To: Maximum Profit subscriber

Sent: Thursday, January 5, 2023

Stocks performed terribly last year — the worst year since 2008.

That’s not news to anyone.

What I haven’t seen talked about, however, is the breakdown between stocks and gold…

Last year, we had inflation reach 40-year highs. We had Russia invade Ukraine and nearly kick off World War III. We had the near-unanimous consensus that we were or would be entering a recession.

Historically, gold prices soar with that sort of backdrop.

Instead, gold ended 2022 pretty much flat. In other words, it didn’t go anywhere.

This is a surprise. It potentially spells a breakdown in the historical relationship between gold and certain macro factors. Gold is typically seen as a “safe haven” when there’s uncertainty in the air. And last year, we had nimbostratus clouds hovering above us.

If gold couldn’t rally through record inflation and global conflict, when will it?

Some believe that gold has fallen to the wayside because it’s not coveted by the younger generation — namely Millennials — like it is with older generations. I’ve seen some calling for gold to collapse by double digits this year.

Now, this newsletter is not in the predictions game. Gold could certainly end the year down. But right now, my Maximum Profit system is saying the exact opposite.

The Stealth Rally In Gold

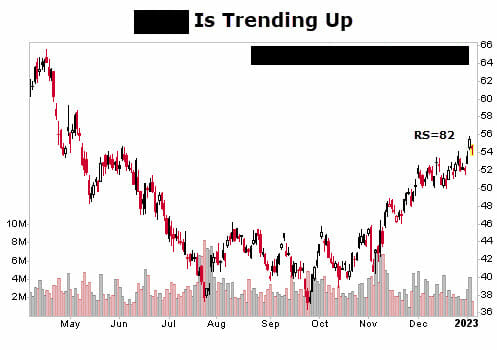

We know that gold — and gold miners — didn’t have a spectacular year last year. We already covered that. But since its September lows, gold has been on a strong stealth rally. Just look at the VanEck Gold Miners ETF (NYSE: GDX) — a collection of gold miners:

As you can see, gold miners are up a staggering 40% since the end of September. Is this the start of something bigger? Only time will tell. But my system flagged a gold miner this week as a “Buy.”

However, before I get to this week’s picks, I want to drive the gold thesis home a bit. I’ll show you the startling similarities between stocks and gold...

What History Tells Us About Gold’s Potential

We all like to relate current times in the market to previous times. It helps us explain and clarify what’s happening and what might happen. Of course, no two times are the same. But as Mark Twain is credited with saying, “History never repeats itself, but it does often rhyme.”

With the collapse in tech stocks, we are seeing a lot of references to the 2000-2001 dot-com bubble. So, let’s roll with it…

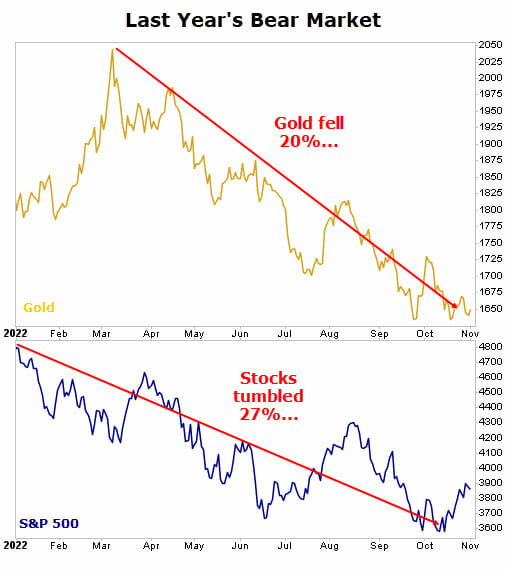

In March 2000, the S&P 500 peaked. Roughly one year later, it was down 27%. Gold peaked in February 2000 and tumbled 20% over the following 14 months.

Fast-forward to the present day. Stocks peaked in January 2022, and at their bottom in October 2022, the market was down 27%. The price of gold peaked in March 2022, and by October, it was down 20%…

I’m not sure about you, but outside of being a couple months off, that is pretty darn close to the present day’s action.

Now, if history is about to “rhyme,” then what I’m about to show you will be shocking. Even I had to lower my standup desk and sit down for this one…

One hint. Good for gold. Bad for stocks.

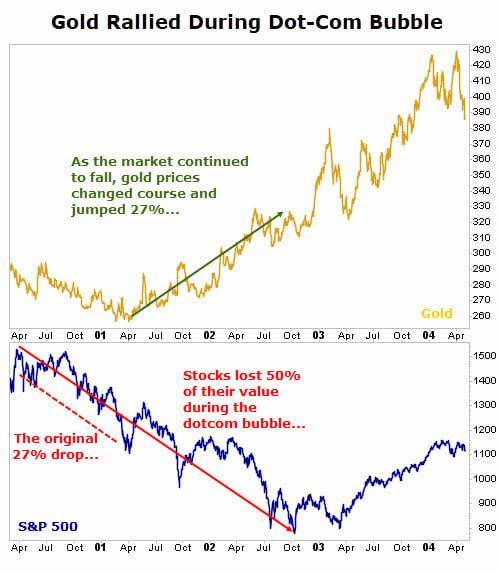

During the dot-com bubble, stocks went on to fall even further. From their peak in March 2000 to the bottom in October 2002 — 2.5 years later — stocks lost 50% of their value.

But gold prices bottomed at that April 2001 low and rallied 27% as stocks continued to find their bottom.

Yes, I realize 27% isn’t exactly a life-changing return. But this is the price of physical gold we are talking about. I’m not recommending going out and buying a bar of gold.

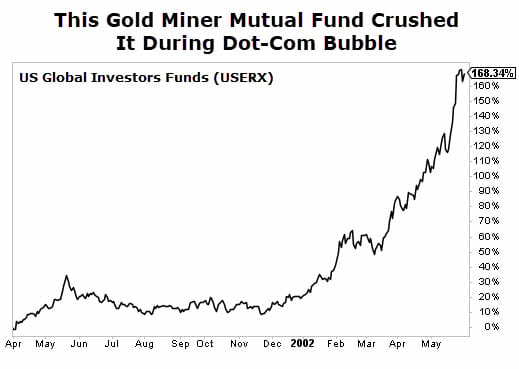

You see, when the price of physical gold climbs, that rally is amplified in gold mining stocks. Unfortunately, ETFs were still in their infancy during the dot-com bubble. The first gold ETF came out in 2004. But mutual funds have been around forever, so I can still show you how that 27% rally in gold prices translated into miners.

Remember, gold did well compared to the stock market: 27% versus a 50% loss. But the US Global Investors Funds US Gold (USERX) returned an incredible 168%.

Now that’s a helluva return. Imagine back then when people were betting big on risky internet startup companies that made no money and lost a bunch of money (sounds familiar).

And here you are more than doubling your money.

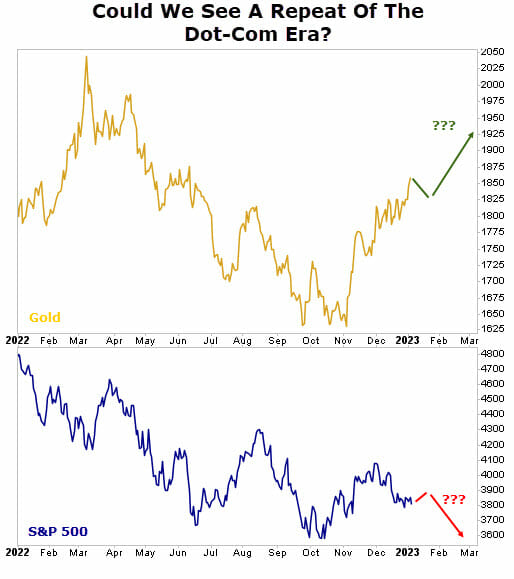

I want to show you one more time where we are today with this relationship between gold and stocks.

I have no idea what will happen with stocks and gold. But if one wants to draw similarities to the dot-com bubble and today… well, I can certainly see them.

In the end, what really matters is that we follow the momentum. Right now, there’s a stealth bull market in gold and gold miners that my system has detected. If it turns out to be nothing, we will cut our losses and move on. But if history does indeed rhyme, then we could be in for some massive gains…

This Week’s Picks

International Portfolio

Buy: Our first trade of 2023 will be gold miner confidential confidential confidential confidential. Its operating mines are located in Canada, Finland, and Mexico, with exploration activities in each of these countries as well as the United States and Colombia.

Confidential is one of the premier gold miners in the world. It boasts mines with some of the highest-quality gold around. On top of that, it doesn’t cost the company a ton to pull this gold out of the ground. This gives confidential some of the highest margins in the industry.

Understanding Gold Miners

Now, miners are a slightly different animal than what you might find from a more “traditional” company like Apple or Amazon. Miners don’t exactly have a say in how much they can sell their product (gold) for. They’re at the mercy of the spot price of gold.

On top of that, it’s not cheap to mine for anything. You have to build the facilities, usually located in remote areas, then purchase equipment, all of which can quickly add up. And this is all before they can mine a single ounce of gold, which they can sell to cover costs and hopefully have some money leftover.

And let’s not forget that what they produce will eventually run out after all this. So they need to continue finding and developing other gold or precious metal deposits.

But if we keep things simple, we can easily understand what makes a good mining company. They need to get the gold out of the ground for cheaper than what they sell it for.

Fortunately, we don’t have to do much work to figure this out, as the mining companies do all the calculations for us. They boil it down to a key metric called “AISC,” or “all-in sustaining costs.” This tells us exactly what it costs for a mining company to produce one ounce of gold.

Obviously, the production costs need to be less than the price of gold. The wider the discrepancy between AISC and gold prices, the more profitable the company is.

In the company’s most recent filings (third quarter 2022), its AISC was $1,106 per ounce. This is in line what the company’s historical track record.

Compared to some of its peers, confidential is among the most efficient gold producers in the world.

The current price of gold sits close to $2,000 per ounce. That leaves plenty of cushion (profit) for confidential and its investors.

Important Numbers

confidential is a high-quality gold miner. Although I should note that the mining company does generate sales from silver, zinc, and copper. But its bread and butter is gold. It accounts for 97% of total sales, nearly $4.8 billion in 2021. That figure is expected to check in at over $7.9 billion for 2022, representing a 65% sales jump.

Looking at our favorite metric — cash flow — the story is the same. In 2021, the company generated over $1.6 billion in cash from operations. It is on track to bring in over $3 billion in 2022. That’s some nice growth.

I should note that the company is shareholder friendly. This isn’t something we track super closely since we are here for capital appreciation, but it is worth mentioning that this gold miner has paid a cash dividend every year since 1983.

The Chart

2022 wasn’t a remarkable year for confidential. But shares have been building momentum and are looking to retake their highs set last April. As you can see in the chart below, after trading sideways for much of late summer/fall, shares finally broke out and have been steadily climbing.

Risks to Consider: Gold, and gold miners, can be fickle. Much like energy stocks, they can and will swing wildly. Shares will be sensitive to the price of gold, so if the price of gold retreats, investors will likely bail on miners as well.

Action to Take: confidential comes in with a relative strength rating of 82, a cash flow relative strength rating of 75, and a Maximum Profit score of 79. I will add confidential to my International portfolio on Friday, January 6.

I will use a 15% trailing stop loss with this trade instead of the usual 12% for all other trades in the portfolio.

Small Cap Opportunities

Buy: Our next gold trade is a company called confidential out of South Africa. Obviously, this pick qualifies for our International portfolio, but because it has a market capitalization of just $680 million, I found it more fitting to put it in with the small caps.

Despite having gold in its name, confidential has transitioned away from traditional underground or open-pit gold mining. Instead, the company extracts gold from surface tailings. Tailings are a byproduct of mining. They are typically stored in large, man-made ponds or impoundments, or in large piles or mounds on the ground surface.

The storage of tailings has always been a thorn in a mining company’s side because they can be an environmental concern. Tailings typically contain hazardous substances that can leach into the soil and water if not properly managed. Management and disposal of tailings is heavily regulated by various environmental laws and regulations.

confidential saw this giant problem and is helping solve it. Its Ergo gold recovery plant in South Africa is arguably the world’s largest gold surface tailings retreatment facility. It has another operation, confidential, located west of Johannesburg.

The company has a partnership with confidential confidential -- another gold producer out of South Africa -- to process its mine tailings. Then it also processes the tailings from the former gold mine, President Brand gold mine.

Its operations generated $336.3 million in sales during the fiscal year 2022, which runs from June to June each year. Cash flow for the year checked in at $98.4 million.

Outside of the surge in gold prices helping fuel the stock’s ascent, I believe investors have jumped into this stock for its dividend. The stock currently yields 4.4% and has paid out a dividend for 15 consecutive years.

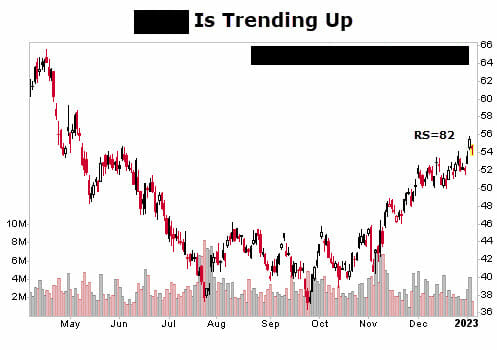

As you can see in the chart below, the stock has entered a nice uptrend:

Risks to Consider: Gold prices and future partnerships with mines will be driving factors in this company’s performance. If it can’t partner with other mines to process their tailings, that will surely impact sales and profits.

Action to Take: The stock comes in with a relative strength rating of 91, a cash flow relative strength rating of 88, and a Maximum Profit score of 90. I will add confidential to my Small Cap portfolio on Friday, January 6.

I will use a 15% trailing stop loss with this trade instead of the usual 12% for all other trades in the portfolio.

Jimmy Butts is the Chief Investment Strategist for Maximum Profit.

Jimmy Butts is the Chief Investment Strategist for Maximum Profit.