[vertical_spacing]

2021: The Year of the Mega-Merger

“Even the whisper of a

“Even the whisper of a

“mega-merger” can hand investors returns as high as 113.64%… 343.93%…

and even 671.14%.

But one potential deal

could dwarf them all…”

—Nathan Slaughter

Fellow Trader,

$3.2 billion.

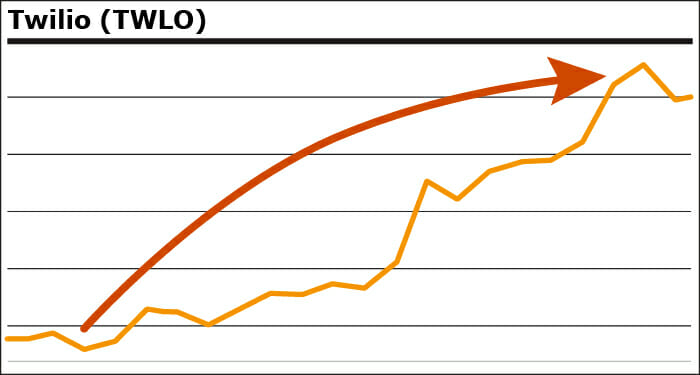

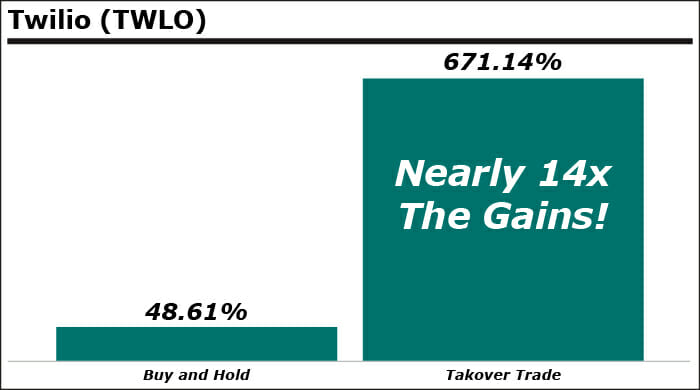

That’s how much Twilio (NYSE:TWLO) ponied up to acquire data company Segment last fall.

It was, by definition, a “mega-merger.”

And I saw it coming.

On September 16th, 2020, a small group of investors received an alert from me that something big was on the horizon for Twilio.

Almost overnight, the share price began to shoot up — and continued its climb for the next month.

Traders who followed my simple recommendation and put $10,000 into that trade, had the opportunity to make a cool $4,987 in profit… in a month.

I don’t think anyone would complain about that.

Here’s the funny part: the acquisition wasn’t completed until November…

The month AFTER my trade closed out.

So what made Twilio soar early?

Well, I know the secret.

It’s… the news.

That’s right, it may sound too simple… but all it took was the mention of a potential mega-merger in the headlines to make Twilio shoot up.

That’s the power that this type of event holds on Wall Street.

Even when it’s just talk.

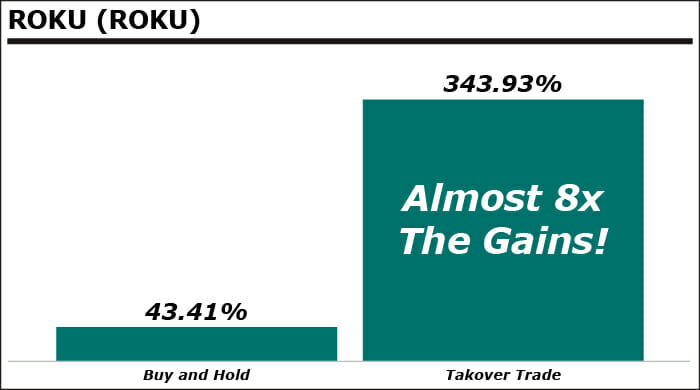

ROKU: Rumors lead to triple-digit gains

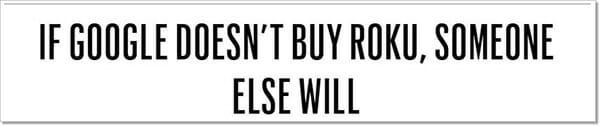

In June of last year, media heavy hitters were openly discussing rumors of a Google-Roku merger. Certainly, two tech titans like these would be an epic marriage worth many billions of dollars.

Everyone seemed to have a viewpoint on the idea, including Yahoo…

![]()

The National Interest…

And Variety:

There were no official announcements from either company. Everyone was just guessing.

But before they even wrote those headlines… I had already alerted investors to stake their claim in ROKU.

I saw this potential mega-merger coming long before it ever crossed the minds of mainstream media.

The result after the rumors hit? A 343.93% return.

That’s enough to turn a $5,000 investment into a $22,196.50 stockpile of cash!

It didn’t matter that ROKU was never actually acquired.

In fact, most of the time, the companies I target don’t wind up getting acquired.

And that’s ok with me…

Because the system I’ve built pinpoints stocks that have the biggest potential to be takeover targets…

Which allows investors to get in ahead of the rumors.

And getting in early — with the right type of trade — is the #1 key to raking in massive gains… even if it’s just the mention of a potential merger!

Today, I’m going to show you exactly how this system works and how you can use it to potentially bank gains of 135.00%… 150.00%… 343.93%… maybe even more.

Simply watching the headlines won’t work

Because as I’ve just shown you, by the time you read about the possibility of a mega-merger in the news, the real action — and the real profits — are long gone.

So how do you go about finding two companies that are about to “tie the knot” before the rest of the world catches on?

How do you beat well-funded media conglomerates and slick Wall Street research houses to the punch?

I do it all the time.

It’s one part understanding why one company would want to buy another… and one part understanding what they’re looking for…

And after decades of hardcore investing experience combined with relentless digging and a maniacal analytical approach…

I’ve built that leads me to likely takeover targets… before they hit the headlines.

Take Google for example. It’s no secret this Mountain View, California-based giant regularly buys companies to speed up its product development process.

In fact, that’s why everyone in the media thought Google would buy Roku!

Developing a new product can take years…

But if you’re one of the biggest companies on the planet, you can’t wait that long.

When you’re under Wall Street’s microscope and need to show revenue growth — and fast — you’d better do it before your share price suffers.

So to plug a hole in its product offerings — and deliver the growth both analysts and shareholders expect — it’s easier — and far faster — to go “shopping” than make it yourself.

So it stands to reason that if Google wanted to increase its foothold in the streaming wars it would be far easier for them to simply buy up the most popular streaming platform in the world.

It all made sense… that’s why the mainstream media speculated about it and pumped their headlines full of Google-Roku marriage rumors.

Now, unlike most people…

I didn’t have to wait for those rumors to hit for this to land on my radar.

As I mentioned… I have a series of signals that point me to potential takeover targets before the media catches on.

And when these signals lit up like a Christmas tree — pointing to streaming company Roku as a potential acquisition target…

I sent an alert to a small group of traders who follow my work letting them know I was adding Roku to my model portfolio on June 5th:

Remember those headlines about a potential Google acquisition? They were from mid-June… over a week after I sent out this alert.

So I beat virtually everyone to the punch. Again.

More impressive though, is that when July 9th rolled around, investors who followed my simple instructions were able to cash out with that 343.93% gain…

Which, again, could turn a $5,000 investment into a $22,196.50 windfall.

And that’s far from the only time my system has pinpointed a massive profit opportunity before it hit the headlines.

In fact, throughout 2020, it handed investors shot after shot at huge returns based on takeover projections…

- In August, I alerted a small group of traders that Lyft (NASDAQ:LYFT) would be a takeover target. A few months later, in October, Bosch started talking with them about a merger, and I walked away with a 80.29% gain.

- I was ahead of the game when XPO Logistics (NYSE:XPO) announced it would be open for acquisition in mid-May, because my readers had already been alerted to this weeks earlier in April — those who traded XPO cashed out with an 88.33% winner.

- In March, I told traders that Sprouts Farmers Market (NASDAQ:SFM) was set up to be acquired — and Oppenheimer analysts said the same thing to Barron’s a month later. On May 7th, our trade closed out with a 150% gain.

As you can see… just the whisper of these deals — called “mega-mergers” — hold the power to deliver immense returns.

But why?

What sets them apart from your normal mergers and acquisitions?

In a word: scale.

Mega-Mergers: Get your share of the billions they’re throwing around

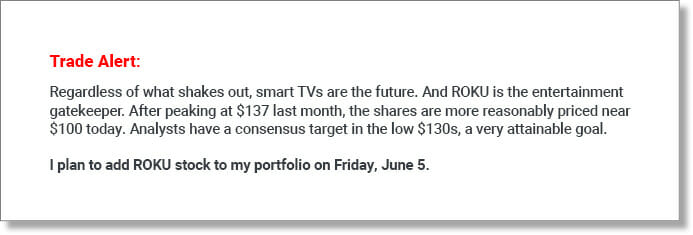

According to Bloomberg, the average merger deal is only worth a few hundred million dollars:

Mega-mergers, on the other hand, can be worth billions.

And with so much money at stake, investors who beat the herd to the punch…

Have the potential to make a small fortune when the “news” finally hits.

Which brings me to why I’m here with you today…

I’ve spent years helping traders like you profit from my market-beating analysis…

My name is Nathan Slaughter.

My name is Nathan Slaughter.

I’m the Chief Investment Strategist at StreetAuthority — one of America’s most trusted independent financial publishers.

I’ve built my career on digging deep into the DNA of companies…

Skipping past the headlines and the mainstream “analysis” of cable news pundits…

Getting at the core of industry trends, how they affect companies, and running sophisticated analysis myself…

All with one goal in mind…

To deliver exceptional profits to my readers.

And based on notes like these, I don’t think I’m boasting when I say I’m hitting the mark:

Now, these results are exceptional…

And I can’t guarantee that you will see the same kind of results these folks did.

But give me the next few minutes of your time, and I’ll show you how you can have exclusive access to the exact same system that pinpointed the trades they wrote in about…

And how you could use it on my next potential mega-merger target for a shot at 671.14% — or more.

These are the types of profitable opportunities connected Wall Street investors like to hoard for themselves.

But I want to help you get your hands on them.

That’s what I do.

It’s what I’ve done my entire life.

I understand what it’s like to be the underdog… because I was one!

For 23 years, I’ve spent my time and energy helping ordinary investors profit from big trading opportunities.

That’s why 12,000+ people follow my investment research.

And unlike many analysts, who hoard their research so they can make the trades themselves, I’m here to help.

Because I’ve seen the other side of it.

I’m from Louisiana. Not too many bigtime Wall Street traders start out in Louisiana.

I’m just a Southern boy from the second-poorest state in the country.

Unlike many of my peers, who were handed everything on a silver platter — I had to work my tail off.

No one gave me any shortcuts.

And because of that…

Everything I did, I did in overdrive.

I got up earlier. Worked harder. And stayed later.

In the end it paid off. Because I landed a full-ride scholarship to a Top 25-ranked business school and then a job on the Wall Street trading floor…

I thought I had it made — until I realized who I was working with… and for.

These huge investment firms, like AXA / Equitable Advisors and Morgan Keenan, are filled with elite professionals, many of whom were born with silver spoons in their mouths.

It was clear…

They never had to work hard…

For anything!

It didn’t take long for me to become disillusioned with a group of people who were more focused on their own financial success than that of the people who came to them for help.

So I soaked in everything I could.

I spent hours upon hours studying what they did… how they did it… what they looked for… and what made some opportunities more profitable than others.

I applied the rigorous work ethic that took me out of the bayou to my investing job, so that I could know the markets forward and backward…

And then I walked away from it.

I didn’t want my life to just be about making myself wealthier…

Or increasing the wealth of people who were already well off.

I wanted to help regular, salt-of-the-Earth people, just like the friends and neighbors I grew up with.

So I took all that knowledge… all that experience… and all that hard work… and poured it into educating Main Street traders.

Now, I get notes almost every day from regular people who tell me they love what I am doing for them, like this one:

Millionaires are minted on Wall Street… through hearsay?!

When I walked away from Wall Street, there was one thing I knew I couldn’t duplicate for Main Street traders: the connections.

Over and over again, my colleagues and coworkers would follow tips and information passed to them through what I call “the whisper network.”

Is that fair?

I think most of us would agree it’s not.

But it happened…

It still happens.

And the most lucrative “whispers” tend to center around takeovers.

Call them “mergers and acquisitions” if you want.

But the fact is, there is a lot of money to be made when you are trading on these deals.

The problem was…

There wasn’t really a good way to ferret out these potential deals ahead of time.

It’s not like you can go to a finance website and click on “Mega-Merger Targets.”

The best any regular investor could do was watch the headlines — and as we know, that’s too late for any big gains.

So I decided to come up with a system to find potential takeovers before they hit the airwaves…

Without needing the “insider connections”…

And certainly without doing anything I’d be embarrassed sharing with my mom.

So, I analyzed every mega-merger I could find.

I spent countless hours unravelling the DNA of these deals…

WHY a successful company would want to buy a struggling one…

The markets they operated in…

The products they sold…

Their financials…

All with one goal in mind…

To create a system that catches the tip-offs that happen BEFORE a deal is announced.

And with a track record that includes winners like…

- 44.71% on Lyft…

- 113.64% on Ring…

- 135% on Papa John’s…

- 343% on Roku…

- And even 671.14% on Twilio…

I think you could argue I’ve succeeded.

Now before I go any further, I need to be upfront about something…

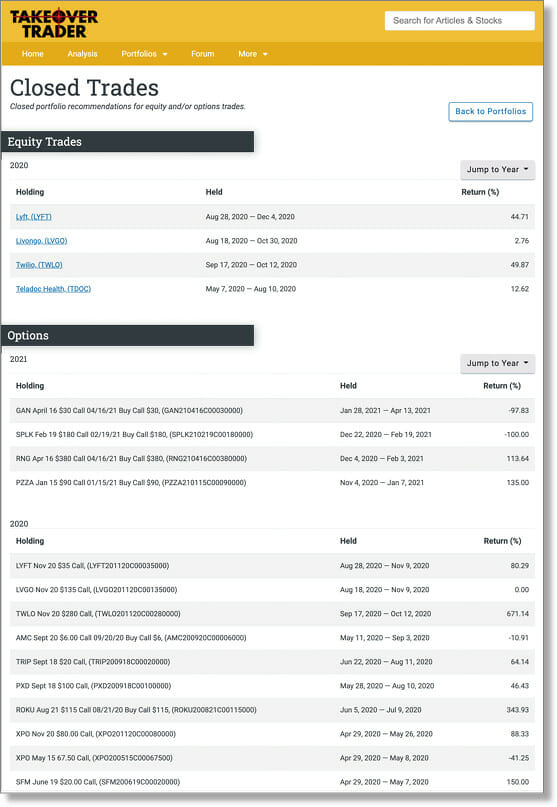

Not every trade I’ve put out has made money.

It’s true what they say, no system is perfect.

So you should never risk more on any trade than you can afford to lose.

At the same time, I don’t think it’s hard to see how taking part in just a handful of winning trades like these could significantly change your financial future for the better.

Which brings me to why I’m here with you today…

Right now, every signal I have is pointing to one industry that I believe will turn heads and create breathless headlines (and unthinkable profits) in the coming months.

And remember: while what I’m about to show you isn’t being covered on the nightly news…

That could change any day now.

So I urge you to pay attention to what comes next.

Because I’ve zeroed in on one mega-merger deal that could trump them all…

A Takeover Target with the potential to turn $5,000 into as much as $22,196.50 — or more.

But before I talk about that one pick, let me quickly show you why it is in the perfect industry right now.

The ONE industry that will be loaded with mega-mergers in 2021 and beyond

Telemedicine.

What is telemedicine? In short, it’s the modern-day version of a “house call.”

But instead of opening your door to let the doctor walk in with his black bag in hand, you just open your laptop or pull out your smartphone and “meet” with your doctor via live streaming video.

I know it may sound like something out of The Jetsons…

Or at least it did a year ago…

Before coronavirus hit and changed everything about our daily lives.

Because the pandemic turned “nice-to-haves” into “must-haves,” like…

- The app that allows you to enjoy meals from your favorite restaurant without ever leaving your house…

- The service which assembles uncooked “dinners in a box,” becoming the go-to solution for people who want to make their own food…

- The ability to switch on a camera and stream live video, allowing you to keep your business running even though the office was closed…

It didn’t stop there.

We also learned that we can visit our doctor without having to sit in a waiting room full of sick people.

And yes, people were already doing this before the pandemic…

But in 2020, doctors scrambled to offer telehealth services.

At the start of the year, 22% of doctors offered it.

By the end of the year, that number spiked to 80%.

The number of patients who used telehealth tripled.

Virtually overnight.

And it’s not stopping in 2021.

Telehealth has become the next revolution in health care.

COVID was just the spark that ignited the flame.

Huge health care conglomerates are scrambling to round out their product offerings.

They need to… because this trend isn’t going to slow down.

Telehealth is only getting bigger:

More than 75% of patients (and rising!) are demanding it

Data analysts McKinsey & Company conducted deep research to answer one question: What happens to telehealth after COVID?

Was the pandemic a catalyst event that reshaped the way society interacts with health care…

Or was it a temporary event that will fade away once we return to normalcy?

Once their research was concluded, the stats were eye-opening:

- 76% of consumers want to keep using telehealth moving forward

- 64% of telehealth users are now more comfortable using it again

- 20% of emergency room visits could be avoided using telehealth

- 24% of outpatient services could be shifted online

- $250 billion of health care spending could be moved to telehealth

In other words, health care providers could drastically cut their workloads — and the vast majority of patients want to make the shift now.

When three quarters of your market is looking for a change, you want…

No strike that…

You NEED to be on the front lines to provide it for them.

The companies that fill that void quickly are the ones who will keep a tight grip on their market share — and potentially grow it.

Remember: there are billions of dollars at stake here.

But being quick isn’t something the healthcare industry is known for.

These slow-moving titans just aren’t flexible enough to shift their operations this drastically.

So they are looking for a smaller company that has already done the legwork for them.

All they have to do is cut a check…

And cement the deal.

Plus, with demand for telehealth so high…

It only stands to reason they’ll pony up a lot of dough to get it done ASAP.

And I’ve found one particular company I believe is uniquely positioned to be on the front lines of this shift…

One that could potentially help you make 7x your money.

I know that, on its own, that’s bold prediction…

And I don’t just expect you to take my word for it!

So let me break it down using the four signals from my proprietary “takeover detection” system.

Mega-Merger Signal #1:

Synergy

Does the target company’s business activities mesh well with the potential buyer?

This is an analysis of two companies’ strengths, and where they meet.

I’m looking to see where the mega-merger target can fill a void that the buyer suffers from.

For a very simple example, think about Disney and Pixar.

Walt Disney Animation was on the decline for over half a decade after peaking in the mid-’90s.

By 2006, Pixar had developed and released six blockbuster movies, cementing their strengths with animation and storytelling.

That had become a weakness for the “House of Mouse.” So Disney bought Pixar for $7.4 billion.

They tied Pixar to the Disney name and brought their creative talent and cutting-edge animation technology along the way.

By doing so, Disney solved its problem of poor animated movie releases, and rode Pixar’s strengths — and resources — to the bank for years to come.

That’s synergy, and it’s what I look for first when evaluating potential targets.

The Takeover Target on my radar has built the infrastructure necessary to provide telehealth services to patients regardless of the health care system they are in.

In fact, their software is in 60 of the top 100 hospitals in the United States already.

That’s right: 60% of the top U.S. hospitals are already using their system.

The market knows the brand, and a large chunk of it is familiar with the product.

This Target already has the other building blocks in place, too:

- HIPAA-compliant

- Battle-tested infrastructure

- Redundancy at every level

This isn’t a system that needs to be “brought up to speed” or “made compliant.”

This is a turnkey solution that slides right in where any health care company wants it.

Any big titan in health care can snatch up their technology, brand it as their own, and incorporate the Target’s resources and infrastructure seamlessly… because the Target is already doing this!

Mega-Merger Signal #2:

Growth

A great business isn’t just about what you’re selling — it’s about selling it to the RIGHT market.

In other words, you can make the strongest product in the world, but if nobody is buying it, you’ll fail.

And one of the reasons companies snatch up smaller businesses is because they believe they can expand their customer base.

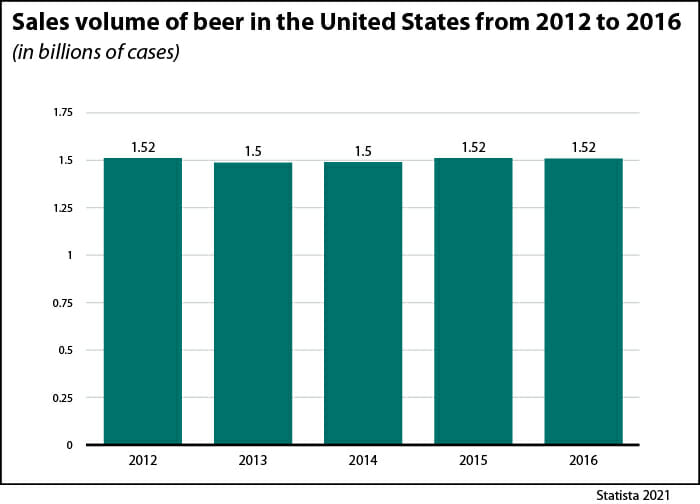

In 2015, AB InBev and SABMiller merged in a $107 billion deal which brought two of the world’s biggest brewers under one umbrella.

Few markets are as consistent as beer sales — and AB InBev wanted a bigger piece of the 1.5 billion-plus cases that sell every year in the United States:

The demand for beer was not going anywhere.

But when two companies merge together, they combine their market share.

Big companies jump on mega-mergers because they can snatch up more of the market just by writing a check.

And today’s Takeover Target can offer serious market share to any major health company who wants it:

- A global presence in more than 175 countries…

- Operating in 40 languages…

- And works across more than 450 medical subspecialties.

Whoever buys them has no need to develop any of this themselves — they immediately take over a massive chunk of the telehealth market overnight!

Mega-Merger Signal #3:

Cost Cutting

Will the merger save the buyer money?

Sometimes it’s about staffing reduction. Or simply a streamlined production process.

When I’m evaluating a potential mega-merger target, I need to know that the target is going to hold the potential to reduce costs.

Notice I said potential.

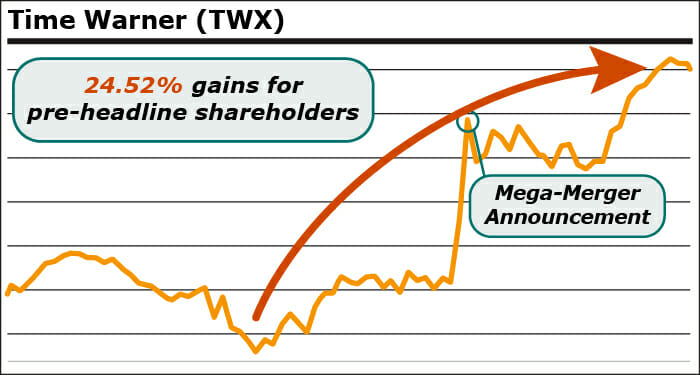

When AT&T bought Time Warner a few years ago, they told everyone they expected to save on ad distribution costs, as well as streamlining the production and distribution of content.

The selling point? Those cost savings could be passed onto the consumer.

That didn’t happen, of course.

But the potential is what sold the mega-merger.

And of course, when the deal hit headlines on October 22nd, 2016, Time Warner’s stock had already seen a big uptick for traders who were prepared…

Now, imagine you are a “Big Health” CEO who wants to offer remote wellness checks, prescription refills, and other therapies that wouldn’t necessary require an in-person visit to a doctor.

Creating a new program from scratch will require resources, talent, and time.

You’ll have to invest in testing, soft launches, bug fixes, and endless other concerns that take forever to shore up.

It will cost a fortune too.

Meanwhile, your competition might be ahead of you and taking over more of the market as you wait to have a solution ready.

But snapping up this Takeover Target will allow you to leap-frog over all of those expensive problems (and your competition).

Yes, you pony up a sizable check. But you immediately impact your market, and you can keep operating costs lower because you don’t have to invest in development.

That’s what this Takeover Target brings to the table.

And speaking of competition…

Mega-Merger Signal #4:

Eliminating Competition

This may be the easiest signal to identify, but it’s no less important: will the buyer increase market share by simply acquiring a competitor?

My Takeover Target is already serving patients. If they wanted to, they could simply keep operating and increasing their share of the market.

But a Target would reap huge financial windfalls from being acquired.

They instantly get a bigger piece of the pie themselves, and their new, expanded budgets allow them to further develop their technology without having to worry about whether or not they can afford it.

It’s a win-win for everybody.

That’s why I believe a mega-merger deal is on the horizon: big health companies don’t want that kind of competition. They’ll pay anything to get this company under their wing — and away from the competition.

As you can see, this Takeover Target is flashing all four of my Mega-Merger Signals.

And when all 4 of these signals point to a single company, then I’m “all in.”

I’ve put all the details on this opportunity in a special report called….

The Telehealth Mega-Merger:

The ONE Takeover Target You Need in Your Portfolio for 2021

Remember: telehealth is now the new normal.

Remember: telehealth is now the new normal.

It’s not a matter of if it will become a way of life. It already is.

So companies don’t have the luxury of time while building out new infrastructure to handle this growing demand.

I mean think about it — would it be better to:

- Spend millions of dollars and many years hiring developers to build a new system, test it relentlessly, and eventually deploy it across a network of providers, or…

- Buy a proven system that is already in use and serving patients successfully.

The smart answer is obvious…

You don’t reinvent the wheel.

That’s why I believe another company will snap up this Takeover Target, put their name on it, and soak up the technology and market share.

That allows them to go from “can we figure out a way to shift gears and address this growing market need” to being the #1 provider of telehealth services in the country.

Overnight.

This report will give you the full story on this company including:

- Why this Takeover Target has an unmatched value proposition…

- How it has built a wide moat, establishing pure dominance in the space…

- And how it plans to continue driving this never-before-seen disruption in health care.

More importantly, I’ll give you two ways to profit from this opportunity.

One will be buying the stock itself…

And the other will be a simple options trade designed to amplify your profits.

The same kind that lead to gains of…

- 80.29% on Lyft…

- 150.00% on Sprouts Farmers Market…

- And 343.93% on Roku.

Based on how much time I’ve put into the research…

I could easily charge $2,000 for access to this report.

But today, I want to give you a copy… absolutely FREE.

All you have to do is join me in my elite trading service, Takeover Trader, where I’ll show you:

How to bank up to double- and triple-digit gains from potential Takeover Targets

With Takeover Trader, you get detailed, step-by-step instructions on how to play takeover targets.

There’s no guesswork and no speculation needed on your part. I do all the heavy lifting, and you get notifications detailing:

- When to buy

- How much to pay

- How much profit to expect

- When to sell

- What price to sell at

It’s as close to a turnkey solution as you can ask for.

Plus…

With Takeover Trader, you don’t just get one way to profit from the opportunities my system turns up…

You get THREE.

This Takeover Trader strategy multiplies gains 7x over (or more)… regardless of the industry

First and foremost, you get the ticker and instructions on how to buy shares of the potential takeover target my system has pinpointed.

But then I take things a big step further…

Because I’ll also give you the step-by-step instructions on how to make a simple options trade that amplifies the profits over and above what you’d see from just buying shares.

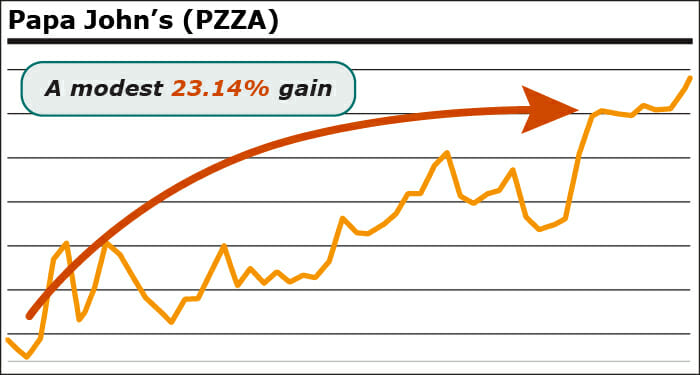

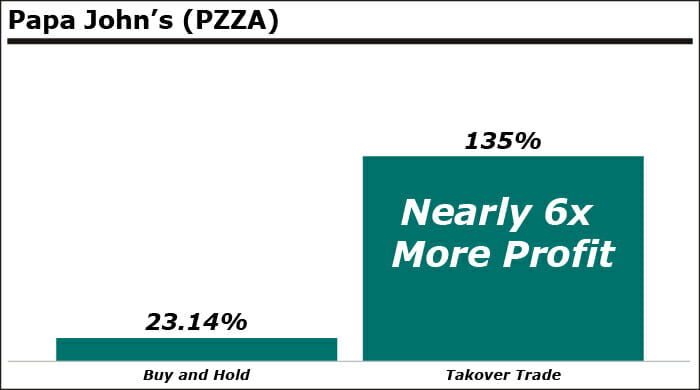

Take a look at this trade I made on Papa John’s (PZZA) for example.

It gave readers a shot at a 135% profit.

But that’s not what the stock did.

In the time my trade was open PZZA only ticked up 23.14%:

Now, nobody will complain about a 23.14% gain…

But 135% is nearly 6x MORE PROFIT.

With the addition of this simple options trade…

You have three different ways to profit..

You can buy the stock… you can make the options trade… or you can do both.

And no matter which approach you choose, I’ll show you exactly how I would play it.

There’s no guesswork. Just follow the steps and make the trade — whichever one you choose.

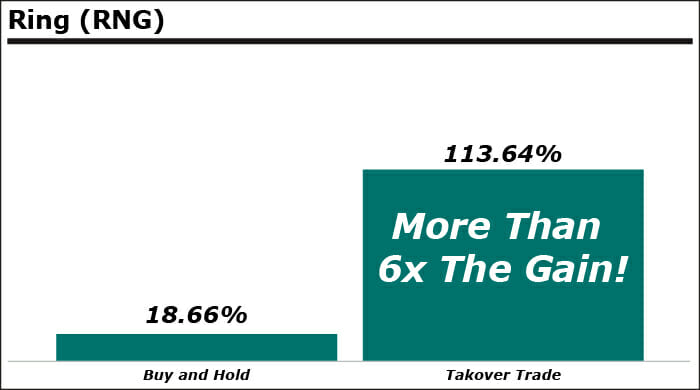

This is how I was able to lead traders to these gain-multiplying winners like…

Ring (RNG): An 18.66% gain into 113.64%…

Twilio (TWLO): A 48.61% gain into 671.14%…

ROKU: A 43.41% gain into 343.93%…

Imagine if you had this dual-pronged profit strategy in your back pocket…

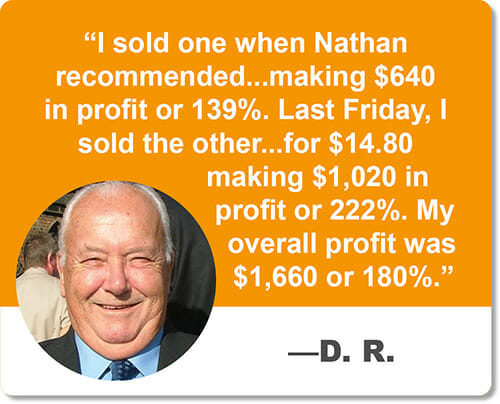

You could end up like one of my readers who goes by the initials D.R.

“My overall profit was 180%…”

D.R. sent me a message claiming just how effective it has been for him:

An overall profit of 180%.

An extra $1,660 in his pocket.

Impressive to be sure.

But let me be 100% clear, since we’re all adults…

Not every trade I release in Takeover Trader delivers the kind of profits D.R. saw…

The truth is some don’t make money at all.

If fact, in the interest of full transparency here’s the full list of trades I’ve closed since I launch this advisory last year.

I’ll do the math for you…

My AVERAGE gain across all closed positions is 86.27%. Including four losing trades!

That’s 534% better than the 10-year average on the S&P 500!

I don’t think it’s hard to imagine what investing results that powerful could mean to you…

Will you finally be able to give back to others?

Cut back on work and enjoy your days on the golf course like you always dreamed?

Start taking those vacations and spending the quality time with your family that you want?

If your goal is to make any of these dreams your reality…

NOW is the time to pay attention.

Takeover Trader keeps you where you need to be: Ahead of the mega-merger headlines

As a member of Takeover Trader, you get instant, unlimited access to a full suite of benefits, all designed to help you bank as many winning trades as possible.

Your membership includes:

- 2 brand-new issues of Takeover Trader every month: Twice a month, I send you my BEST trading idea. Each one is based on my proven approach for finding profitable takeover targets… before they hit the headlines.

- Unlimited access to our portfolio: Any time you want, you can log in and see all the current and past “buy” recommendations, right at your fingertips, on demand.

- Unlimited, exclusive access to the members-only website which is home to…

- All my weekly updates

- All my archived content

- All my special situation reports

- All my feedback to subscribers

- And more!

- Unlimited — toll free — access to my VIP Takeover Trader concierge staff: They’re available to help you with any issues you may be having 9 a.m. to 6 p.m. ET Monday through Friday.

And if you act quickly — and decisively — you can have it all for an outrageous discount.

Join Takeover Trader today and save 60%

When Takeover Trader was launched around this time last year, it came with a $5,000 price tag.

And based on the gains I’ve already delivered…

I don’t think I’m going out on a limb when I say that was extreme bargain.

But I also know times are tough…

So I went to bat for you with my publisher…

Did a little arm-twisting…

And came back with what I think is a killer deal.

Today, you can lock in your membership for over 60% OFF.

That means for only $1,950 you’ll get instant and unlimited access to:

- The Telehealth Mega-Merger: The ONE Takeover Target You Need in Your Portfolio for 2021

- The step-by-step trade recommendations that sniff out potential Takeover Targets before they hit the headlines

- 2 brand-new issues of Takeover Trader every month

- Unlimited access to our live portfolio

- Unlimited, exclusive access to the members-only website

- Weekly email updates

- All archived content

- VIP Customer Care

Unfortunately, there is a small catch.

While my publisher gave in to the ridiculous discount I pushed for…

He didn’t completely lose his mind.

Because he’s only letting 25 people join Takeover Trader today.

And considering with how much money you could potentially make following my lead for a full year…

I don’t think those 25 seats will last long.

[button_1 text=”YES! Make me a Takeover Trader Today” text_size=”19″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-satt-megamerger”/]

Especially considering that I’m going out on a limb to “sweeten the deal” even more with a bonus set of Takeover Targets in the healthcare industry.

FREE BONUS REPORT #1:

FREE BONUS REPORT #1:

3 More Healthcare Takeover Targets to Trade in the COVID Recovery

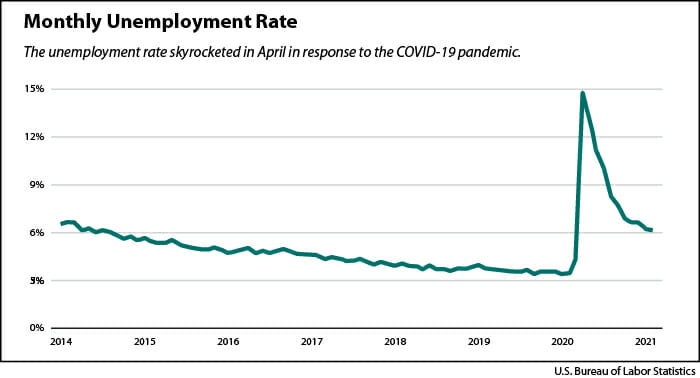

Did you know that 1 in 5 patients delayed seeking healthcare in 2020 thanks to the COVID panic?

Or that nearly 10 million cancer screenings were missed throughout the pandemic?

Or that unemployment is still far above pre-pandemic levels, meaning thousands of people are without health care coverage?

It’s clear that the healthcare industry needs more than just telehealth services to recover from the COVID pandemic.

In 3 Healthcare Takeover Targets to Trade in the COVID Recovery, I’ll reveal three more potential Takeover Targets in the health care industry that have turned all 4 of my Mega-Merger Signals green.

This report reveals…

- The makers of a revolutionary new cancer treatment that offers a “steroid boost” to the immune system, so that patients’ bodies can fight off cancer cells…

- One of the leading developers of cancer screening technology, including 3D mammography and sophisticated cervical cancer detection…

- And a subscription-based health care provider aimed at those without health insurance…

Again, this report will have the names, ticker symbols, and complete trading strategy to multiply any potential gains by a factor of 2x… 3x… 5x… (or more).

And I’ll send it to you FREE of charge when you join Takeover Trader now.

At this point, you’ve seen the profit potential of these Takeover Trades…

You’ve seen how powerful the 4 Mega-Merger Signals can be…

You know that there are huge gains to claim if you can get into mega-merger targets before they hit the headlines…

And you’ve seen how simple it is to multiply those gains with the right trading strategy.

But before we go any further, I need to make one thing clear:

There are no refunds when you join Takeover Trader.

I’m sorry if that sounds unfair…

But I simply can’t let any of the 25 highly-discounted spaces we’ve opened today go to someone who’s not 100% committed to making money from Takeover Targets.

You’re either all in. Or you’re not in at all.

Plus, I am so confident in the Takeover Trader strategy and my Mega-Merger Signals, that I’m going out on a limb and offering twice as much protection for your membership…

The Takeover Trader Double Guarantee

Here’s how it works:

- 1,000% gains or you get another year free: If Takeover Trader doesn’t hand you the opportunity to collect 1,000% gains in the next 12 months, I will give you a second year, for free. I stand by the performance of this system, and I believe the trading opportunities will deliver that profit. But if I fall short for some reason, simply contact our customer care team and let them know. They’ll add another year of Takeover Trader to your account. Free of charge.

- If you are unsatisfied for any reason, you can make a switch: This really is as simple as it sounds. You can transfer the balance of your membership to any other premium publication that StreetAuthority For any reason. No questions asked.

This way, your profit potential and your satisfaction are both guaranteed.

[button_1 text=”YES! Make me a Takeover Trader Today” text_size=”19″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-satt-megamerger”/]

Still on the fence about joining me in Takeover Trader?

Let me make the decision even easier for you.

Join me today, and in addition to the 60% discount…

And the 2 research reports we’ve just discussed…

The first 25 people that join today will also receive…

FREE BONUS REPORT #2:

How to Hunt Down Takeover Targets

in ANY Market

While the healthcare companies I’ll cover in your first two free reports possess massive profit potential…

While the healthcare companies I’ll cover in your first two free reports possess massive profit potential…

That’s not the only area of the market I watch.

My Mega-Merger Signals are hunting down Takeover Targets in all sectors.

Because if you want long-term success on Wall Street, you have to adapt to the changing environment.

If there’s one lesson to walk away from in 2021, it’s that nobody can predict what the market will do next.

Up… down… sideways… world events have a way of turning the market on a dime.

With this special bonus report, you’ll discover how Takeover Trader could help you find profits in ANY market:

- How frequently to expect new Takeover Target plays

- Why they shoot so high, so fast (only if you’re interested in what’s “under the hood” — not necessary to profit)

- How to automatically sell your shares after a buyout for quick profits

- Our favorite brokerage accounts & which ones could be right for you

- What to do once you’ve secured a big, fast gain

- And much, much more!

It’s the complete nuts and bolts of my entire trading strategy…

Why would I share all this?

Because here at StreetAuthority, we don’t just hand you a ticker symbol and send you on your way.

We want you to have the confidence and skills to single out your own trades…

IF that’s what you want.

Think of it like the classic “give a man a fish or teach him how to fish” scenario.

And to drive that point home — I’m adding one more special research report for the first 25 people who join today…

FREE BONUS REPORT #3:

Multiply Your Gains:

How to 7x… 8x… or even 14x

I’ve already shown you that the Takeover Trader strategy uses a simple options trade to amplify our gains.

I’ve already shown you that the Takeover Trader strategy uses a simple options trade to amplify our gains.

And you’ve seen just how effective it is.

But how does it work?

In this report, I pull back the curtain a little bit to give you a peek at the power behind the Takeover Trader strategy.

I’ll show you how to take regular stock gains of…

- 66%

- 41%

- 61%

And multiply them into windfalls of…

- 64%

- 93%

- 14%

It’s like a trading “superpower” you can keep in your arsenal — and I’ll give you a peek under the hood and show you how it works.

These in-depth bonus reports are ONLY available to members of Takeover Trader.

They will never be sold or made public… the only way you can access them is through my service.

I can go on and on about how powerful my system is and everything you can expect to see as a member of Takeover Trader… but:

Don’t just take my word for it

Check out what other Takeover Trader members have said recently about profits they’ve banked using this strategy…

Remember, not every investor who follows my work sees the same results.

But these traders were able to use this system to grab 45%… 78.5%… and even double their money during one of the most volatile markets in recent history.

And this is your chance to join them.

But you have to hurry.

Remember, I can only welcome 25 new traders into Takeover Trader today…

So this is likely your one-and-only chance to get in the door.

[button_1 text=”Yes!%20I%20want%20to%20lock%20in%20one%20of%20those%2025%20discounted%20memberships

%20to%20Takeover%20Trader” text_size=”19″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_italic=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-satt-megamerger”/]

Move now before the headlines catch up

Remember, my Mega-Merger Signals have all turned green for four red-hot Takeover Targets in the telemedicine sector…

But the mainstream financial media is silent.

For now.

That could change tomorrow.

And once it does, your shot at maximum gains is out the window.

Don’t miss out.

Click the Yes! button below, to lock in your spot now.

[button_1 text=”YES!%20I%20want%20access%20to%20this%20red-hot%20Takeover%20Target%20now!” text_size=”19″ text_color=”#ffffff” text_font=”Arial;default” text_bold=”Y” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”28″ styling_height=”20″ styling_border_color=”#000000″ styling_border_size=”0″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient=”Y” styling_gradient_start_color=”#FF8620″ styling_gradient_end_color=”#FF8620″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#000000″ drop_shadow_opacity=”50″ inset_shadow_panel=”N” align=”center” href=”/olp-satt-megamerger”/]

Thank you,

Nathan Slaughter

Chief Investment Strategist

Takover Trader

P.S. Takeover Trader was red hot in 2020.

And my research is telling me 2021 is on track to be even better.

Don’t let this shot at life-changing profits pass you by.

Click here now to get started.

Copyright © 2022 StreetAuthority, a division of Capitol Information Group, Inc. All rights reserved.