Ex-Wall Street Insider Issues Urgent Warning to Anyone Over 50…

The Biggest Lie America Has EVER Been Sold…

Is About to Destroy the Retirement Dreams of Tens of Millions.

Are YOU at Risk? (Full Story Below)

“Work hard, pay your taxes… and when you retire, we’ll take care of you.”

A simple goal… a simple promise… a bold-faced lie.

And we all bought it… hook, line, and sinker.

Unfortunately, millions near retirement may never get “taken care of.”

Because I believe THIS “promise” is about to be revealed as the biggest lie we’ve EVER been sold…

And investors who don’t take immediate action… risk seeing their retirement dreams shredded to pieces in the years ahead.

Fellow Investor,

My name is Nathan Slaughter…

And I take no pleasure in delivering this message to you today.

But it’s critical you give me your full attention for the next few minutes…

Because what I’m about to reveal could make the difference between a future in which you and your spouse enjoy the stress-free luxury retirement you’ve dreamed about (and worked so hard to reach) for decades…

And one where you just scrape by… barely able to make ends meet.

You see, you… me… and every other hard-working American alive today have been lied to.

For years, we were led to believe a decent chunk of the tax dollars clawed out of our paychecks were going to a “better place.”

One where they’d be invested wisely by professional “money men”…

Paying us back in spades when we reached our “golden years.”

It was a simple promise… and a massive lie.

One we all bought… hook, line, and sinker.

Because instead of investing wisely, the men and women we all blindly trusted to invest trillions of our precious retirement dollars…

Have failed us in the most horrible way imaginable.

The great lie?

Social “Security.”

As you’ll see in just a moment…

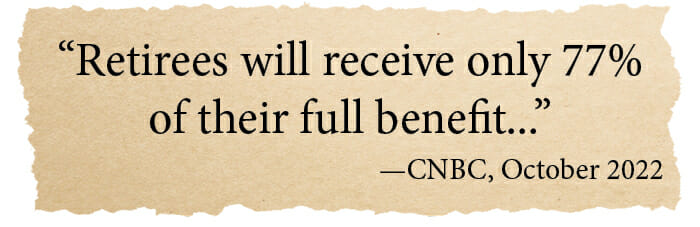

The folks in charge of that “sacred institution” have officially admitted and confirmed Social Security is on a fast track toward slashing its payouts to retirees.

That’s right…

Imagine your employer announcing you’re getting a 23% pay cut.

That would almost certainly have you running for the doors to find another job.

But for a retiree?

There are no “other jobs” to run to.

This is heartbreaking news, to say the least.

And for anyone close to, or at, retirement age… it couldn’t come at a worse time.

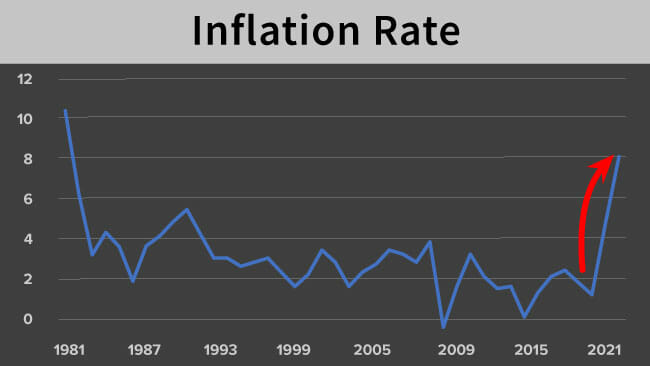

Because as I sit to write this, inflation is hovering near record highs…

Recently topping 9%…

Our country hasn’t felt inflation this high since Jimmy Carter left the White House.

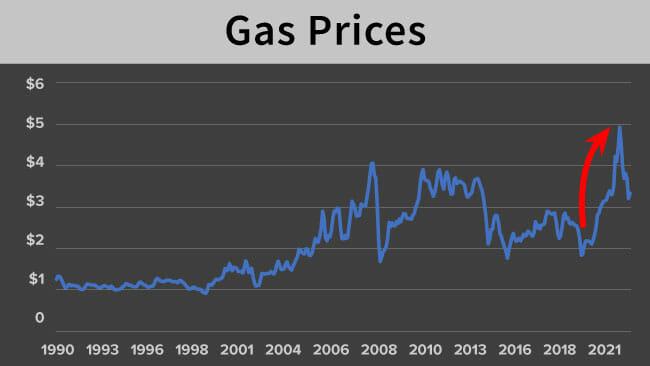

On top of that, the war in Ukraine combined with OPEC’s production cuts drove gas prices through the roof… the highest we’d seen in over a decade…

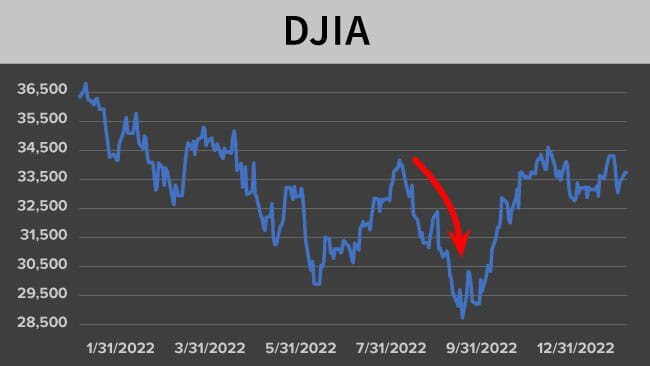

Add in the stock market downturn that started in late 2021 (and still hasn’t fully recovered) that’s left virtually every American with a brokerage account a whole lot poorer… and the economic outlook is even more bleak.

So, to discover our nation’s biggest “safety net” is on the verge of defaulting on its commitments…

Makes me sick to my stomach.

And it should make you upset as well.

I mean… for decades, you’ve had somewhere close to 6% of your salary deducted from every paycheck you’ve received in the form of payroll taxes.

And your employer matched that amount for a total of 12% of your gross salary…

All in the name of creating a financial cushion to help make your retirement more affordable.

So discovering all that money — literally TRILLIONS of dollars — has been so poorly managed for so long DOES NOT sit well with me.

If that’s how Uncle Sam intends to “take care of me” after 40+ years of toiling in the salt mines…

I’m having none of it.

I’ve been preparing for this devastating shortfall for years.

And I’ve stood on my head, trying to warn family, friends, neighbors… anyone who would listen.

Most of them stared at me like I was speaking a different language.

But that didn’t stop me from spending every spare minute I could muster…

Working out the details of a sure-fire strategy custom tailored to building MY OWN wealth.

A strategy that doesn’t rely on the stuffed shirts in Washington, D.C. for success.

Stick with me for the next few minutes and I’ll show YOU the precise steps I’m taking to break free of the failing Social Security system…

And how you can put together your own “private retirement fund” …

One that could help generate as much as $32,522 in annual income… every year.

Don’t worry… this won’t affect your Social Security (SSI) payouts (or what’s left of them by the time you retire.)

Of course, this isn’t “money for nothing” — the amount of income generated is directly related to how much you’re willing to put towards the trades in your private “fund” (we’ll get into that more later).

But with a solid starting stake and a bit of patience, the income from your “private fund” could make your SSI payments look like pocket change in comparison.

I won’t spend too much time dwelling on how badly Social Security has been mismanaged…

Or bombarding you with a million boring facts to make my point.

But I’d like to ask you to consider a hypothetical situation…

The Worst Investment Fund in History?

Imagine a professional money manager approaches you with the following investment plan:

- He alone decides how much you contribute each month…

- You have no control over the types of assets your money is invested in.

- No matter how badly you might need it, you can’t touch the money in your account until you’re at least 62 years old. (Even then, you can only withdraw a small amount each month.)

- You can’t pass any of the investment assets on to your children or grandchildren.

- And as an added bonus… the manager’s historical rate of return is just a fraction of ne percent above inflation.

Does that sound like a plan you’d rush to sign up for?

Me neither!

But that’s exactly the “deal” that was forced upon us when we received our Social Security card in the mail many years ago.

The reality is…

If you’re like most Americans, over the course of your 40+ year career, you’ll pay close to $270,000 in Social Security taxes.

After you retire?

Adjusted for inflation, you’ll receive close to $290,000 in benefits.

I’ll save you the trouble of doing the math…

Those numbers amount to a paltry, shamefully low 7.4% investment return

Not 7.4% per year.

But 7.4% for the entire 40+ year time frame.

That breaks down to a measly 0.18% per year.

That’s just a slightly better return than you’d get by putting your money under a mattress for 40 years.

And if that disastrous investment performance isn’t enough to convince you…

We’re now being told — by the Social Security Administration themselves — that the good ol’ days of any return greater than zero are quite likely gone forever.

At this point, you might be wondering…

How On Earth Did We Even Get Here?

I won’t bore you to death with the details but, long story short…

Every worker in America pays into the system.

And every qualified retiree receives payouts from it.

As long as the amount of money entering is at least equal to the amount leaving it each year, the system stays afloat and continues cranking along just fine.

It worked exactly that way since President Roosevelt signed the Social Security Act in 1935.

In fact, for many years, the tax dollars entering Social Security were much higher than the amounts being paid out.

That allowed SSI to build a nest egg close to $2.8 trillion (yes, that’s trillion with a ‘T’).

But over the past few decades, America has changed in two very important ways:

- Life expectancy has increased — In 1950, the average American lived 68 years. Today, it’s closer to 79. So today’s retiree receives Social Security benefits for 11 years longer than they did in 1950. That’s 11 more years of payouts… spread across tens of millions of people.

- Birth rates have declined — Today, there are half as many births per 1,000 Americans as there were in 1950. That translates to half as many workers adding money to the system.

The math here is simple…

There’s more money exiting Social Security than there is entering it

And it’s created a financial “house of cards” that’s very close to crashing to the ground.

Even the folks running the show at the Social Security Administration agree…

America’s $2.8 Trillion Retirement Trust Fund

Just Gave Itself An “F Grade”

Let me be clear…

The details I’m about to show you aren’t based on a hunch, rumor, or opinion.

They’re pulled directly from the pages of an official government document…

Addressed to Nancy Pelosi and Kamala Harris…

And signed by Treasury Secretary Janet Yellen, along with a handful of other high-ranking government employees…

In June of 2022.

That makes this document as official as it gets.

I’m shocked the mainstream media hasn’t been shouting the details from the rooftops…

Because in this shocking Annual Report, the Social Security Board of Trustees admits the fund is well on its way to being “depleted.”

Which, in my mind, is just a kinder and gentler way of saying…

The word “depleted” doesn’t come close to describing what’s really going on.

It’s not just the case that contributions into the system are lower than benefits being paid out.

It means they’re so low that Social Security has to eat into its $2.8 trillion “nest egg” in order to continue making payments to retirees.

Not only that, but…

The fund’s administrators have estimated precisely when the nest egg will reach zero.

After that tipping point?

- There’ll be no investment income coming into the fund — because there’ll be no money to invest…

- And no “rainy day cushion” to get the system through rough times.

In fact, once that $2.8 trillion is all dried up…

Every day’s going to be “rough” if you’re relying solely on Uncle Sam to fund your retirement.

How long will that take to happen?

The Administration’s own report card says it’s right around the corner……

In 2034.

That’s when the last of the $2.8 trillion evaporates into thin air.

After that…

Social Security’s only source of income will be payroll taxes.

And remember — because there’s now more money leaving than entering…

SSI will not have enough money to make its promised payments.

A promise they’ve been making to some of these folks for over 40 years.

The Board of Administrators goes on to tell us, in 2034, they’ll have to slash monthly payouts across the board by an astonishing 23%.

To call this “bad news” would be the understatement of the century.

It means tens of millions of Americans who don’t know about my private plan…

Good people like you…

Won’t have the opportunity to set themselves up to collect up to $32,522 a year with the plan I’m about to show you.

Sadly, these folks will be left out in the cold…

Some of them literally…

Living on less income…

While the cost of virtually everything around them — food, gas, rent, entertainment — continues to rocket higher with each passing month.

For me, this is one heartbreak too many.

Yes… I’ll sure-as-heck deposit whatever chump change Social Security sends me when I retire. (And I recommend you do the same!)

But it’s clear we can’t depend on them for “security” of any kind.

It’s far too risky in my mind.

And I’m convinced the ONLY way out of this mess for any of us is to take charge of our own retirement investments…

And the best time to start is TODAY.

That’s exactly why I’ve created this presentation.

Stick with me for the next few minutes… and you’ll uncover how you could set yourself up for success (and a comfortable retirement) no matter what happens with Social Security.

Because I’ll hand you the precise blueprint — every tiny detail you need to free yourself from relying solely on government safety nets for your financial security and peace of mind.

I’ll show you exactly how to position yourself to see steady streams of cash hit your bank account like clockwork…

Freeing you and your spouse to enjoy the kind of retirement most Americans only dream about.

Plus… it won’t impact the Social Security payments you’re rightfully owed!

In 2023, the average American retiree will collect $21,924 in SSI benefits.

Adding the simple “private fund” strategy I lay out for you in this presentation has the potential to generate as much as $32,522 a year — dwarfing SSI’s payouts by a huge margin.

If you’re already retired, this “extra pool of cash” could help you stay ahead of inflation with enough left over for you and your spouse to treat yourselves to a first-class vacation (or three) every year.

And if you’re approaching retirement age but “not quite there yet,” an extra $32K a year would go a long way toward building a rock-solid nest egg for your golden years.

I’ll show you everything you need to get started today…

But first, a proper introduction is in order.

I’m Nathan Slaughter…

And I’m Chief Investment Strategist at High-Yield Investing.

And I’m Chief Investment Strategist at High-Yield Investing.

For the last 16 years, I’ve made it my solitary focus to help everyday Americans invest profitably for retirement.

I’ve always taken my job seriously.

But since discovering we’re all about to get railroaded by Social Security at the worst possible stage of our lives…

I’m more passionate than ever about helping investors like you find simple ways to take control of your financial future.

My personal investment journey began at 14 years old when my school sponsored a stock picking contest.

After a month had passed, my one-stock “portfolio” had made more money than any other student in the school…

And I emerged as the winner — earning an official certificate for a single share of stock.

I admit… this high school investment victory was pure luck…

But it hooked me on investing and the stock market for life.

After college, I went to work for AXA / Equitable Advisors, passed my securities licensing exam, and got myself a front-row seat for the dot-com market crash in 2000.

A few years later, I got “called up to the Major Leagues” by brokerage firm Morgan Keegan.

I was thrilled at the prospect of researching companies, digging into financial reports, and using the details I uncovered to help everyday investors build wealth for retirement.

Unfortunately, the company wanted me to spend 99% of my time finding new clients…

And only 1% investing their money.

It didn’t take long for me to get tired of the “game” they wanted me to play.

So, I stuck around just long enough to become skilled at uncovering and unleashing massive income opportunities (often long before other analysts caught whiff of them).

The moment I’d learned what I needed to know to invest profitably, safely, and with amazing consistency…

I high tailed it out of the Wall Street jungle and never looked back.

Today, I bring my 25+ years of experience to investors like you…

Helping you set yourself up to make your “golden years” truly golden…

Flush with money to finally enjoy all the things you and your spouse have dreamt of for decades…

Like:

- Gourmet dinners

- Luxury vacations

- Paying for your grandkid’s college education

- Ensuring you have the best medical care in the world

- Or anything else that puts a spring in your step

But don’t take my word for what’s possible…

Here are just a few thank-you notes I’ve received from everyday investors who follow my work…

I don’t share these examples to brag…

But rather to show you I have a long track record of helping everyday investors of all ages and walks of life accumulate wealth.

And I’d like to do the same for you.

Let me start by showing you…

How to Create Your “Private Retirement Fund”

Don’t let the words “private retirement fund” scare you.

It’s not a 401(k), an IRA — or anything the IRS has control over.

It’s a name I give to the simple income investments you could make to take control of your retirement with zero involvement from Uncle Sam.

And creating this “private fund” is A LOT easier than it might sound.

We’re not talking about some operation that requires employees, office space, or millions in investment capital.

This is a series of personal investments designed to drive more income into your retirement account than you’d ever hope to collect from SSI. You get to decide how much cash you keep, how much you reinvest, and which investments to make (but don’t worry, you won’t be going at it alone).

As long as you have free cash in your brokerage account and access to a telephone or web browser…

You can start your “fund” within the next 48 hours.

Best of all, you don’t have to wait until retirement to withdraw your money.

You can, of course, wait for retirement — and given the power of compound interest, that’s almost always your most profitable play.

But then again, you’re free to dip into your “fund” any time you want and for any reason you want.

Try calling up Social Security today and telling them you want some of the $200,000+ you’ve contributed…

I suspect you’ll hear dead silence… or muffled laughter…

You’ll also give the SSI representative a story they’ll tell coworkers for the next 20 years.

However…

The simple strategy I’m about to reveal could quickly put you on the path to seeing a steady stream of cash show up in your account, almost like clockwork…

Meaning the puny checks Social Security sends you could end up looking like “beer money” in comparison.

Not only that…

But I’m confident these instructions could set you up to beat SSI’s laughable 7.4% over 40 years track record by a country mile…

With miniscule risk compared to options strategies, tech stocks, or cryptocurrencies others may be pushing you to invest in.

You might be wondering…

What makes a “retirement fund” different than a regular ol’ “investment account?”

Well, retirement funds need to focus on two critical things…

Focus #1:

Outsized, Dependable, and Rising Income

I’ve never shied away from a good old-fashioned “buy low / sell high” stock opportunity.

I’ve recommended a ton of them in my day… and I have no plans to stop anytime soon.

But for an investor at or near retirement age, the majority of your focus needs to be on income.

Think about it…

When you no longer have an employer depositing money into your bank account every couple of weeks, you essentially have to “pay yourself a salary.”

Even when you own your home and car free and clear… and have no debt…

You’re still going to have everyday living expenses, including:

- Food

- Gas

- Utilities

- Property taxes

- Entertainment

![]()

You get the picture.

You can’t buy any of these essentials with paper gains from stocks you still own.

You can only buy them with good ol’ greenbacks.

So it’s critical for all investors approaching retirement to shift the bulk of their portfolios into stocks that pay strong, solid, dependable dividends.

And whenever possible, you want those dividends to come from a company with a track record of increasing them over time…

For example:

- One of the stocks I’m tracking — a retail landlord — has increased its dividends payouts an amazing 97 consecutive quarters (that’s almost 25 years) and more than double the number of increases SSI has made since 1975.

- Another — a mid-sized lending company — has nearly doubled its payouts since 2007 without a single cut, ever.

- A third company — a global property manager — has increased dividends for twelve straight years at a pace of 11% per year. Take that inflation!

With stocks like these in your portfolio, spending your golden years sipping Mai Tais on a beach without giving a hoot about inflation doesn’t seem quite so farfetched.

Of course, dividend income is all well and good…

But if the company paying it out is on shaky ground, you can find yourself in a situation you never want to face in retirement.

That’s what makes our second focus critically important as well…

Focus #2:

Rock-Solid, Unwavering Safety & Security

A retirement fund needs to keep the safety and security of your life savings squarely on the radar at all times.

When you’re younger and have 20 to 30 years of runway left to retirement, you can afford to take a few risks with your investments.

Now, when I say “risks,” I don’t mean being reckless or irresponsible.

But when you’ve got three decades on your hands, you can take a loss on a few speculative penny stocks without batting an eye.

However, the closer you are to retirement age, the more important it is to take every possible precaution to protect your savings from losses.

That means investing only in the highest quality companies with impeccable track records.

So that’s exactly where we’ll begin in putting together our “private retirement fund”…

With a laser-guided focus on stocks that meet the two crucial “must-haves” for retirement investing…

Income and safety.

I dedicate the lion’s share of my work week to uncovering stocks that are a perfect fit for our private retirement fund…

Stocks that generate outsized income month after month and year after year…

And at the same time, are among the most profitable, dependable, and stable companies in the world… bar none.

Right now, I’m going to share the details behind five of my “best in breed” personal retirement fund picks.

These five stocks form a rock-solid foundation for decades upon decades of high and increasing income.

Let’s start with…

Stock #1:

Mother Nature’s “Little Helper”

No matter how advanced our world becomes in the years ahead, there are two critical things every human will need to survive:

- Clean drinking water

- Electricity

Now imagine a single company that’s a world-class leader in both…

And pays a dividend that’s more than four times the market average.

It’s not a fantasy. This company really exists.

It generates wind, solar, geothermal, and hydroelectric energy — over 2,000 megawatts, enough to power 1.6 million average homes…

Owns more than 1,200 miles of electrical transmission lines — enough to stretch from Chicago to Houston…

And on top of that, the company operates a series of water desalinization plants…

Turning 131 million gallons of seawater into fresh, clean, and safe drinking water… every day of the year.

When you consider the company’s raw materials — sunshine, wind, and salt water — are 100% free…

It’s not hard to understand how they’ve managed to increase dividends 15 times in the past five years…

Including back-to-back hikes in 2020 and 2021 during the height of the pandemic. How’s that for dependable and stable?

Until Mother Nature starts charging for her natural resources — I don’t see this upward dividend trend slowing down any time soon.

And when you consider you could lock in a healthy 6.7% dividend yield today and see it increase steadily well into your retirement…

You’ll see exactly why I’m so bullish on this stock.

Next up…

Stock #2:

A “Midstreamer” with a Rock-Solid Dividend

No matter what Elon Musk and his minions might tell you…

Gas-powered cars aren’t going away any time soon.

At the very least, not in our lifetime.

If you fueled up your car with gas this week, there’s a good chance this company made it possible…

Yet it’s not an oil or gas producer.

Remember… for your retirement fund, we’re all about stocks that deliver both income and safety.

So I won’t recommend an energy company whose profits can swing around wildly any time there’s…

- a hint of war somewhere in the world…

- a breakthrough in clean energy technology…

- or some kind of Wall Street shenanigans.

This company doesn’t pump or refine oil.

It also doesn’t sell oil or gas to end users.

In fact, it never owns or takes possession of any petroleum products.

Instead, it gets paid for storage and transportation services — the “midstream” part of the process.

One of the reasons I love this stock is the prices of its services stay pretty much rock-solid no matter how much a gallon of gas costs.

That gives the company almost complete isolation from the price gyrations of the oil market.

Even though every car manufacturer on the planet is launching an electric vehicle… gas isn’t going away.

That means there’s going to be a long-term need for top-tier midstream companies like this one.

And these guys are NOT a small player. In total, they own close to 12,000 miles of oil and gas pipelines connecting close to half of America’s oil refineries.

That’s allowed them to rake in just over $1 billion in 2022…

And based on my research, they’re ideally positioned to bring in at least another billion in 2023…

Making it an almost certainty they’ll raise their dividend payout yet again — something they’ve done 75 times (almost every 90 days) since going public in 2001.

Compare this spotless 20+ year track record to oil industry behemoths like Occidental Petroleum, Marathon Petroleum, or ConocoPhillips…

Companies whose dividends are sometimes less predictable than East Coast weather in the summer…

And you’ll have no trouble seeing why this “midstreamer” gets my highest recommendation.

At today’s price, the stock has a dividend yield just shy of 8% making it what could be the shining star of your private retirement fund.

Stock #3:

An Insurer with a Double-Digit Yield

As I mentioned a moment ago, all the stocks I’m showing you in this presentation are among the safest, most secure, and most dependable sources of retirement income you’ll find anywhere.

But the one I’m revealing now is a cut above them all.

This under-the-radar commercial insurance company raked in almost $9 billion in premiums in 2022…

And has maintained an ‘A’ (‘Excellent’) credit rating for…

110 years.

That’s not a typo.

To boot, they’re one of only four companies on planet Earth who can make that claim.

You may be wondering, “Okay, but what about their dividend payouts?”

Well, that’s where this outfit really shines…

Because it’s one of the few companies I’ve ever uncovered with a track record for delivering special dividends every few months… and not just a few pennies per share either.

For example…

Between June and November 2021, they dished out four special dividends totaling $24 per share.

A lucky strike? Think again…

Because in 2022, they gave investors three additional special “pay days” worth a combined $14.31 per share.

And all of those special payouts were on top of the company’s regular dividend that’s increased every year for the past 17… and grown by an astonishing 12% per year for over a decade.

This stock is a truly one-in-a-million opportunity…

And with an all-in yield of over 10% — you’ll want to lock down your shares before this company becomes a household name.

Stock #4:

A Global Shipper with a Gargantuan Profit Stream

Here’s something that comes close to blowing my mind…

As much as 90% of the world’s goods travel from where they’re manufactured to where they’re consumed… by ship.

That’s right… 90%!

And… no matter how you slice it, the global economy continues to grow.

Meaning every year — almost without fail — there are more goods being made, more people consuming them…

And a growing demand for shipping services.

If that’s not enough to get you interested in this opportunity… then maybe the fact that this company has one of the most profitable business models I’ve seen in any industry will…

They lease each cargo ship in their fleet out to shipping companies for up to $47,200 per day…

And get this… their cost to run them…

Is just $6,000 per day.

That translates to $41,200 in pure profit EVERY DAY.

And as much as $15 million in profit every year… PER SHIP.

Multiply that by 65 ships and you get a company that can pay you as much as $870 on every $10,000 invested.

So, having a shipping company like this in your private retirement fund is as close to a layup investment as you’re likely to ever see.

And that brings us to the final cornerstone of your SSI “independence plan” …

Stock #5:

A 65-Year Infrastructure Veteran

This unique company owns the largest fleet of natural gas compression equipment in the U. S. of A. and leases its equipment to gas producers and processors for fixed monthly fees.

And those fees stay the same for the entire length of the contract no matter what happens to the price of oil.

This stock is a rare breed…

A company that emerged from the COVID pandemic making more money than before shutdowns began.

How’s that for a “safe and secure” retirement investment?

Today, the stock is delivering investors a tremendous 6.78% dividend yield… making it another great addition to your private fund.

Let’s Get Started Right Away…

With Social Security on the verge of leaving tens of millions of American retirees high and dry, it’s more important than ever to take control of your retirement finances.

The five stocks I’ve just shown you are all it takes to bootstrap your own “freedom plan.”

There’s nothing to qualify for…

No complicated paperwork to file…

No need to continue working until a specific age…

And unlike SSI, you can literally pull money out of your account at your convenience — as much as you like… as often as you like.

But by far, the best part of this approach is…

As I sit to prepare this presentation, the combined dividends from the five stocks I’ve just shown you beat Social Security’s pitiful 0.18% per year gain by…

An incredible 3,818%.

Yes… you read that correctly.

That’s how much better YOU could do with your private retirement fund when compared to the “experts” at Social Security.

And given the direction that whole institution seems to be headed, there’s no better time for you to start your private fund than today.

To get the ball rolling …

I’ve boiled down everything you need to know about the five companies I’ve just shown you into easy-to-follow report called…

Social Security Insurance: How To Generate $32,522 Per Year Starting Tomorrow ($299 value)

And I want to put a copy in your hands today… absolutely free of charge.

Inside this exclusive report, I reveal:

Inside this exclusive report, I reveal:

- The massive financial “iceberg” the Social Security Administration has steered our country directly into.

- Two options the government has for “fixing” SSI… and how both of them are political death for the party that executes either one.

- The steps you must take immediately to protect yourself from Social Security’s demise and prepare your “private retirement fund.”

- Plus complete details on the five stocks picks I’ve revealed in this presentation including their names, ticker symbols, and my recommended “buy under” price (so you never pay too much).

This report contains all the details you need to get started quickly.

Heck, depending on when the report arrives…if you’re a fast reader, you could devour the report in less than half an hour and stake your claim in all five stocks today.

Imagine how amazing it will feel knowing you’ve “untethered” yourself and your family from relying solely on Social Security…

Because based on a starting portfolio of around $451,700 (the average portfolio size of members in my advisory), the information inside this report could easily position you to rake in as much as $32,522 every year well into retirement.

Income like that has potential to double or triple your annual Social Security payouts.

That makes it almost impossible to attach a dollar value to this report.

My publisher put a “suggested value” of $299 on it.

And when you weigh $299 against the tens of thousands it could generate for you every year…

I think you’ll agree, it’s worth far more than that.

The reality though is, this report isn’t available for sale anywhere or at any price.

YOU, however, can still have a copy in your hands today… absolutely free.

All you have to do is accept this invitation to join my premium investment advisory.

It’s called…

As the name suggests…

My advisory is 100% dedicated to uncovering the world’s most lucrative and safe income investments…

Investments designed to insulate you from Social Security’s “mess”…

Allowing you to transition into retirement stress-free…

Knowing you and your spouse are in a financial position to turn your retirement dreams into reality.

It’s vitally important for you to know…

As valuable as the five stocks I reveal inside Social Security Insurance: How To Generate $32,522 Per Year Starting Tomorrow are…

They’re just the tip of the iceberg.

At this very moment, I’m tracking close to 50 of what I consider the best income stocks on the planet…

Some with dividend yields of 11.3%… 12.7%… even as high as 14.7%…

Spanning every industry on the planet, including:

- Pharmaceutical & Healthcare

- Real Estate

- Energy

- Banking and Insurance

- Technology

Plus any other industry where I uncover the most-profitable and safe high-yield opportunities.

The moment you join High-Yield Investing, you’ll get access to every last one of them…

Plus every new high-yield opportunity I uncover for the next 12 months.

And like you might have gleaned from this presentation, I’m not the kind of guy who just throws you a bunch of ticker symbols and leaves you alone to figure out the details.

Instead, I’m with you every step of the way…

Showing you exactly what to buy…

When to buy…

And keeping you in the loop on any news or developments you can use to maximize your income.

Bottom line:

You’ll never be stuck wondering if you’re making the right move.

I’ve spent the past quarter century figuring out the smallest details…

All you have to do is follow my simple recommendations and let the income take care of itself.

Here’s everything you’ll get access to as a new High-Yield Investing member:

#1 — 12 Full Issues of High-Yield Investing

Every month for the coming year, I’ll deliver an exclusive briefing containing the safest and “juiciest” income opportunities you’ll find anywhere on the planet. These recommendations are truly best-in-breed — offering both outsized high-yield income and explosive growth potential. You’ll get new opportunities every month to see growing streams of cash flood your brokerage account… both today and for years to come.

#2 —Mid-Month Updates

Every two weeks, I’ll send you a brief but thorough update to keep you in-the-know about new profit opportunities or any important developments that might impact the high-yield stocks you own today.

#3 — Instant Priority Alerts

Any time the markets move in an unpredictable way, you’ll receive an instant action alert email containing precise instructions on any changes I recommend you take to maximize your wealth. I’ll never leave you hanging — wondering how to respond to unpredictable market moves. I’ve got your back!

#4 —Unrestricted Access to All My Research

The moment you join, my team will give you access to our private, password-protected members-only website. Inside, you’ll find over a decade’s worth of detailed investment analysis, research, model portfolios, special reports, and more. The gems you’ll discover in this “jewel box” could generate thousands in extra income for you this year. All of this is only a mouse click away and available to you 24/7.

#5 — Free Subscription to StreetAuthority Insider (An exclusive bonus for new members!)

This weekly bulletin gives you a peek at the market picks (and the experts behind them) that have made StreetAuthority one of the most respected publishers in the United States — yours absolutely free as a new member of the StreetAuthority family.

#6 — VIP Concierge Help Desk

During regular business hours Monday through Friday, my team of talented, US-based, customer support reps are available to handle any questions or issues you have on anything related to your membership. The moment you join, we’ll share this exclusive phone number with you and encourage you to use it any time you need to.

Ready to start your own “private retirement fund?”

Get started NOW!

At this point, you may be wondering what all of this costs.

Given that just one of the recommendations revealed inside Social Security Insurance: How To Generate $32,522 Per Year Starting Tomorrow, or from any of the stocks in my members-only model portfolio, could add thousands of dollars to your brokerage account every year for the next twenty (or more) years…

My publisher could easily justify slapping a $1,000 price tag on High-Yield Investing’s annual membership without losing a wink of sleep.

However, since leaving the “big banks” almost 20 years ago…

I’ve dedicated my career to working with everyday investors — people who can really use my help…

NOT the fat cat Wall Street “overlords” I used to work for.

Today, I want to remove the main financial barrier to signing up…

So good people like you can truly benefit from my work.

That’s why we’ve set the one-year membership fee at just $99.

When you consider everything you have access to the moment you join High-Yield Investing…

I’m almost certain you’ll agree… $99 is a sweetheart of a deal.

Even so…

The imminent implosion of Social Security is a crucial issue for all Americans…

And I want to get copies of Social Security Insurance: How To Generate $32,522 Per Year Starting Tomorrow into the hands of as many investors as I can in the days ahead.

So I’ve twisted my publisher’s arm (almost to the breaking point!) and made him to agree to a discount we may ever see again.

I’ll reveal the nitty-gritty on that in just a moment.

But first, let me show you a gift I’m going to send you when you join today…

BONUS REPORT: Bulletproof Buys: 5 Income Stocks to Own Forever ($49 value)

World-famous investor Warren Buffet likes to say his preferred holding period for any stock is “forever.” It’s one of the reasons his 1988 investment in Coca-Cola is today worth close to $24 billion.

Because it’s my goal to recommend stocks that dump cash into your brokerage account year after year without you having you having to lift a finger or make any rash decisions… I tend to agree with Buffet’s “forever” attitude.

Because it’s my goal to recommend stocks that dump cash into your brokerage account year after year without you having you having to lift a finger or make any rash decisions… I tend to agree with Buffet’s “forever” attitude.

Inside this exclusive report, I reveal:

- The four critical “North Star” criteria I use to pinpoint the most profitable stock investments for retirees… and soon-to-be retirees.

- Why it’s critical for a company to develop a “wide economic moat” and how it can have a profound effect on your retirement lifestyle.

- Five truly exceptional stocks with potential to generate wealth for you and your loved ones… basically “forever.” (Number 2 might surprise you!)

I value this report at $49… but once you’ve spent five minutes with it, you’ll instantly see why it’s worth more than 10 times that amount.

All totaled, the combined value of everything you’ll receive as a new High-Yield Investing member is $447.

Factor in how just one or two of the recommendations I deliver to you over the next 12 months could easily change your financial trajectory for the rest of your life…

And you’ll begin to understand exactly why High-Yield Investing members take time out of their busy lives to send me notes like these…

It goes without saying… these results are exceptional and I can’t guarantee yours will be similar.

But even if your gains are a small fraction of what these folks have seen, you could still be ahead on your $99 membership by a factor of 100X… maybe even 1,000X.

However, as I mentioned just a moment ago, I’ve strong-armed my publisher into an unheard of 60% discount off the regular fee. Meaning…

When you become a High-Yield Investing member today, you’ll get your first year…

For just $39.

That’s not a typo.

Your entire 12-month membership ($99 value)…

Your special report, Social Security Insurance: How To Generate $32,522 Per Year Starting Tomorrow ($299 value)…

Plus your exclusive bonus report… Bulletproof Buys: 5 Income Stocks to Own Forever ($49 value)…

A $447 value… all for just $39.

Plus, when you click through to the next page, I’ll show you how to get your hands on three additional not-for-sale-anywhere wealth building reports, including…

BONUS REPORT #2: Monthly Money Makers: How to Collect More Income Every Month of the Year ($49 value)

There’s nothing quite like the feeling of collecting a dividend payout. It’s almost like getting a paycheck… but without having to get up early, shower, and commute to an office.

There’s nothing quite like the feeling of collecting a dividend payout. It’s almost like getting a paycheck… but without having to get up early, shower, and commute to an office.

And if a quarterly dividend check is great… a monthly check is flat-out wonderful.

In this report, I reveal my 12 top monthly dividend-paying stocks…

What makes each worthy of “making the list” …

Plus, how to package them together and beat your bank’s CD rates by a factor of 10X or more.

As always, each of the 12 stocks is a best-in-breed investment with a focus on outsized income and rock-solid safety.

This report has a suggested value of $49. But a single month’s worth of dividends from any one of the stocks you’ll find inside could easily make you wonder why I don’t sell it for $490 (or more).

BONUS REPORT #3: 3 High-Yield REITs With Recession-Proof Dividends ($49 value)

Andrew Carnegie — steel industry giant and one of the richest Americans in history — once said:

“Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined.”

“Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined.”

That statement is as true today as it was in Carnegie’s day.

Inside this easy-to-read briefing, you’ll find everything you need to start collecting income from real estate — almost immediately — without any of the headaches and heartaches of being a landlord yourself.

I’ve analyzed hundreds of real estate investments and reveal my three top picks (the best-of-the-best) inside this report. Plus, the simple steps you can take to lock in your shares right away.

BONUS REPORT #4: 3 “Private Banks” Averaging 7% Yields ($49 value)

Have you ever wondered if there was a way to invest in the next Facebook, Airbnb, or WhatsApp… BEFORE it goes public?

To rake in the kind of cash Silicon Valley venture capital funds see on a regular basis?

To rake in the kind of cash Silicon Valley venture capital funds see on a regular basis?

For a long time, that was pretty much impossible — unless you were already a millionaire. But things have changed…

In this report, I disclose three unique stocks that allow everyday investors to get a cut of the action on private companies long before the general public knows they exist.

I’ll show you exactly how to grab these three exclusive bonuses when you click through to the next page.

There is one small catch to the opportunity I’ve laid out for you today.

With an offer tilted so heavily in your favor, I can’t promise my how long my publisher will let folks join…

So I wouldn’t risk waiting.

Especially when you know this presentation was sent to 10s of thousands of income-hungry investors.

There’s really no good that can come from waiting…

Especially when you remember every day you wait to start your private retirement fund means potentially less money in your pocket.

So, click here right now to lock in your discounted High-Yield Investing membership.

And if, for any reason, you’re still on the fence…

Let me remove every last trace of financial risk with my…

Double-Barreled 100% Satisfaction Guarantee

This isn’t a 10-page legal agreement with a ton of loopholes that give me an easy way out.

Instead this is how it works:

Take 90 days to check out everything your membership has to offer…

That’s three full months to review your special report and bonuses, add a few of my stock recommendations to your portfolio…

Maybe even see the first few divided checks show up in your account.

During that period, if you see anything about High-Yield Investing you don’t like…

And I mean anything…

Make a quick call to my VIP Concierge Desk and I’ll return every last penny of your membership fee — no questions asked.

The bottom line is if you’re not happy… I’m not happy.

And I will not keep your money unless you’re 100% satisfied.

But I don’t stop there, because…

Even after 90 days have passed, I’ve still got your back.

If, at any point during your membership term, you decide you don’t love the wealth-building opportunities, research, and communication my team and I deliver…

Once again, a quick phone call to my Concierge Desk is all it takes and I’ll give you a refund for the unused portion of your subscription.

On top of that, you’re welcome to keep any and all free reports, bonuses, and monthly briefings you received during your membership.

Think of them as my way of saying “thank you” for trying us out.

However, I’m confident you’re going to love your High-Yield Investing membership so much…

You’ll never dream of pulling the trigger on this guarantee.

The important thing is you can join today knowing I stand fully behind my work….

And will go above and beyond to make sure you’re satisfied.

The Next Move Is Yours…

Throughout this presentation, I’ve done my best to show you the immense wealth and security you could build by becoming a High-Yield Investing member.

But right now, you have a decision to make — you can march down one of two paths:

Path #1: Close this page and go back to life as usual.

If you already have enough money to fund your retirement and don’t care about your Social Security payouts getting smaller and smaller with each passing year…

Frankly, you’ll likely be fine… you probably don’t need High-Yield Investing.

However, if you’re like the tens of millions of Americans on the verge of getting shafted by Social Security…

And could use a few extra thousand dollars in your retirement account… I encourage you to consider:

Path #2: Take charge of your finances today and take High-Yield Investing for a risk-free test drive.

The news about Social Security’s “depletion” proves the rumors that have been circulating for almost a decade.

Uncle Sam DOES NOT have your back…

And the government IS NOT going to take care of you during your golden years.

As much as I hate to say it…

It’s solely up to you to take control of your retirement finances…

To ensure you and your spouse are NOT struggling to make ends meet…

And instead enjoying the stress-free luxury retirement of your dreams.

I created High-Yield Investing to make all of this a reality for you.

And for as little as $39…

Plus, with an iron-clad money-back guarantee in your back pocket…

There’s virtually no way you can go wrong by joining right now.

There it is… Path #1 or Path #2…

What’s it going to be?

I respect whichever path you choose…

But you need to decide quickly.

This presentation is going out to tens of thousands of investors.

And my publisher could raise the price back to $99 at any moment.

Don’t let that happen… click the button below and lock in your 60% discount right away.

[button_1 text=”Yes%2C%20I%20Want%20In!!!” text_size=”32″ text_color=”#ffffff” text_font=”Tahoma;default” text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”N” text_shadow_panel=”Y” text_shadow_vertical=”1″ text_shadow_horizontal=”0″ text_shadow_color=”#ffffff” text_shadow_blur=”0″ styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#0d64a9″ styling_gradient_end_color=”#3d5a9d” drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#ffff00″ inset_shadow_opacity=”50″ align=”center” href=”/olp-sahyi-lie”/]

I look forward to welcoming you as a new member very soon.

To your wealth,

Nathan Slaughter

Chief Investment Strategist

High-Yield Investing

Copyright © 2023 StreetAuthority, a division of Capitol Information Group, Inc. In order to ensure that you are utilizing the provided information and products appropriately, please review StreetAuthority’s terms and conditions and privacy policy pages.