[vertical_spacing height=”2″]

Ex-Wall Street Insider Makes Stunning Prediction…

“It’s Going To Be A Feeding Frenzy!”

The World’s Wealthiest Companies Are Bursting With TRILLIONS In Excess Cash…

- Apple: $196 Billion…

- Meta (Facebook): $68.2 Billion…

- United Health: $45 Billion…

- Oracle: $38.5 Billion…

- Plus hundreds more…

- Google: $157 Billion…

- Microsoft: $153 Billion…

- Chevron: $44.5 Billion…

- Ford: $33.5 Billion…

…And They’re About To Unleash It Onto Wall Street. Take Advantage Of The Coming Chaos To Lock In Your Shot At Profits Up To $7,236… $10,200… $21,077 (Or More)!

Fellow Profit Seeker,

The world’s wealthiest companies have a serious problem…

They’re DROWNING!!!

Not in debt…

Not in crippling regulations…

But in cold, hard, CASH!

A $6.84 TRILLION dollar (and growing) pile of it, to be exact.

Yes… believe it or not, in this economic and political environment, a mountain of cash is a massive liability for hundreds of large companies.

But I’m confident this cash problem and — more importantly — what they’re going to do solve it…

Could send one group of stocks soaring!

And investors holding these stocks could see profits up to $7,236… $10,200… $21,077… or more!

I call these incredible events “profit shocks”…

They’re the sudden, and often extremely profitable, upward surges in stock prices when a unique event tears into the market.

They can be caused by anything from major news events to new product releases, to earnings reports…

But there’s one specific “profit shock” that stands head and shoulders above the rest in my book…

This event has the potential to hand everyday investors shot after shot at REAL, life-changing windfalls… IF they know where to look.

Stick with me for just a few minutes and I’ll show you just how profitable these events can be… as well as why these companies having hundreds of billions of dollars in idle money is a HUGE problem.

But first, it’s important you understand the scale of this massive cash headache.

Even better, I’ll show you how to turn THEIR problem into YOUR shot at a massive profit opportunity…

An opportunity that could transform even a tiny $5,000 stake into as much as $21,077 (or more).

At this moment, it’s estimated that as much as $6,840,000,000,000 is just sitting in these mega-corps accounts and tax safe-havens.

Three of these companies alone — Apple, Microsoft, and Google — are squatting on over half a trillion dollars between them.

Jamie Dimon, the CEO of JP Morgan, the largest investment bank in the world, claims his company is sitting on another $500 billion… IN CASH.

In fact, some companies are sitting on so much money they’re running out of places to stuff it…

Think about that for a minute…

The Wall Street Journal says that banks, an industry in which cash and deposits are the lifeblood of their business, are asking companies to either spend their money… or stop giving it to them.

This isn’t a good sign.

In fact, it’s unsustainable…

You see, it’s not just that the world’s wealthiest companies are running out of places to stash their cash…

Or that they don’t want a stockpile of money as a safety blanket or “rainy day” fund…

And this isn’t just a cash storage problem…

If they don’t get rid of this cash quickly… it’s going to get taken from them.

Banks turning away deposits should be viewed as a warning sign that something is seriously wrong in the financial system.

A decade of low-interest rates and easy access to money has flooded the economy with cash…

And it unleashed something else that’s coming for that $6.84 billion stockpile… runaway inflation.

When the money supply increases, but the number of products (or assets) doesn’t increase with it, the prices of those products skyrockets.

And the worst part is that inflation creeps up so slowly… you and I don’t typically feel the immediate effects.

But it’s always there…

Constantly eating away at the value of your money nibble by nibble… bite by bite.

That’s how this “silent cash killer” works.

As I said, most of the time you and I don’t notice when prices on goods and services climb a nickel or dime here and there.

That’s inflation doing what it does best.

But the fact remains, your dollars are worth less and less every day because of inflation.

That $100 bill you had in your pocket just twenty years ago will only get you around $62.03 worth of goods and services today.

Nearly half of the value just disappeared… in a puff of smoke.

That’s the destructive power of inflation for regular people like you or me.

And it can be nearly impossible to escape for wealthy companies sitting on HUNDREDS of BILLIONS of dollars in excess cash.

Inflation is eating away at every penny.

And its appetite is only going to grow…

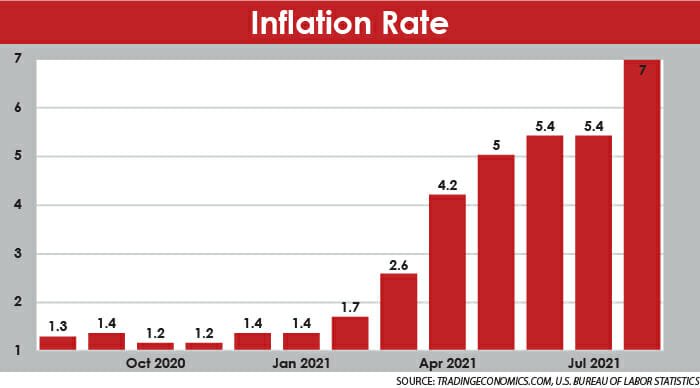

The annual inflation rate recently surged above 7%…

The highest we’ve seen in 40 years.

To put that in perspective, less than two years ago the annual inflation rate was just 1.3%…

Going back even further to a “normal” year like 2019, before the pandemic lockdowns put the economy into a tailspin…

Inflation was only 2.3%.

Right now, we are more than TRIPLE that.

Across the board, the cost of products and services we buy every day are rising at an alarming rate…

- Fruits and vegetables… 2.2%

- Shelter… 2.8%

- Hospital services… 2.8%

- Clothing… 4.2%

- Meat, poultry, and eggs… 5.9%

- New vehicles… 6.4%

- Gasoline… 41.8%

And while rising inflation might be causing some pain at the grocery store and gas pump for you and me…

It’s absolutely destroying BILLIONS of dollars that these wealthy companies have in cash stockpiles.

At a 7% annual inflation rate…

Apple gets a $13,720,000,000 billion dollar bite taken out of its $196 billion stockpile every year…

Microsoft bleeds out $10,710,000,000…

Google suffers from a $10,990,000,000 loss… every single year.

While consumers rarely feel the full weight of inflation in their wallets… it hits these giant companies like a freight train…

Even a “small” $100 million dollar stockpile of cash in 2019 is worth only $92 million today.

That’s an $8 MILLION dollar loss in just two years.

This inflationary pain is being felt by companies in every industry…

No sector is safe.

Hundreds of cash-heavy companies sitting on billions of dollars are watching helplessly as their costs skyrocket and the value of their cash piles plummet.

If they don’t do something with all this money — and do it fast…

Inflation will destroy it.

Play your cards right… and their pain could turn into windfall profits for you.

Just like you and I, the world’s wealthiest companies need to put their money into assets and investments that deliver a return higher than what inflation carves away.

Take Advantage Of the Coming Wall Street Feeding Frenzy To Lock In Your Shot At $21,077 (Or More)!

How will the world’s wealthiest companies offload this massive cash stash?

The answer couldn’t be simpler… corporate buyouts!

And these companies will go to the same place you and I do when we need investments that outpace inflation… Wall Street.

However, they’re not picking up a few shares… they’re buying out ENTIRE companies

Needless to say, making this move doesn’t come cheap…

The company doing the buying is often forced to pay a hefty premium to acquire them.

Savvy investors know this…

Which is why just the word of a major Wall Street buyout — even when it’s nothing more than a rumor…

Is often enough to cause a stampede as everyday investors scramble to buy shares of the company being bought out.

This mad dash sends the stock price screaming higher…

Potentially delivering 2X… 3X… sometimes 11X returns (or more)… in a matter of weeks.

The fast-paced nature and extreme price spikes are exactly why I call these corporate buyouts “profit shocks.”

I’ve spent years spotting and taking advantage of events just like these.

But I’ve NEVER seen anything like what’s happening today.

There’s something else lurking out there in the market — in addition to inflation — that’s eyeing up this $6.84 TRILLION dollar mountain of cash…

And what happens next will only accelerate the speed at which these ultra-wealthy companies will start targeting buyouts.

Specifically, I’m talking about skyrocketing government taxes on corporations.

I believe out-of-control inflation combined with skyrocketing corporate taxes…

Will practically FORCE the world’s wealthiest companies to finally put their massive “war chests” to use…

Which means we could be just days away from an eruption of these buyout opportunities, each with the potential to hand investors payouts up to $7,236… $14,471… even $21,077 or more.

Thanks to what I believe is…

The Best Way to Profit From The

Biggest Legal Cash Grab On The Planet

Unfortunately, taxes are a fact of life, regardless of which political party you support.

Sometimes they go up… and amazingly, once in a blue moon, they go down.

Regardless of which side of the political aisle you sit on, we can all agree that at the end of the day, roads have to be fixed, bridges built, national defense secured, and Social Security and Medicare need funding.

And that money, trillions of dollars of it, has to come from somewhere.

But politicians are clearly aware that raising income taxes on everyday Americans is a death sentence for their re-election campaigns.

Which is why you’re now seeing “alternative” policy funding options being pushed in the media…

A recent quote in the Associated Press clearly sums up the aim of these new policies…

The message is clear: the government is eyeing up these record corporate profits and piles of cash…

But their problem is quickly becoming your opportunity for profit.

And a chance for you to finally turn the tables in your favor and build a life of real financial freedom.

These companies know what they have… and they’re not about to let all that money slip through their fingers.

They’re going to invest it where they can get the best return…

By buying, acquiring, or merging with other companies.

Like “blood in the water,”

this corporate cash pile could ignite a

feeding frenzy in the markets…

I expect we’ll soon see the world’s wealthiest companies scrambling to get TRILLIONS of dollars off their books by scooping up prime buyout opportunities.

But offloading hundreds of billions of dollars to escape that pain is not the only reason a company will buy out another.

Often, they just need to prove to investors that they’re still growing.

In most cases, it’s easier for a small $1.00 company to go to $10.00…

Than it is for a $100 company to go to $1,000.

So larger companies have three options…

Partner with another company… build new products… or buy out somebody else’s.

But partnering with a competitor doesn’t always make sense when their customers have different needs and core values.

And it takes years of R&D, building supply chains, and manufacturing to bring a new untested product to market….

That’s time that these companies, frankly, can’t afford to waste.

So that leaves one solution…

Buy out somebody else’s tested, market-proven products.

Often it’s a direct competitor.

To continue growing its market share, Apple has acquired over 23 companies in the last four years alone.

Spending hundreds of millions on individual takeover opportunities like…

- $400,000,000 for Shazam when Apple wanted to get into the music streaming sector…

- $100,000,000 for NextVR when they wanted to get a foothold in the virtual reality market…

- $600,000,000 for Dialog Semiconductor when it was in search of a secure source of integrated circuits for its electronics…

- $200,000,000 for Xnor.ai allowed Apple to expand into the new field of artificial intelligence…

- $100,000,000 for Mobeewave when the company wanted the software to turn their line of mobile devices into digital cash registers without needing additional hardware…

- And there are dozens more, dating all the way back to 1988…

In July 2019, Apple shelled out over $1 BILLION to acquire Intel’s smartphone modem business… and that’s not even their largest acquisition.

Back in 2014 the company paid over $3 billion to acquire headphone manufacturer, Beats Electronics.

Regardless of whether you call it a buyout, a merger, or an acquisition…

There’s no denying that there’s simply nothing else like them on Wall Street.

I can’t think of any other type of market event that creates the opportunity to rake in so much wealth in such a short amount of time…

Than a Wall Street buyout.

Unfortunately, for main street investors, most buyouts and takeovers happen behind closed doors. By the time news hits the headlines it’s often already too late to make a move…

But I’ve developed a strategy that pinpoints takeover trade opportunities that anyone can take part in. No inside connections needed.

Just like it did when buyout rumors handed investors the chance to rake in multiple double and triple-digit returns like a 44.71% on ridesharing company LYFT…

Or a 127% return on American freight transportation company XPO Logistics…

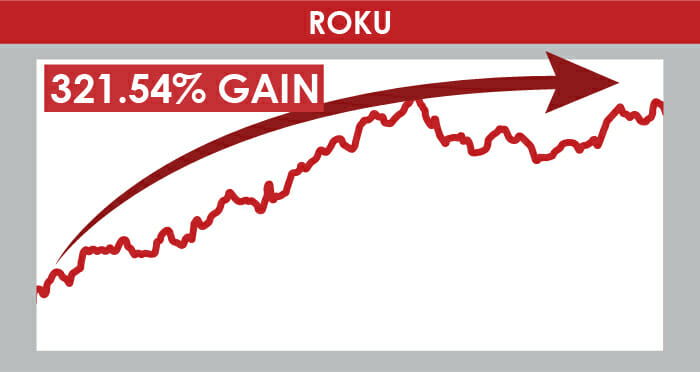

Even a wallet stuffing 321.54% return on streaming media provider ROKU…

The most interesting part about this Roku Trade… the “profit shock” that triggered its insane surge was based on “rumors.”

You heard right… a simple rumor of a buyout was all it took to send Wall Street into a frenzy.

In fact, just after I issued that Roku trade alert… the media “rumor mill” went into overdrive, claiming Google or someone else was about to buy out ROKU…

Including Variety on June 17th, 2020…

Yahoo News on June 22nd, 2020…

Even as far back as October 2018, Barron’s fanned the flames of a Roku buyout rumor…

But even as I write to you today, years later…

Roku still hasn’t been bought out. And I’m completely OK with that.

Especially when “rumor” based returns are enough to turn a $5,000 investment into $7,235… $11,323… or even $21,077 in a matter of weeks.

We’re seeing the first few bites of a potential $6.84 trillion dollar feeding frenzy as the world’s wealthiest companies begin devouring these smaller companies.

Get Ready…

The Buyout Feeding Frenzy

Is About to Begin…

One after another, we could start seeing some stocks skyrocket, delivering double… triple… even quadruple-digit profits over the course of a few weeks.

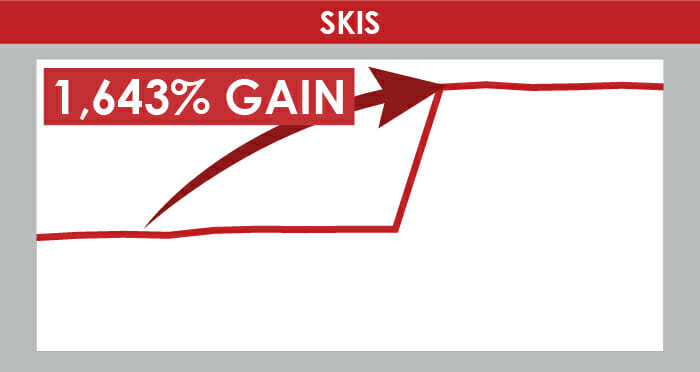

Just like when the ski resort company Peak Resorts was acquired and handed investors in Peak the chance to bank a 1,643% gain… in 20 days.

17X your money in 3 weeks sounds pretty good, right?

But the profits from these corporate buyouts can get even better.

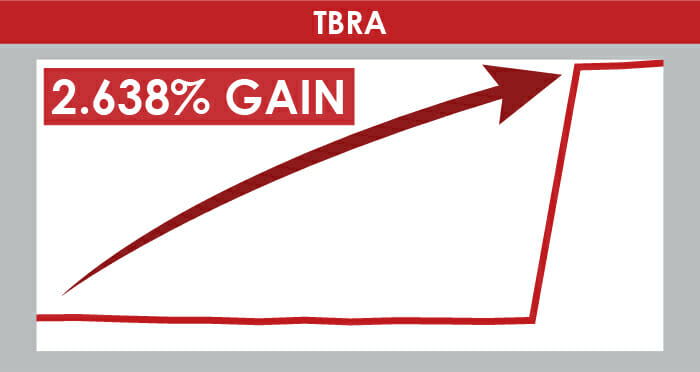

Like when news got out that the biotech company Tobira Therapeutics was getting acquired…

Handing investors the chance to pocket up to 2,638% in just 21 days.

And while that “profit shot” is impressive… it’s nowhere near the top.

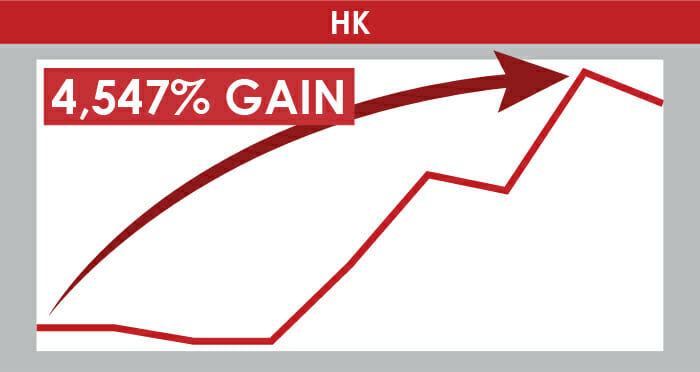

Just look at what happened with the oil company Petrohawk.

When word got out that it was being acquired…

Investors could have banked a massive 4,547% gain… in 13 days.

Think about that — you could have cashed out $45,471 for every $1,000 invested.

Or up to $227,353 for every $5,000 you put in… in just under two weeks!

All thanks to a single corporate buyout opportunity

Now, to be clear, I can’t promise that the gains from the next takeover will go as high as these examples (or that you’ll cash out with a winner every time following my work)…

It’s true what they say…

Nothing in investing is guaranteed… and you should never risk more than you’re willing to part with.

But if played right… a string of these trades could consolidate YEARS of gains into months.

Allowing everyday investors like YOU the potential to “leap-frog” decades of investing time into financially secure retirement, years ahead of schedule.

This isn’t your standard strategy of buy… hold… and hope for the best.

The goal of my strategy is “buy, hold for a few weeks, then sell so you can start planning your next big vacation.”

And if you want to get your share of the multi-trillion dollar buyout bonanza I see coming down the pike you need to …

Lock In Your Shot at Maximum Profits TODAY: Make ONE SIMPLE MOVE Before the Feeding Frenzy Goes Into Full Effect…

In order to cash in and get your share of the enormous amount of money I believe we’ll soon see flowing into the markets, you’ll need to know…

Where they’re putting their trillions in cash to use…

Which stocks are prime buyout targets…

When to make your move and scoop up shares BEFORE everybody else…

What price target you need to get in at…

And — most importantly — when to cash out and take your profits.

I’ll show you exactly how to get access to all those action points in a minute…

First… I think it’s only fair to introduce myself.

An Unconventional Strategist Delivering Uncommon Profit Opportunities To You…

My name is Nathan Slaughter.

My name is Nathan Slaughter.

I am the Chief Investment Strategist at Takeover Trader, a unique investment advisory dedicated to uncovering high-profit takeover opportunities in the markets.

Years ago, I walked away from a career that most people in the financial industry would consider a “dream job.”

I’m not exaggerating here…

I’ve worked for some of the most elite investment firms on Wall Street including AXA/Equitable Advisors and Morgan Keenan.

I was there, front and center, during the devastating “dot-com” crash and the Global Financial Crisis of 2008…

And let me say this…

Unlike many hardworking Americans, most wealthy people became even wealthier during each of these chaotic periods.

It’s a testament to the nature of money and power on Wall Street. The rich get richer in times of financial chaos…

And I helped them navigate it.

But I was spending nearly a hundred hours a week just to add another comma to the net worth of some fat cat who likely wouldn’t even notice… let alone appreciate it.

And that’s one of the reasons I turned my back on Wall Street.

Unlike most of my former clients, I didn’t come from money.

(And it was painfully obvious that they did.)

Now believe me when I say that nothing — and I mean absolutely nothing — has been handed to me in life.

I was born in the bayous of Louisiana, the second poorest state in the country.

I was raised to appreciate the opportunity to work hard for a living.

And if I hadn’t been exposed to the true inner workings of Wall Street…

I never would have honed the skills that now allow me to spot, analyze, and ultimately “exploit” the accelerated wealth-growing opportunities available to everyday investors just like you.

And while I may have walked away from Wall Street over two decades ago…

I never got out of the “investing game.”

Instead, I now help hundreds of regular investors take advantage of the same type of profit opportunities once reserved for wealthy Wall Street elites.

Profit opportunities like the one I spotted playing out with Twilio (TWLO).

On September 16th, 2020, my system alerted me that the communication software developer was showing all the signs that a potential buyout was taking shape.

I quickly issued a buy recommendation… and the timing couldn’t have been better.

Almost immediately after sending out my alert, shares of TWLO went on a tear…

Topping out at $330 a share when I suggested to my readers it was time to take their profits. A 49.87% return in less than ONE MONTH…

That’s enough to juice a $3,000 investment into $4,496.

A healthy $1,496 profit… in just four weeks.

But that’s not the REAL moneymaker on this trade.

You see, I’m a big fan of “double-dipping” my profits…

Which is why virtually every stock recommendation I issue also contains an options play.

This “double-dip” strategy gives you not one… but TWO ways to profit when the underlying stock surges.

At times, these option trades far outpace the gains made from my straight stock trades… in a fraction of the time.

(And the best part is you can take part in the stock trade… the option trade… or both!)

The choice is completely yours and yours alone.

That’s exactly what played out with my Twilio recommendation…

In just three weeks the call options I recommended delivered a breathtaking 671.14% gain…

That surge alone would have turned every $5,000 invested in Twilio into more than $33,557 in pure profits — over 13X more money — in far LESS time than buying and holding shares.

So what was it about Twilio that caught my attention?

Due to a tech sector pullback at the time, Twilio was trading at a steep discount compared to other Software-as-a-Service (SAAS) rivals.

Making it a prime takeover target for a company with excess cash to spend.

But Twilio didn’t stay down for long…

An Investor Day presentation revealed its next quarter revenues were expected to hit over $406 million…

A growth rate of more than 40%.

And at the same time my Twilio recommendation was playing out, another company I had been watching showed signs that a buyout opportunity on the ride-sharing service Lyft (LYFT) was ready for takeoff…

My research told me LYFT was oversold due to COVID-19 lockdown conditions and up for grabs as a takeover target.

I suggested investors pick up shares while the stock price remained under $35. Anybody who followed my recommendation could have collected a decent 44.71% return… in just a few short months,

Enough to turn every $5,000 invested into $7,236.

But it gets even better…

Not only did I issue a stock “buy under” price, but I also recommended placing an options trade on Lyft.

Now if you’re thinking buying options calls are difficult or you’ve heard that options are risky…

I can assure you the way I trade options couldn’t be simpler.

In fact, you can enter an options trade in as little as FIVE MINUTES (including the time it takes to read the alert that gives you the details)…

Setting yourself up for a shot at collecting lightning-quick double-digit (or higher) gains in a matter of weeks.

Just like when our option call on LYFT handed investors an additional 80.29% return… on top of the stock trade!

A few months before our LYFT recommendation, I issued an alert on the freight transportation and warehousing provider XPO Logistics (XPO).

Shares of XPO had fallen from $100 a share down to $60 and showed signs of becoming a potential takeover target.

My research was telling me Amazon and Walmart, along with thousands of other online retailers, would soon see a severe storage and transportation bottleneck.

With XPO operating one of the largest internet retail fulfillment providers in the northern hemisphere…

I knew we had HUGE potential for a buyout at our fingertips.

I even stated as much in my investment alert to subscribers…

“I plan to take full advantage and will add XPO to my “Get on Base” Portfolio on Thursday, May 7.”

Just shy of 3 months later, I advised readers to exit XPO… those who followed my recommendation could have raked in a breathtaking 127.59% return on the stock trade alone…

The profit train didn’t end there though… because I also recommended an options trade on XPO.

And that simple trade brought in an extra 88% profit… in 1/3 of the time (less than a month)!

All based solely on the prospect of a profitable, well-run company becoming a potential buyout target.

That’s the real beauty behind the recommendations inside Takeover Trader. A company DOES NOT have to be bought out to deliver a massive windfall.

They just need to show the signs of being targeted for a takeover to get on my radar…

Signs like…

- Visible growth prospects…

- Compatibility — or synergy — between the companies…

- Enhanced pricing power in the market…

- Increased competitive advantage…

Often, that’s all it takes to send shares surging.

Not a confirmation from the companies involved or an official report from a stock exchange or a filing with the Securities & Exchange Commission (SEC)…

And if a company pops up on my radar as a potential takeover target more than once…

I’m perfectly fine with that.

Because every time the rumor mill starts spinning it opens up another chance for us to pocket more profits.

And we’ll just keep stacking one takeover trade on top of the next as the media spreads these buyout rumors.

The Key to Profiting From the

Coming Feeding Frenzy? Don’t Fall for the

Hype in the Headlines…

Whatever you do…

Don’t try to pick a takeover prospect by scanning the headlines…

By the time the rumors hit the front page, you’re already too late.

And as for just picking out stocks you think are “cheap” and destined to be acquired by another company?

Trust me, that’s a sure-fire way to lose a lot of hard-earned money in a very short amount of time.

And I absolutely hate losing money…

If you’ve made it this far in my presentation, I’m assuming you probably hate it as much as I do.

Which is why all of my trades are on companies that already operate safe, well-run, and incredibly profitable businesses with the potential to deliver MASSIVE gains…

Even if they’re never bought out at all.

In other words, they’re natural buyout targets for the wealthy companies sitting on mountains of cash…

So even if news of a massive buyout or merger ends up only being a rumor…

You’ll still be setting yourself to come out ahead simply by investing in companies that’ll deliver a solid return on your investment.

You get the double benefit of investing in world-class companies AND cashing in on high potential buyout events.

Which with soaring inflation and aggressive corporate taxes devouring the cash stockpiles of some of the world’s wealthiest companies…

I believe we’re just days away from a full-fledged feeding frenzy as cash-rich companies rush to put their money to use before its value plummets.

Right now my system has pinpointed 3 stocks with the potential to hand you massive profits…

And at the risk of repeating myself… if you want to profit, you have to be positioned before the news hits the headlines.

But in order to do that, you need to know which stocks are the most likely buyout targets.

Sure, you could spend hours — even days — researching the thousands of publicly-traded companies on the market…

But there is what I believe to be a better… and much easier way.

One that could hand you profits up to $7,236… $10,200… $21,077 (or more) in the coming months.

And it’s all summed up in my newest research report…

Profit Shocks Revealed: 3 Target-Rich Market Sectors FILLED With Buyout Opportunities

With hundreds of publicly-traded companies sitting on BILLIONS of dollars in cash, buyouts and takeovers can happen at any time and in any market.

But in this market, it’s almost impossible to keep up with every single move. It’s a full-time job even for me.

If you want to set yourself up to beat the odds and ride this coming wave of “profit shocks” into an early retirement…

Your best bet is to focus on the top three market sectors I believe are packed with takeover opportunities… tech, bio-tech, and commodities.

Tech, natural resources, and pharmaceuticals have always been “grow by accumulation” industries. And I don’t expect that to slow down anytime soon.

But right now, I’m predicting we’re on the edge of an accelerated wave of buyouts fueled by the need for mega-corps to deploy their cash stockpiles before inflation and taxes eat them away.

Over the years, these three industries have seen an explosion of buyouts and takeovers…

Like when telecom giant Verizon absorbed Sprint for $26 billion…

And when biopharmaceutical tech giant AbbVie acquired Allergan for $63 billion…

Or when metal mining operator Rio Tinto snapped up Alcan for $38.1 billion…

I expose my top three takeover targets in Profit Shocks Revealed: Target-Rich Market Sectors FILLED With Buyout Opportunities!

I expose my top three takeover targets in Profit Shocks Revealed: Target-Rich Market Sectors FILLED With Buyout Opportunities!

Inside you’ll find every ounce of research I’ve poured into this project… all in a quick, simple-to-read, and easy-to-act-on report.

If I were to release the information inside this report to the public… it would hit the shelf with a hefty $1,000 price tag (minimum).

And frankly, it would STILL be a steal at that price, considering the trades I reveal have the real potential to hand out profits of $7,236… $10,200… $21,077 (or more).

But today… I’m not asking you to pay a single penny for this report.

I want to get it into your hands for FREE.

There’s only one way to grab your copy of Profit Shocks Revealed for free today

You read that right… I want to give you my in-depth report on the buyout feeding frenzy I believe is just days away from going into full effect.

This report will never be made available to the general public or sold at any price…

The only way to gain access to this exclusive report (along with every other takeover trade opportunity I’ll uncover in the coming year) is to accept this personal invitation to join me inside my elite advisory, Takeover Trader.

I believe takeover trades are the FASTEST way to uncork a geyser of profits… and I’m not alone.

MarketWatch says:

And Harvard Business Review confirmed these trades can:

Even stodgy publishers like Kiplinger’s praise takeovers as:

Which means buyouts aren’t only thought to be the fastest way to make money from the stock market…

But also, one of the best ways I’ve ever found to score the biggest wins… with less risk.

How these takeover trades work is simple:

When a bigger company buys a smaller company… the smaller company surges.

That’s why Forbes agrees it’s BETTER to be holding the SMALLER company (the ‘target’)…

It’s precisely these smaller takeover targets that I hunt down inside Takeover Trader…

And while the tickers I’ll reveal inside your free edition of Profit Shocks Revealed are an excellent place to start.

Make no mistake…

Those stocks are only the tip of the iceberg.

Takeover trades are popping up in practically every industry you can think of.

And with the tidal wave of buyouts I’m certain will be coming down the pike…

The Best Way To Get The Profitable Details Is To Join Me As A Takeover Trader — Now

Takeover Trader is my exclusive investment advisory service dedicated to spotting takeover trades — including these “profit shock“ events — before they hit the headlines.

As I sit here today, there are well over a dozen takeover opportunities playing out in our model portfolio…

And you’ll get instant access to every single one of them the minute you accept my invitation to join Takeover Trader.

On top of that, every month I’ll send two Takeover Trader Alerts directly to your inbox. Inside each Takeover Trader Alert is essentially my personal investment “journal” where you’ll find my profit-rich investment insights.

If you’re looking to get in early on high-profit buyout events without devoting hours (or days) of your life searching for just the right opportunity…

Takeover Trader is the answer.

That’s where subscribers were alerted to numerous takeover trade opportunities that delivered double and triple-digit returns.

Returns like…

- 62% return on Teledoc Health

- 87% return on Twilio

- 59% return on XPO Logistics

- 71% return on Lyft

- 54% return on Roku

- And more…

Not every trade turns out this well of course. I wouldn’t be telling you the level truth if I said we didn’t have losing trades too.

No system is perfect after all. And mine doesn’t have to be…

Because I give you so many ways to set yourself up to profit from these takeover targets.

Remember, in addition to our “long haul” buy and hold stocks, you’ll also get access to options plays that could deliver rapid-fire returns like…

- 150% return in one week on Sprouts Farmers Market, Inc.

- 33% return in less than one month on XPO Logistics

- 93% return in a month on Roku

- 43% return in just over two months on PDX

- 14% return in six weeks on TripAdvisor, Inc.

- 14% return IN LESS THAN ONE MONTH on Twilio

- 29% return in two and a half months on Lyft

- 64% return in two months on RingCentral, Inc.

- 135% return in two months Papa John’s International, Inc.

- And more…

Never traded options before?

I’ve got you covered…

As a special gift for trying out Takeover Trader today, you’ll receive immediate access to my proprietary options training guide…

FREE Takeover Trader Bonus:

The 11X Secret: The Millionaire Trick To “Supercharging” Your Takeover Trades…

If you’ve never traded stock options before, this is the perfect starting point for you.

If you’ve never traded stock options before, this is the perfect starting point for you.

And frankly, even if you’ve been trading options for years… this special report is an incredible refresher and may even show you a few “tricks of the trade” you didn’t know existed.

Inside The 11X Secret I lay out everything you need to get started trading options today. Including…

- What options are…

- What calls, puts, premiums, and option expiration date are…

- Understanding the basics of options trading…

- How to place your first trade…

- How to make options work for your investment plan…

The recommendations I’ve released inside Takeover Trader have already handed members dozens of opportunities to grow their wealth (and I’ve got no plans of slowing down any time soon.)

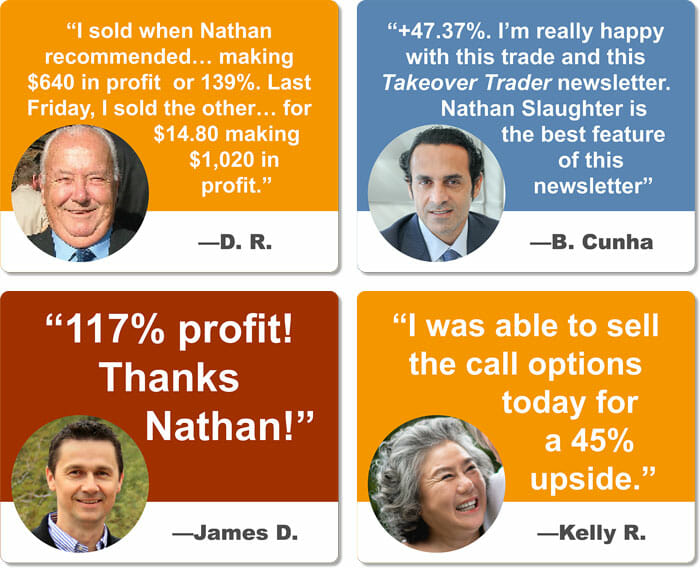

But don’t just take my word for it. Take a look at what subscribers are saying…

Now I can’t — and never will — promise you’ll see the same results as these investors…

Because, nothing is guaranteed when it comes to investing and anybody who tells you otherwise is likely only looking out for their wallet, not yours.

But these messages from my readers do show what is possible. And here’s what I can promise you…

As a member of Takeover Trader,

you’re guaranteed unlimited access

to everything I offer

Including…

- 24 Trade Alerts — Delivered twice a month directly to your email inbox. Inside each issue, you’ll find all the deep market insights you need to harvest these takeover opportunities as my system uncovers them… including the name of the stock, industry breakdown, and my recommended “buy-under” price.

- Instant Access to the Takeover Trader Portfolio — Includes up-to-date stock and option trades. Easily update and position your investing account for high-potential takeover.

- Special Situation Reports — My detailed investing guides and reports that cover the major “themes” I’m watching unfold in the markets that could deliver extraordinary wealth for followers of my investment advisory.

- Searchable Takeover Trader Archives — Want to get caught up on a trade I recommended? Simply search the archives. Every single past issue of Takeover Trader is at your fingertips.

- Unlimited Access to the Members-Only Website — Secured by your personal username and password, anything and everything Takeover Trader can be found on the members-only website.

- FREE Subscription to StreetAuthority Insider — This weekly bulletin gives you a peek at the market picks (and the experts behind them) that have made StreetAuthority one of the most-respected investment advisory publishers in the United States. Yours free as a new member of the StreetAuthority family.

- VIP Customer Concierge Service — Unlimited and toll-free, the Takeover Trader customer service team is available 9 a.m. to 6 p.m. ET Monday through Friday to help you with virtually anything you need.

Every last detail you need to capture these incredible takeover opportunities can be found in Takeover Trader.

You’re not spending days, weeks, or even months combing through news reports, press releases, investor presentations to find takeover opportunities.

My proprietary system does all the hard work for you…

So how much is all that research, special reports, trade alerts, and high-profit investment portfolio worth?

When I first opened up Takeover Trader to the public, my publisher wanted to price membership at $5,000.

And frankly, considering the sheer number of profit opportunities coming down the pike…

It’d be a steal at that price.

But, unlike most other investment “gurus” out there, I’m not interested in making a fortune on the backs of my readers.

That’s not my style.

Today, I’m more interested in delivering these potentially life-changing takeover trades to hard-working everyday investors like you.

Trades that could help you become financially free, in record time.

I’m talking about being able to go grocery shopping without price checking, even as run-away inflation drives food prices to the moon…

Or pay off your mortgage years, possibly decades ahead of schedule.

Dreaming of an early retirement?

Imagine waking up without an alarm clock, free to spend your days as you please doing exactly what you want, when you want?

Maybe it’s just time to take the financial weight of the world off your back so you can finally spend time discovering what you really want out of life…

Even if that’s just spending more quality time with the people most important to you.

Takeover Trader could be the key that finally allows you to turn your “American dream” into a reality…

But if you want in… you have to make your move NOW.

In order to fill these spots as quickly as possible…

I’ve slashed over 80% off the price of Takeover Trader.

That’s means when you take me up on my offer, you won’t pay anywhere near $5,000.

Today you’ll lock in 12 months of unlimited access to everything inside Takeover Trader for only $995.

[button_1 text=”YES!%20I%20want%20In” text_size=”29″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-satt-feedingfrenzy”/]

Unfortunately… I do have a bit of bad news.

While I would LOVE to show this opportunity I’ve put together to as many investors as possible…

Based on the “sweetheart” deal I’ve put together… my publisher has put his foot down.

Make Your Move FAST

Only 100 67 Spots Available Today

The blood is in the water… and I’m all but convinced this takeover “Feeding Frenzy” could start any day now…

And with the potential profits on the table… honestly, I don’t think it’ll take long to fill every spot today.

But do need to make ONE thing clear…

When you join me inside Takeover Trader today… there are no refunds.

I’m sorry if that seems harsh, but my experience has been that the folks who have the most success with my program are the ones serious enough to put some real “skin” in the game… and are ok with the fact that all sales are final.

But if you have even the LEAST bit of doubt about joining me today…

I have one last thing that I believe will help you overcome any last-minute jitters.

Today when you join Takeover Trader…

I Have Your Back With My Incredible

DOUBLE “Iron-Clad” Guarantee

I’m absolutely convinced Takeover Trader is the best investment advisory on the market for independent investors like you.

And I’m more than willing to stand by that claim.

Which is why Takeover Trader is backed by not one but TWO “Iron Clad” guarantees…

- “1,000% GAINS… or else”: I’ll just come right out and say it… if the gains from the closed trades inside our model portfolio don’t add up to a minimum of 1,000% in the next 12 months, I’ll give you a second year of Takeover Trader “on the house.” Simply call our toll-free customer service team to let them know and they’ll add another year to your account at no additional charge.

- If you’re unsatisfied for any reason… you can easily switch the remaining balance of your membership to another premium service here at StreetAuthority. Simple as that. No questions asked and no hoops to jump through.

I’ve done everything I can think of to make this the ultimate “no-brainer” offer.

My exclusive special bonus reports and the guidance offered inside Takeover Trader are worth FAR more than what I should be charging.

And combined with my “1,000% gains OR ELSE” guarantee…

What do you have to lose?

Never before in history have companies like Amazon, Google, Microsoft, United Health, and hundreds of other companies had so much money to burn and so little time to do it.

Soon, $6.84 TRILLION dollars could pour into the market as these ultra-wealthy companies scramble and fight to pick up the best buyout opportunities…

And all this action will send waves of “profit shocks” throughout the markets…

Delivering massive double and triple-digit profit opportunities for Takeover Trader subscribers who follow the trade recommendations.

The blood is in the water… and the feeding frenzy is about to begin.

Which leaves you with one very important choice to make…

Will you join me inside Takeover Trader for a shot at total returns of $7,236… $10,200… or even $21,077… from as small as a $5,000 initial investment.

Or will you simply sit on the sidelines… kicking yourself when you realize what you’ve missed out on?

I’ve laid everything out on the table… the right choice is yours to make.

I’ll see you on the inside.

Click the button below to secure your spot TODAY!

[button_1 text=”YES!%20I%20want%20In” text_size=”29″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-satt-feedingfrenzy”/]

Thank you,

Nathan Slaughter

Chief Investment Strategist

Takover Trader

Copyright © 2022 StreetAuthority, a division of Capitol Information Group, Inc. All rights reserved.