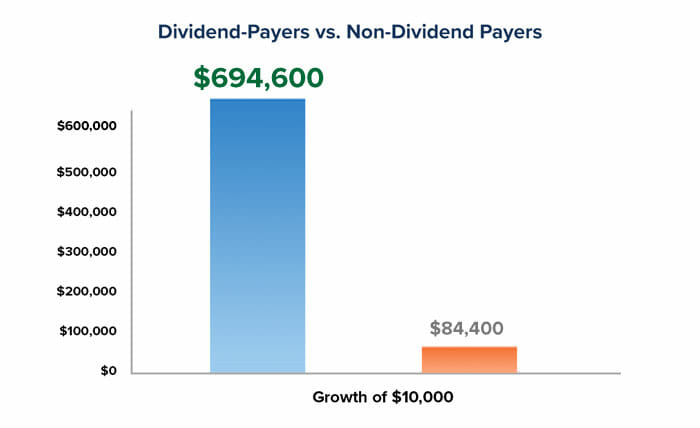

Over the vicious three years from 2000-2002, the stocks in the S&P 500 that paid dividends actually rose 10.4%, while the non-payers sank -33.1%.

And in the crash of 2008-09, dividend-payers once again outperformed other stocks (this time by 26%).

According to Ned Davis Research, $10,000 invested in the dividend payers of the S&P 500 index in 1973 would have shot up to $694,600 by 2020…

While anyone who invested in the non-dividend paying S&P stocks would be sitting on just $84,400. That’s a sickening 88% less.

Bottom line: Dividends are crucial.

There have been plenty of 10-year periods where dividends provided the only return for the S&P 500. (And something tells me we could be about to enter one of those stretches right now.)

The Last Free Lunch

I’d never claim that every stock in your portfolio has to be a high-yielder — but dividend-paying investments offer the most compelling risk-reward trade-off you can find.

They also give you a smooth path to wealth instead of heart-stopping peaks and plunges.

Dividend-paying stocks don’t jump around as much as other equities. So they have been far less volatile while producing their market-beating returns.

It’s the only free lunch in investing…

You can get better returns and lower risk just by owning dividend-paying stocks.

The odds are so kind that it’s hard not to come out ahead when you invest this way. I am constantly amazed that more investors don’t help themselves to this delicious free lunch.

And our mission at High-Yield Investing is to bring you a full buffet of these wealth-building delicacies.

If you want to keep your money out of long-term losers like T-bills and CDs and put it to work in tireless investments that will never stop making you money…

You’re in the right place.

Put Some Security Into Your Securities

Like a constant wind at our back, every investment we make is supported by a generous and steady yield. This puts a strong floor of support under its share price.

Every one of the opportunities we bring to our followers offers the two things we cherish most:

- A long history of honest-to-goodness growth (as opposed to contrived growth engineered by accounting fictions)

- A generous record of dividends

Our picks operate solid businesses with increasing profits, and they share these profits with their shareholding owners by paying them generous cash dividends.

Some of them we find in the most unexpected places…

Check Out This Behind-the-Scenes Operator Yielding 9.7%

There are plenty of income-oriented funds out there, but none quite like this one.

Its freewheeling manager moves freely between asset classes and countries… collecting income from an eclectic portfolio of stocks and bonds issued by “real asset” companies, including real estate, pipelines, and utilities.

Unlike funds that rigidly adhere to a specific agenda, he can alter course during changing market conditions to avoid trouble spots and capitalize on opportunities.

If you want a fundamentally strong portfolio of well-positioned companies with tangible assets and stable, recurring cash flows then look no further.

You can sleep easy knowing that toll roads, airports, power plants and other critical infrastructure will always be in demand and generating predictable income.

As the cherry on top, real assets like these are a great way to protect yourself from inflation because unlike dollars, Washington can’t create more out of thin air.

The clinching factor here is the sweet discount you get. The fund’s collection of stocks and bonds is worth $592 million right now — giving it a net asset value of $15.83 per share.

And if this were an ordinary mutual fund, that’s how much you would pay. But right now, you can pick up shares for just $14.41, giving you these assets at just 91 cents on the dollar.

If the 9% discount shrinks to zero in the coming year, you can add that 9% gain to your 9.7% yield payout and you’ll be up almost 20%.

You don’t find many securities in today’s market with a solid balance sheet bearing a double-digit income stream. I’m telling my readers to snap this one up ASAP. Read on to see how you can gain access to all the details on this cash cow right away.

Steady Wins the Race

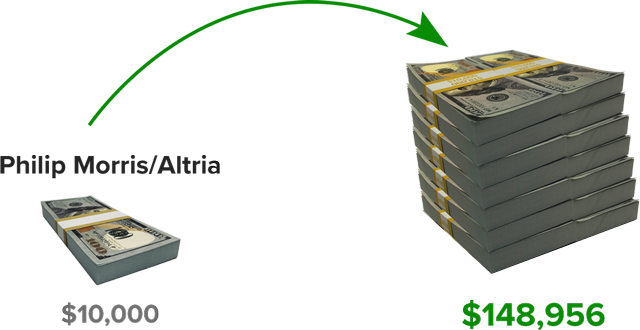

Altria (the old Philip Morris), which most investors dismiss as a stodgy company, is a perfect example of this phenomenon…

There’s nothing fancy about making cheese, coffee, and cigarettes. But with its high dividends and years of 15%-20% growth, “Big Mo” has thrown off some of the best long-term returns of any investment of the past two decades.

While $10,000 invested in the S&P 500 20 years ago has grown into a substantial $34,132, that same $10,000 put into Philip Morris exploded into $148,956!

You can attribute the bulk of that remarkable 14-fold gain to the company’s decades-long record of high and rising dividends.

And believe it or not, these investors incurred 22% less risk than the market during their 20-year ride.

Talk about enjoying the best of both worlds!

They gave up nothing on their path to wealth, while enjoying a priceless peace of mind along the way.

To be fair, the Philip Morris/Altria story is a particularly strong example of the miracle of compounded dividends.

But it’s far from unique…

You can find similar results from any number of steady but unspectacular stocks with long-term records of high and rising dividends.

Take Johnson & Johnson, for example…

Buying $10,000 of J&J 20 years ago would have gotten you 109 shares.

By reinvesting J&J’s fat dividends into more stock, you would now have 342 shares worth $46,595 — more than four times your money.

And your shares would be throwing off $1,300 in dividends a year.

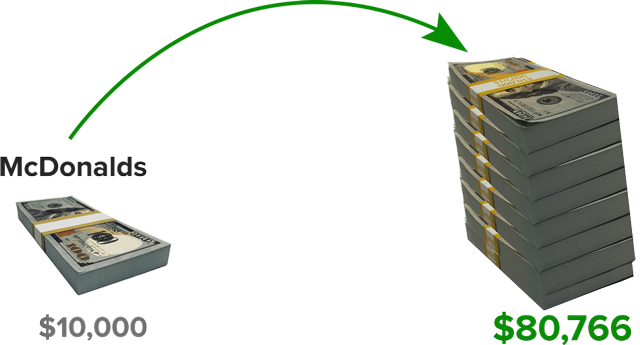

Likewise with McDonald’s…

Despite all the ups and downs in the fast-food business, McDonald’s has raised its dividend every year since making its first payout in 1976.

Anyone who bought the stock 20 years ago has now collected almost as much in dividends as the stock cost to begin with.

And every $10,000 invested has turned into $80,766.

When you venture away from household-name stocks you find even more-spectacular cases…

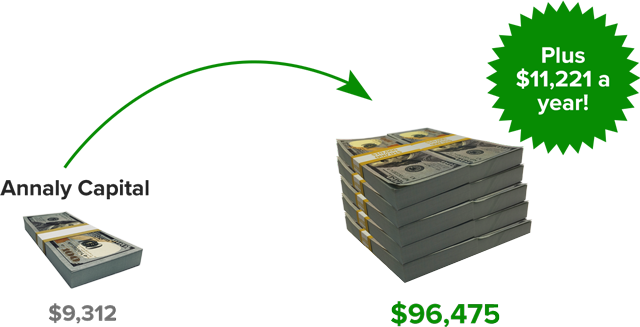

Take Annaly Capital…

Not many people know about this small-business lender, but it’s one of my favorite get-rich-with-dividends stories of all…

You could have picked up 1,000 shares 20 years ago for just $9,312. But Annaly has paid such massive dividends over the years that if you plowed them back into more stock…

You’d now be sitting on 10,201 shares worth $96,475. A classic 10-bagger.

And you’d be pocketing $11,221 in cash every year on top of that. That’s a 120.4% yield on your original investment, every single year!

Just as you would expect, this “dividend effect” works like a charm in the high-yielding utility arena.

Look at Dominion Resources…

Twenty years ago, 1,000 shares of this old workhorse would have set you back $45,125.

Now, you’d have 4,580 shares worth $375,102 — an 8-bagger…

And you’d be pocketing $16,809 per year in dividends, to boot.

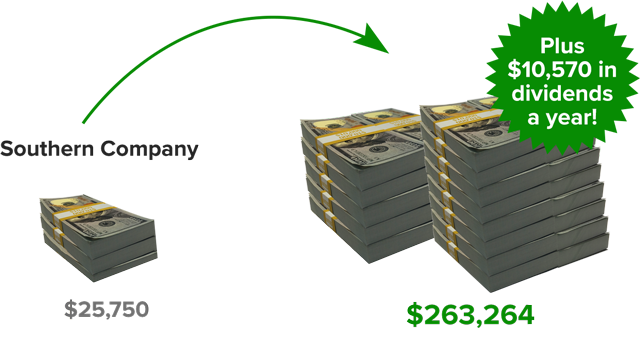

Same thing with Southern Company…

1,000 shares 20 years ago cost $25,750.

Today you’d have a pile of utility stock worth $263,264 — a 10-bagger.

And you’d be getting $10,570 in dividends per year. That’s a 41% yield on your original investment.

Another place dividends work wonders is in pipeline companies…

Take Enterprise Products Partners…

1,000 shares 20 years ago would have set you back $19,625.

Since then, your $87,983 in dividends would have bought you 10,020 new shares…

And you’d be sitting on a total of $400,652. That’s a 20-bagger and then some.

You can also turn a steady dividend into a fortune in energy…

Valero is one of the top gasoline refiners in America. You could have bought 1,000 shares 20 years ago for $19,250.

By now, you’d have 6,429 shares worth $565,752…

And you’d be getting $23,144 a year in dividends — a 120% yield on your initial investment.

You don’t need a lot of money to get started…

Ventas was selling for just $4.75 a share 20 years ago. So you could have picked up 1,000 shares for $4,750.

Now the stock is above $70. So that’s a 15-bagger right there.

But Ventas has also paid out $43,272 in dividends over this stretch, creating a 5,514% total return—a 55-bagger!

Meaning your $4,750 is now worth $266,665. Plus you’re still getting a stunning $9,009 per year in dividends.

As these stories make clear, your dividend check can eventually grow so large that it surpasses the original price you paid for the stock.

Ventas’ investors are now getting paid almost twice their initial investment every single year!

The exhilaration of “lapping” your stock that way is a feeling you never forget. But you’ll never experience that “dividend high” unless you own stocks that pay them!

That’s why every single investment you’ll find in High-Yield Investing has a yield. And not just any yield, but a bare minimum of 5% before we’ll even take a closer look.

Capturing High Yields

Without Losing Your Shirt

I’m not naive about the dangers that sometimes lurk behind high yields.

Now and then, you’ll see stocks, bonds, and funds sporting outlandish dividends of 25%—and even higher.

Please don’t rush out and blindly buy these super-aggressive yielders. Nine times out of 10, a stock yielding that much is actually in big trouble.

Wall Street knows that its dividend is unlikely to continue in the future, or the big boys would be piling into the stock.

The dividend yield can stay high for a while, but before long, look out below!

MCI was a great example of this.

I remember a period when the stock was paying a 30% dividend yield. It paid that enormous yield for a few quarters, but that was about it. The company then went bankrupt and investors lost everything.

It’s In The Tough Markets

That We Earn Our Stripes

The market crash and recession of 2008-09 was a brutal period for investors.

As the recession ate into profits, some of the biggest corporate names in the country cut their dividends…

Or eliminated them altogether.

Even the so-called “dividend aristocrats” like General Electric — whose dividends were considered untouchable — felt the axe.

But it was a different story here at High-Yield Investing.

At the worst point of the stock market rout in October 2008, the dividend payouts for the 19 companies then in our “Dividend Optimizer” portfolio had actually increased 16.2% over the previous year!

Excuse us if we brag a little, but that’s quite a feat given that 61 companies in the S&P 500 eliminated $41 billion in distributions that year.

Even Bank of America, which had increased dividend payments annually for 25 years, was forced by the financial crisis to cut back.

But only one of our picks cut its dividend (by just -7.8%) while the other 18 either held flat or rose… by as much as 111.5%!

So how do we sidestep the dividend cuts that hammer so many other investors? Simple…

We focus on SAFETY as much as yield.

You want stocks and bonds you can count on to deliver stable income year-in and year-out, not high-yield junk. That’s what our research staff at High-Yield Investing is for — to help you separate the junk from the jewels.

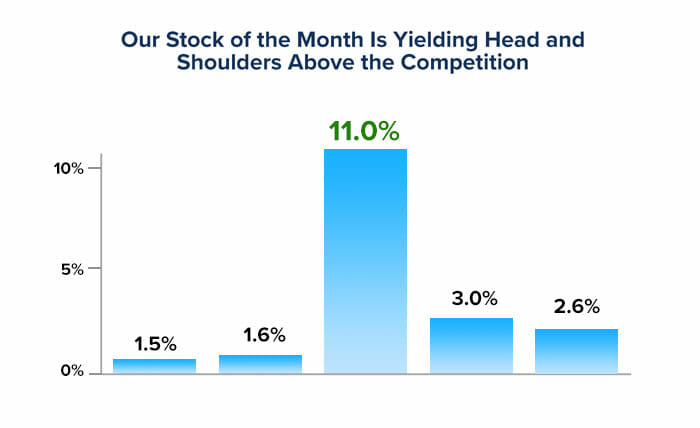

Now — Lock in 11% a Year from this “Floating Factory”

My top idea this month is like something out of science fiction. It’s called a “Floating Storage Regasification Unit.” FSRUs are immense floating factories moored close to shore that create natural gas and then pump it straight onshore to the user.

I’ve found an outfit in Norway that owns five of these behemoths. One of its vessels is so big it can supply the natural gas needs for the entire country of Lithuania, by itself. Another is leased out to the third-largest oil company in China. It’s moored off the coast of Tianjin… and fetches $129,000 per day. The Chinese are required to pay regardless of how much they use it.

Clearly, business is booming. Its fleet is 100% booked, with no downtime for the next nine years. So why is this quality operation yielding so much? Simple…

Last April, the share price plunged on fears that the pandemic would disrupt business. Consequently, the yield soared. But those worries proved unfounded.

By diligently containing Covid outbreaks on its vessels, its fleet was 100% utilized last quarter, with no downtime. There was no negative impact on the bottom line.

This outfit leases out its vessels to users around the world… and every customer has made all their payments in full, throughout the pandemic and global economic slowdown. Not every landlord on dry land can say that.

The future looks equally good. Global exports of liquefied natural gas are likely to expand over the next few years as cheap, abundant natural gas supplants coal on power grids. But that gas isn’t usable in its liquid state – and building regasification plants on land is wildly expensive.

By contrast, you can build an FSRU for about $300 million—half as much as an onshore import terminal. And they can be up and running six times faster, sometimes in just a year. And the great thing is that if another user offers more, these vessels can quickly move to the highest bidder.

The key here is that since business is booming, the dividend is safe. It hasn’t dropped a penny, EVER, and I don’t expect it to.

Call me crazy, but I love irrational market pullbacks. When the market is sane and efficient, stocks are priced close to what they’re worth. And it’s tough to score big gains when you buy a $20 stock for $20.

But if Mr. Market gets a little loony and decides to put the same stock on sale for around $16, now you’ve got a real opportunity.

I’m willing to bet good money that within 12 months the market will apply the same price tag to this business as it did before. For now, you can still pick up the stock for just under $16 a share and lock in a double-digit yield on your money.

Compare that to the 1.5% yield offered by the S&P 500. It would take more than seven years for blue chips to deliver the same income our “High-Yield Stock of the Month” will deliver in the next 12 months alone.

Corporate bonds don’t come close either. The average “AAA”-rated corporate bond yields 3% at the moment.

And Treasury notes? Forget it. The 10-year Treasury note currently offers a yield of just 1.6%. That’s not even in the same ballpark as our pick.

Even Standard & Poor’s Dividend Aristocrats, with their 2.6% yield, can’t hold a candle to it.

With all this in mind, you might want to lock in this abnormally high yield today while it’s still available.

What Gives This Stock Its Edge Over the Competition?

CD-Crushing Yield — With its steady history of quarterly dividends, this stock pays 11 times more than the paltry 1% CDs offer.

Solid Track Record — Throughout the tough economy we’ve experienced, the company has done a spectacular job of maintaining its quarterly distribution… paying money out like clockwork… showering shareholders with check after check.

Deep-Discount Valuation — Usually a stock with these attributes trades at a premium. However, this one trades at P/E ratio of just 9.8. And its enterprise-value-to-earnings ratio is 12.7, versus an average of 22.3 for its competitors. That gives you a chance to own a cash-generating machine for just 57 cents on the dollar compared to what you’d pay for its peers.

Margin of Safety — Unlike some aggressive outfits that pay 100% of their earnings to shareholders (and even borrow to cover the dividend when earnings fall short), this firm is paying out just 61% of its earnings for 2020. That way it can continue making generous payouts going forward without breaking the bank.

You don’t get many chances to lock in an 11% yield, especially those with growing income and a conservative payout ratio. When you do, you grab it… and hold on for a long and profitable ride.

Plenty More Like This One

Every Month

In each issue of High-Yield Investing, we uncover a new company that offers a towering dividend and strong capital gains potential.

Between REITS, closed-end funds, income deposit securities, ETFs, and exchange-traded bonds…

not to mention plain old stocks and bonds… we expose our readers to every sort of income-paying security on Wall Street.

Examine High-Yield Investing at

Our Lowest Rate Ever…

with ZERO Risk

We’re confident that once you examine your first issue of High-Yield Investing you’ll become a subscriber for the long haul. So, we invite you to try it out for only $39 for a year. That’s 70% off our regular rate.

For less than $40, you’ll be on your way to generating thousands of dollars in annual income for the rest of your life.

You’ll get full details on our current “High-Yield Stock of the Month,” a full year of High-Yield Investing, access to members-only web site content and model portfolios, mid-month email updates, plus free copies of our newest in-depth investment reports.

We’re Not Allergic To Capital Gains, Either!

It’s a funny thing about the high-payout companies we dig up in High-Yield Investing: hold them long enough, and before you know it, you’re usually sitting on a nice-sized capital gain as well.

For example, we featured Diana Shipping a few years back because its 13.9% yield caught our eye.

While the dividend came in like clockwork over the next two years, the share price more than doubled at the same time…

Handing investors a 203% total return!

Likewise with another shipper we featured around the same time, Eagle Bulk Shipping.

This one was yielding a whopping 15.8% and we liked it so much that we made it our “High-Yield Stock of the Month.”

Within two years we were sitting on a 131% total return!

Sometimes the dividend itself rises so high and so fast that capital gains are beside the point.

For example, a few years ago we added a stock to our portfolio at $57.41. Within three years, it had paid us dividends totaling $43.68. So we almost had our stock for free at that point!

We bought an oil royalty trust at the same time at $41.33 per share…

Over the next 10 years it threw off more than twice that amount in dividends alone… powering its way to a total return of 562%.

Even so-so yielders, like most utility stocks, can surprise you…

Edison International wasn’t paying a whole lot when we bought it. But we knew its dividend was reliable.

Edison’s payout rose 53% and its share price doubled, giving us a 113% total return.

Same thing with Westar, an electric utility in Kansas that’s as old school as they come.

We bought it in 2009, and sold in 2016 for a 169% gain.

Dividends can even rescue stocks that have been banished to Wall Street’s dog house…

Merck is a great example. Over the past two decades, the stock has been to hell and back.

In 2004, already reeling from the general woes of big pharma, Merck was thrown for a knockout by the Vioxx scandal and plunged from over $90 to under $30.

The stock’s yield spiked to 7.2% as the price dropped. But crucially, Merck never touched the dividend.

It kept on paying throughout the mess… so even if you bought Merck before the scandal — and suffered through all the bad news and billions of dollars in fines — you would have by now tripled your money.

You get the picture.

When you own a steadily growing cash machine, good things tend to happen.

You either pocket paycheck-size dividends on a regular basis… or watch your pile of beans grow into a mountain of cash.

We also help you make sure you hold on to that mountain of cash… by showing you municipal bond funds and other investments where every penny you get is TAX-FREE.

And others that let you put off paying taxes on 90% of your income for as long as you want.

These are great investment options if you’re in a higher tax bracket.

And even if you’re not, who doesn’t want to shield as much of their income as they can?

One of the tax-friendly gems in our portfolio right now yields 9.2%. Try to find a muni bond as generous as that!

But we don’t take our picks lightly….

Everything We Buy Passes Through

Our Financial Boot Camp

Any knucklehead with a home computer can generate a list of high-yielding stocks in five minutes.

But that’s no way to find quality investments.

By contrast, we put everything we recommend through an analytical boot camp before we even think about bringing it to you.

We call it our “Dividend Optimizer.”

This model identifies securities with key traits of safe and lasting income streams. It then ranks them from best to worst based on our unique scoring system.

Here’s a peek back at just a few of the outstanding payouts we’ve locked in from past “High Yield Stock of the Month” selections. (For space reasons, we’re featuring just one per year… but there have been dozens more.)

We use our “Dividend Optimizer” to find growing companies yielding at least 5%.

And when we find a double-digit income stream of 10%+, all the better. (Of course, the price usually rises after we buy it, pushing down the yield — but that is a nice problem to have.)

We want these stocks, bonds, funds, and other securities to have long track records and strong future prospects. Here’s what else we want to see:

- A long history of improving earnings. In general, the longer a firm has been profitable, the more likely it is to deliver steady returns in the coming years.

- Consistent and growing dividend payments. We want to see steadily increasing dividends with no declines or missed payments.

- Strong cash flows. Since you can’t pay dividends without cash, we need to find companies generating copious cash every year.

- Strong projected growth. Because growing firms are more likely to be able to boost their dividends in the future.

- A sustainable payout ratio. Firms occasionally pay out 100% or more of their earnings to shareholders. They can’t do this for long without cutting their dividend. We stay away from unsustainable payouts like that.

This is just a peek at how deep we dig to reveal which yields are treasures and which are traps. This work is vital, because it gives you an early warning if any of your money is in danger.

If you’re at a point in life where you simply can’t afford the damage another bear market will inflict on your stocks — or to have your income wiped out by creeping inflation…

You’ll appreciate the peace of mind these reliable high-payers offer.

While the inner workings of our rating system are complex, its results are crystal clear.

Your investment life will never be simpler. You supply the start-up capital and High-Yield Investing does the rest.

We’ll tell you where to put the money and when and where to move it around.

You won’t trade much.

Why should we fritter away our money on commissions and taxes? That’s plain dumb.

After all, the biggest profits are always made by the steady momentum of compounding.

We want you to get rich — not your broker.

That brings me to another point: Brokers rarely push the kind of investments we specialize in.

There’s just too little in-and-out action for their tastes.

Our picks are so reliable… so safe… and pay such high dividends that you can buy ’em and lock ’em away for years.

You won’t want to sell them. And that means zero commission for your broker. So don’t expect Wall Street to advertise their great dividends and fantastic long-term records to you.

We’re In This Together

At High-Yield Investing, all we do is help you profit from dependable cash-in-hand securities that steadily steamroll ahead, compounding their gains into ever-higher total returns.

We report to no one but you. We accept no advertising. No one else pays us a dime.

If our recommendations don’t increase your wealth, we know we will lose your trust and your readership. And we’d deserve to.

We have one purpose and one purpose only — safely making you wealthy. Without a lot of nail biting and never more than a thimbleful of risk.

On the contrary, when you try High-Yield Investing the risk is all ours. (Try getting your broker to take a risk.)

You don’t risk a penny with our 100% money-back guarantee.

Why do we offer such a generous guarantee? Because virtually no one uses it! They’re too happy beating the tar out of the market.

As we speak, we are sitting on an average total return of 101% in our core “Lifetime Wealth Generators” portfolio.

Not bad considering we’ve owned several of these picks for less than a year.

You’ll get the full details on every one of my current “buy” recommendations the minute you join our service.

But first, let’s look at one of our most appealing high-yielders right now…

Our Favorite Monthly Payer

Most of our picks pay us every three months. And we love cashing all those quarterly checks…

But there’s something even sweeter about getting paid every month.

That’s one reason I added this closed-ended fund to our portfolio.

It owns a package of high-yielding utility stocks… and sends investors a new check every 30 days.

It will also automatically reinvest your dividends for you, putting every cent to work and helping your investment compound even quicker.

But what makes this one really special is that most of its $1.1 billion portfolio is in preferred stocks—not run-of-the-mill common stocks.

These hybrid securities give you the best of both worlds:

- The steady income of a bond.

- The appreciation of a stock.

Like bonds, preferred stocks pay you steady interest, in this case every month.

And like common stocks, they can also hand you nice capital gains as the company grows.

But when you buy a preferred stock, you have one huge advantage over common shareholders…

When a company runs into tough times and cuts or cancels the dividend, it’s tough luck for common stockholders…

But if a preferred stock suspends payment, your payments accumulate on the ledgers and are paid in full when the company recovers.

So barring a total collapse of the economy, you’ll get paid no matter what.

This is exactly the sort of ultra-reliable money-maker I love.

I first recommended it in 2011 and it has paid us 117 dividends in a row without missing a beat.

Meanwhile it’s now up a total of 109% for us… and is yielding 8.5%.

On top of everything else, business keeps getting better: revenues have risen by 36% over the past five years… and cash flows have increased even more, by 65%.

This is exactly the sort of dependable payer I’m always looking for.

By the way, all of these top recommendations I’m talking about today are laid out in a series of research reports I’d like to send you at no charge.

The stocks you’ll find in these reports are not only among the most generous stocks you can buy, but they’re some of the safest, too.

You can buy them, forget about them for years, and let them steadily make you wealthy.

Join the Proven Fortune-Builders

With High-Yield Investing

If anything I’ve said so far makes sense to you…

If you think that I’m even half right about the extraordinary profits and peace of mind that cash-in-hand securities will bring their owners in the coming years…

Then I’d like to send you the most comprehensive source of information you can get — my High-Yield Investing advisory letter.

High-Yield Investing is the only service devoted to helping you make money in every category of income investing.

Nowhere else will you find a more thorough ranking of your income-investment options than in this monthly bulletin. You’ll be joining a growing group of folks looking for reliable investment ideas delivering above-average income — and strong capital gains, too.

And when I say “investment ideas,” I don’t mean just stocks.

We cover every class of income investment in High-Yield Investing. You’ll find a few asset classes so exotic that you probably never knew they existed!

Take the “oddball” security we featured in a recent issue. It’s not a stock, bond, trust, ETF, MLP, or mutual fund.

Only a handful exist in the entire world. They’re so rare that people don’t even know what to call them.

But here at High Yield Investing, we simply call them “Private Banks”…

Forget Banks! You Can Get Paid

10 Times More Interest In These

“Private Banks”

Would it surprise you to learn that there are two banking systems in the United States: one for the rich and another for the rest of us?

While most of us are stuck with measly bank account rates and 1% CDs…

The wealthy have access to another set of banks that offer double-digit yields.

Not only do these alternative banks offer higher yields than the banking system you and I have access to, but they are a much safer place to park your cash than you’d expect.

One of the private banks we’ve found has a loan default rate of just 2%, which is less than the high-yield bond market.

That’s why even traditional banking behemoths like Wells Fargo and Citigroup are using these private banks to grow their own cash piles.

The SEC limits direct access to this arena to millionaires. But we’ve found three backdoor entry points into this playground for the rich.

Another of our favorites lends money to private companies at 10.3%… but is so picky that it accepts only 4% of applicants.

These cash machines pay you every three months. Their recession-resistant business models churn out steady cash flows to support their dividends and interest income.

These cash machines pay you every three months. Their recession-resistant business models churn out steady cash flows to support their dividends and interest income.

And one more thing: these remarkable cash cows yield five times the average stock… now averaging 8.3%…

And their dividends qualify for the low tax rate.

In my special report 3 “Private Banks” Paying Massive Yields, I pry the lid off this hidden corner of Wall Street and delve into three of these under-appreciated yield machines. (You can get this report free as part of your new-subscriber welcome package.)

But private banks aren’t the only way I’m helping investors make life-changing profits…

Landlording for Dummies

There’s no easier way to own bricks and mortar than buying a REIT.

They let you own skyscrapers, shopping malls, and apartment buildings…

Plus get all the cash flow of a lease — along with the liquidity of a common stock and an inflation hedge to boot.

Plus, when you buy a REIT you totally eliminate the everyday hassle and legal liabilities of owning individual properties.

Most of our REIT picks are plenty safe enough for conservative investors.

Others are better for risk-takers who want explosive gains potential.

But they all offer high yields, sometimes reaching into the double-digits.

One of our favorites has thrown off a rising stream of tax-advantaged rental income for the past 52 years.

When it IPO’d on the NYSE, it was generating $40 million a year. Now, it’s churning out that much every few weeks.

This gem has been filling up shareholders’ mailboxes with rent checks every month since Richard Nixon was president. It just paid its 607th consecutive dividend… and management bumps up the payout every 90 days.

This gem has been filling up shareholders’ mailboxes with rent checks every month since Richard Nixon was president. It just paid its 607th consecutive dividend… and management bumps up the payout every 90 days.

I’ll give you every detail and ticker symbol inside Real Estate You Can Trust: 3 High-Yielding REITS With Recession-Proof Dividends.

And I’ll also include another one of my most powerful reports to date…

It answers a very simple question… one that most investors never think to ask…

What if the best stocks on Wall Street aren’t stocks at all?

How We’re Crushing Stocks

with the Most Investor-Friendly

Securities on the Planet

These market-beaters look like ordinary stocks… and they trade like ordinary stocks…

But with one big difference…

The IRS gives them a total pass on income taxes.

Since they pay no tax (saving up to 35% of their income), they have so much leftover free cash to distribute that this tiny group of companies pays the highest yields you’ll find on Wall Street.

You can pocket up to $15,900 a year for every $100,000 you put into these cash cows.

Welcome to the odd and wonderful world of master limited partnerships. Unlike the world of common stocks, when you buy into an MLP you become a partner, not a minority owner. But you’re a partner who doesn’t have to come to work, attend meetings, or deal with any of the hassles of running a business.

Welcome to the odd and wonderful world of master limited partnerships. Unlike the world of common stocks, when you buy into an MLP you become a partner, not a minority owner. But you’re a partner who doesn’t have to come to work, attend meetings, or deal with any of the hassles of running a business.

As an added bonus, up to 90% of the distribution you get is tax-free until you sell. In fact, some partnerships let you pocket double-digit yields for years before you pay a single penny of tax. Others let you defer taxes potentially forever.

In Pipelines of Profits, you’ll see every major type of master limited partnership, along with details on three standouts:

- If you pumped gas this week, there’s a good chance this 9.2% yielder made it possible. Its massive gasoline pipeline taps into almost half of America’s refinery capacity… and you can set your watch by its regular dividend hikes. Since launching in 2001, it has upped its payout 71 times by a total of more than 600% and has turned a $10,000 investment into $243,092.

- One of the largest MLP’s in America, this $50 billion behemoth runs oil, chemicals and natural gas through 51,000 miles of pipelines (enough to circle the planet twice). As reliable as they come, it has increased dividends for 62 straight quarters and counting. Now yielding 7.8%, it has turned $10,000 into $188,060 since its 1998 IPO.

- This behemoth distributes our nation’s vast natural gas resources. The yield soared to a princely 13.2% amid the collapse in oil prices—which made no sense because it’s not an oil play. Management actually hiked the dividend recently, giving new buyers a great entry point. One of the true pioneers in its field, this gem has turned $10,000 into a stunning $1,521,479 for its early owners.

See for yourself how to put the power of Master Limited Partnerships to work for you — a copy is waiting for you in your welcome package.

Start Your Own

Cash Machine Today!

With the S&P 500 yielding under 2% and CDs paying even less, you will never get the income you need to live and retire comfortably from the mainstream asset pools most investors swim in.

Especially with inflation chopping your return off at the knees.

By contrast, we have an entire portfolio of investments that offer an annual cash income running seven to eight times as high. And that’s before we even talk about capital gains.

By contrast, we have an entire portfolio of investments that offer an annual cash income running seven to eight times as high. And that’s before we even talk about capital gains.

I’ll make it easy for you to get started…

First, I’ll send you a free special report called The 3 Best High-Yield Stocks to Own Forever that describes in full detail the mouthwatering opportunities I’ve mentioned in this briefing.

My new report shows you how you can get safe double-digit yields right now… and possibly double or triple your money within two years.

Plus, I have one more hidden income opportunity I want to tell you about today…

Secret Dividends Payers

(That Hardly Any Investors Know About)

Did you know that Corporate America shells out more than $1 billion in dividends every day?

But that’s just the official count.

The true payout is actually much higher, because dozens of “secret” dividends go unreported each quarter.

Don’t misunderstand: These extra payments are dished out openly to all shareholders. But they are considered “special,” not ordinary.

So they aren’t reflected in the yields you see quoted in the press.

So they aren’t reflected in the yields you see quoted in the press.

And get this: these special payments are sometimes 10 times larger than the regular quarterly dividend.

One of the companies in this bonus report, Hidden Dividends: 11 Companies With Much Higher Payouts Than People Think, recently handed out a special dividend of $7.00 per share… when its normal dividend was just $0.50 per quarter.

That’s like getting your next 14 paychecks advanced to you in one lump sum. And still getting your regular paychecks after that.

Pretty sweet!

There’s no special trick for capturing these dividends — you just have to know where to look.

And that’s the problem…

While there is a ton of information out there on dividends, there is practically nothing on tracking down special distributions.

Unless you have your ears glued to the ground like we do, you probably wouldn’t even notice them.

But they are happening all the same.

Vodafone paid one a while ago. So did Dish Network, Whole Foods, and Microsoft.

So these aren’t sketchy companies we’re talking about. In fact, most of these special payers have outrun the market year after year.

We recently ran every special dividend payer we could find through a battery of tests to find the strongest.

You’ll find the elite group that made the final cut in this report.

I’ll send you the complete suite of income-focused breakthrough reports I’ve described FREE…

When you take a trial look at the service that brings these tireless wealth-builders to your door every month: High-Yield Investing.

Join Me Now And Save 70%

I hope you’re ready to use High-Yield Investing to safely accumulate serious, lasting wealth.

Because as a special introductory offer, you can get a full year of this one-of-a-kind resource at a reduced price…

12 monthly issues for only $39 — a 70% savings off the regular price of $129.

And don’t forget the special reports that I’ll send you free.

What’s more, we’re eliminating the risk for you here, because if you decide High-Yield Investing isn’t for you, you’re covered by…

Our “Good-til-the-Last-Issue” Guarantee

Our guarantee is as simple and strong as they come: total satisfaction or your money back.

Take a full 90 days to get acquainted with High-Yield Investing and make up your own mind about its value.

If you decide to vote “thumbs down,” we’ll happily send you a 100% refund.

And you’re still protected past 90 days, too — right up to your last issue, you can cancel for a full refund on the balance of your subscription.

But don’t just take my word for it…

Here’s What Satisfied Subscribers Say About High-Yield Investing…

“Yours Is One of the Best”

“You have a terrific service. I subscribe to a lot of them, but yours is one of the best. Keep it up. I am one guy you will never lose as a subscriber. Thank you.”

—J. A., Wellesley, MA

“Made More Money in Retirement”

“I have made more money in retirement than I did when I was working. Income from dividend- -paying stocks (which I collect every month) is even better than my greatest expectations. Thanks for your help with High-Yield Investing.”

—William B., Newport News, VA

“You Really Do Care About Your Readers”

“Thank you so much for your quick, personal response to my questions . . . it shows me that you really do care about your readers & do ‘walk the walk.’”

—Richard G., Centerville, OH

“I Am Continually Amazed”

“Having read hundreds of financial newsletters on an ongoing basis for over 23 years, I can tell you that StreetAuthority’s services are among the very best in the business. I am continually amazed at the broad range of in- -depth and consistently excellent research that you offer to your readers. Keep up the good work”

—Bob W., Boca Raton, FL

[button_1 text=”Join%20Me%20Now!” text_size=”28″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-sahyi-gains”]

Get Started Now!

To start receiving High-Yield Investing and get your free bonus reports, just click the big “Join Me Now” button below.

Please don’t delay.

Every day that your money languishes in a low-interest CD or money-market fund — or remains nakedly vulnerable in crash-prone stocks — is another day you’re missing out on the safe, high yields and stress-free capital gains our high-yield cash cows offer.

If you want to put your money to work in a tireless investment that will never stop paying you back…

Please join us today in this “push-button” money maker.

All you need is a subscription to High-Yield Investing, a brokerage account, and a mailbox to pick up your dividend checks.

With best wishes for safe profits,

Nathan Slaughter

Chief Investment Strategist

High-Yield Investing

[button_1 text=”Join%20Me%20Now!” text_size=”28″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-sahyi-gains”]

Copyright © 2021 StreetAuthority, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review StreetAuthority’s terms and conditions and privacy policy pages.

Nathan Slaughter draws on a deep range of financial experience to make profitable calls for safety-first income investors.

Nathan Slaughter draws on a deep range of financial experience to make profitable calls for safety-first income investors.